What is Forex Trading?

Forex, short for foreign exchange, is the largest and most liquid financial market globally, with trillions of dollars traded daily. It involves the buying and selling of different currencies and is accessible to both individual retail traders and larger financial institutions.

Image: techonlineblog.com

Forex trading offers the potential for high returns but also carries significant risks. Understanding the basics is crucial for anyone considering entering this exciting yet challenging market.

Why is Forex Trading Important?

Forex trading has several advantages, including:

High liquidity: The forex market is highly liquid, allowing traders to execute orders quickly and efficiently.

Leverage: Forex brokers often provide leverage, allowing traders to trade with more capital than they have.

24/5 accessibility: Forex trading is available for five days a week, during most hours of the day and night.

Low transaction costs: Online forex brokers typically offer low transaction fees, making it accessible to traders with varying budgets.

Types of Forex Traders

There are multiple types of forex traders, including:

Scalpers: They profit from rapid, short-term price movements.

Day traders: They hold positions for one trading day, opening and closing trades before the market closes.

Swing traders: They hold positions for several days or weeks until they can profit from larger price changes.

Position traders: They hold positions for months or even years, seeking long-term trends.

Fundamental and Technical Analysis

Forex traders primarily rely on the following types of analysis to make trading decisions:

Fundamental analysis: This involves studying macroeconomic indicators such as inflation, interest rates, and political events to predict price movements.

Technical analysis: This involves analyzing price charts and patterns to identify trading opportunities.

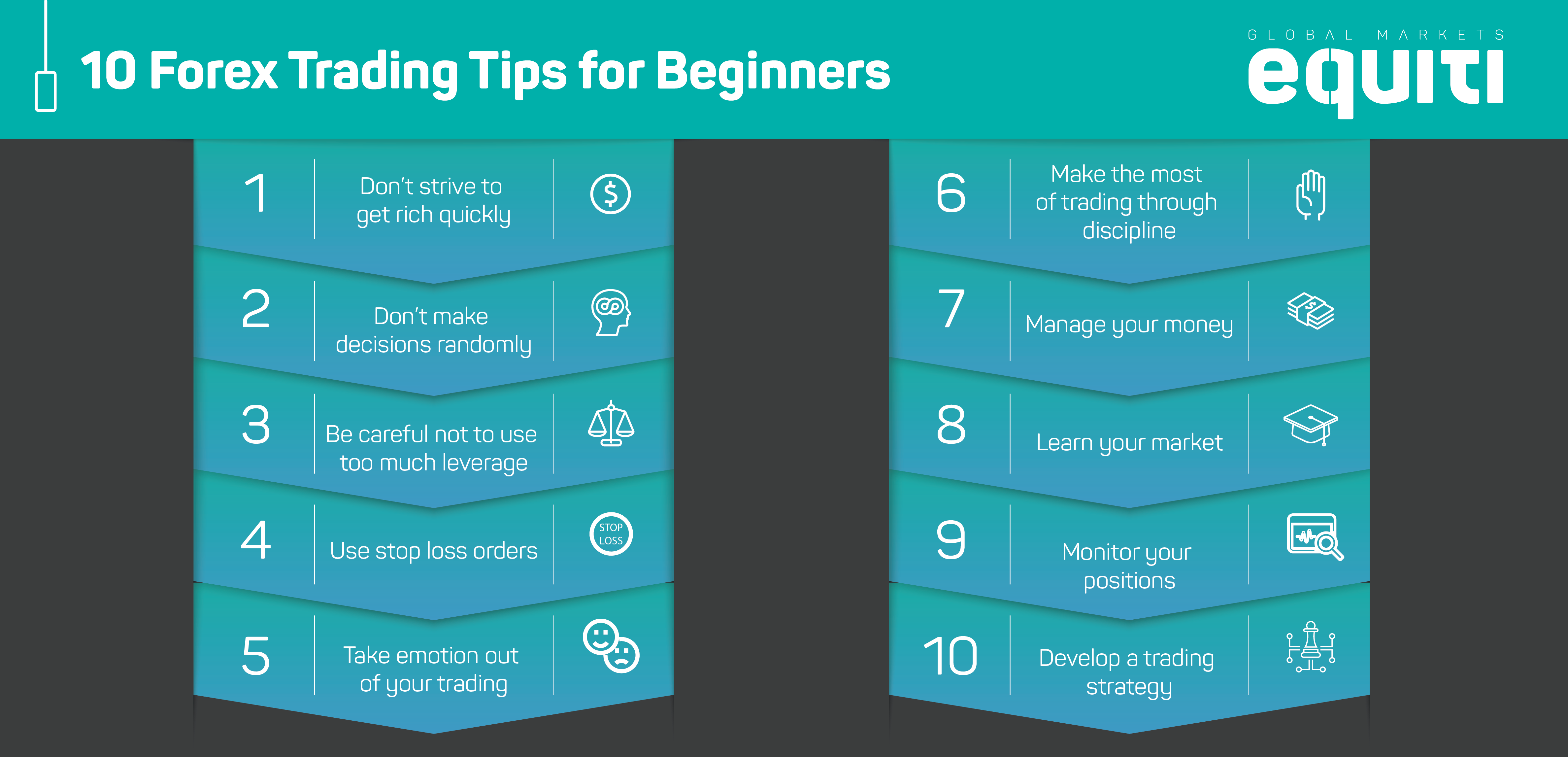

Image: www1.equiti.com

Forex Market Participants

The forex market is a global network of participants that includes:

Banks: They provide liquidity and facilitate currency transfers worldwide.

Investment funds: They invest large sums of money in forex to generate returns for their clients.

Corporations: They use forex to manage their international transactions and hedge against currency risks.

Retail traders: They speculate on price movements using both fundamental and technical analysis.

Finding the Best Forex Broker

When choosing a forex broker, consider these factors:

Regulation: Ensure your broker is regulated by a credible authority.

Spreads: Compare the spreads (difference between the bid and ask prices) offered by different brokers.

Leverage: Brokers offer varying levels of leverage, so select one that suits your risk appetite.

Commission: Forex brokers may charge commissions, so compare their rates.

Platform usability: Choose a broker with a user-friendly trading platform.

Forex Trading The Basics E

Conclusion: Embarking on Your Forex Trading Journey

Forex trading offers a compelling opportunity for those seeking financial growth. However, it’s vital to approach it with knowledge, discipline, and a clear understanding of the market dynamics. By grasping the basics outlined in this guide, you can embark on your forex trading journey with a solid foundation, making informed decisions and maximizing your chances of success. Remember, the financial markets are constantly evolving, so stay inquisitive and adapt along the way to navigate the intricacies of forex trading effectively.