Embark on an extraordinary journey into the world of forex trading and unlock the secrets of the legendary Turtle Trading System. Get ready to transform your trading strategies and witness the power of a proven system that has stood the test of time.

Image: www.fxcracked.com

What is the Turtle Trading System?

The Turtle Trading System is a rule-based trading system developed by Richard Dennis and William Eckhardt in the 1980s. They recruited and trained a group of individuals, known as the “Turtles,” who achieved remarkable success using this system.

The system focuses on identifying and trading breakouts in currency pairs. It involves entering trades based on specific technical indicators, managing risk through position-sizing rules, and exiting trades when predefined profit targets or stop-loss levels are reached.

Benefits of Forex Turtle Trading System

- Systematic and rule-based approach

- High probability breakout strategies

- Proven track record of success

- Clear entry, exit, and risk management rules

How Does the Forex Turtle Trading System Work?

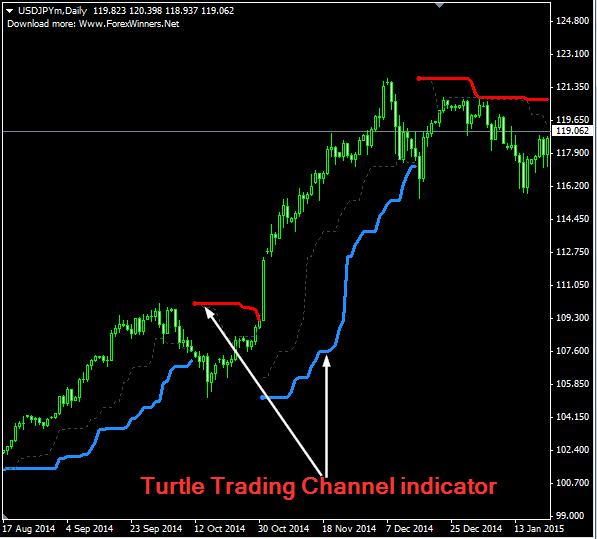

The system utilizes technical indicators, such as moving averages, Bollinger Bands, and momentum oscillators, to identify potential breakout opportunities. Traders enter trades when the price breaks out of a defined range, with tight stop-loss orders to limit potential losses.

Position sizing is crucial in the Turtle Trading System. Turtles risk a small percentage of their account balance on each trade, allowing them to withstand drawdowns and preserve capital.

Image: www.pinterest.com

Latest Trends and Developments in Forex Turtle Trading

The Turtle Trading System continues to evolve as the forex market does. Traders are incorporating new technical indicators, data analysis techniques, and risk management strategies to enhance the system’s effectiveness.

Social media platforms and online forums provide valuable insights into the latest trends and developments in Turtle Trading. Experienced traders share their experiences, discuss strategies, and offer support to the community.

Tips and Expert Advice for Forex Turtle Trading

- Follow the rules strictly without emotional bias.

- Master technical analysis and understand how indicators identify trends.

- Practice risk management techniques to protect your capital.

- Seek guidance from experienced traders and mentors.

- Stay disciplined and avoid overtrading.

By adhering to these principles, traders can increase their chances of success with the Forex Turtle Trading System.

FAQs on Forex Turtle Trading

Q: Is the Forex Turtle Trading System profitable?

A: While the Turtle Trading System has been successful historically, profitability depends on factors such as market conditions, trader skill, and risk management practices.

Q: Can I learn the Forex Turtle Trading System on my own?

A: Yes, you can self-teach through books, online courses, and forums. However, seeking guidance from experienced traders can accelerate the learning process.

Q: Is the Forex Turtle Trading System suitable for beginners?

A: The Turtle Trading System requires traders to have a foundational understanding of forex trading and technical analysis. It is not recommended as an entry-level trading strategy.

Forex Turtle Trading System Pdf

Conclusion

Harnessing the principles of the Forex Turtle Trading System can elevate your trading journey. By mastering technical analysis, risk management, and disciplined execution, you can leverage this time-tested strategy to increase your profitability in the world of forex trading. Embrace the Turtle Trading System and unlock the path to potential trading success.

Are you ready to embark on this extraordinary adventure? Explore the vast expanse of the forex market armed with the Forex Turtle Trading System as your guiding compass. Make enlightened trading decisions and ride the waves of market volatility to achieve your trading goals.