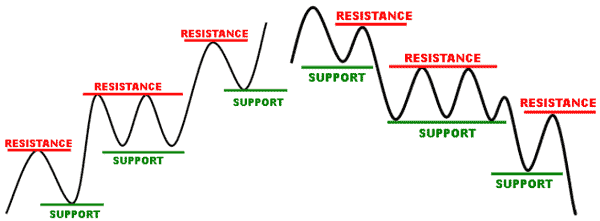

Understanding the nuances of support and resistance levels is fundamental for profitable trading endeavors in the dynamic foreign exchange (forex) market. These levels represent areas where market forces clash, often resulting in price reversals or consolidations. Mastering the art of identifying and analyzing support and resistance lines can massively enhance forex traders’ ability to make informed decisions and increase their market success.

Image: dailyfx.com

What Are Support and Resistance Levels?

In forex trading, support refers to a price point at which a currency pair has historically declined or is expected to find buyers, thereby halting its descent and reversing its trend. Conversely, resistance indicates a price ceiling where a currency pair has repeatedly encountered resistance from sellers, causing it to weaken and potentially reverse course. These levels serve as pivotal indicators in forex trading, guiding traders’ decisions on when to enter and exit the market.

Determining Support and Resistance Levels

There are several methods to identify support and resistance levels, each with its unique characteristics:

- Historical Price Analysis: Scrutinizing past price patterns can reveal areas of consistent buyer or seller dominance, forming support and resistance levels.

- Price Charts: Forex traders use price charts (e.g., daily or hourly charts) to visually spot potential support and resistance zones where price action has repeatedly reversed direction.

- Technical Indicators: Technical indicators like moving averages, Bollinger Bands, and Fibonacci retracements provide insights into potential support and resistance levels based on mathematical calculations.

Trading Strategies Based on Support and Resistance

Seasoned forex traders leverage support and resistance levels to execute various trading strategies, including:

- Breakout Trading: This strategy involves placing buy or sell orders when prices convincingly breach the identified support or resistance lines.

- Range Trading: In range-bound markets, traders buy near support and sell near resistance as prices bounce between these levels.

- Scalping: Scalping is a short-term trading approach where traders capitalize on minor fluctuations around support and resistance zones.

- Trend Trading: Support and resistance levels often demarcate reversal points, prompting trend traders to enter or exit trades based on these pivotal levels.

Image: www.forexpeacearmy.com

Additional Considerations

Understanding the dynamics of support and resistance is crucial, ensuring prudent trading decisions:

- False Breakouts: Price action may pierce support or resistance but quickly revert, indicating a false breakout that can mislead traders.

- Market Conditions: Volatile market conditions can blur support and resistance levels, leading to unexpected price movements.

- Emotional Trading: Waiting for prices to test support or resistance before executing trades reduces the risk of succumbing to impulsive decisions triggered by emotions.

Forex Usd Support And Resistance

Conclusion

Mastering the art of identifying and analyzing forex USD support and resistance levels unlocks a potent weapon in a trader’s arsenal. By recognizing these critical price zones, traders can predict possible market direction, identify entry and exit points, and enhance the probability of profitability in the unpredictable forex market.