In the dynamic world of forex trading, volatility reigns supreme as a defining characteristic. Harnessing the power of volatility can spell the difference between thriving and faltering in this competitive arena. Amidst the myriad of technical indicators designed to guide traders, the SRP Channel Indicator (SRP) stands tall as a potent tool for comprehending and capitalizing on market volatility. This in-depth exploration will illuminate the SRP, unlocking its secrets and empowering you with actionable strategies to navigate the volatile forex market with aplomb.

Image: www.metatrader4indicators.com

Understanding the SRP Channel Indicator: A Foundation for Success

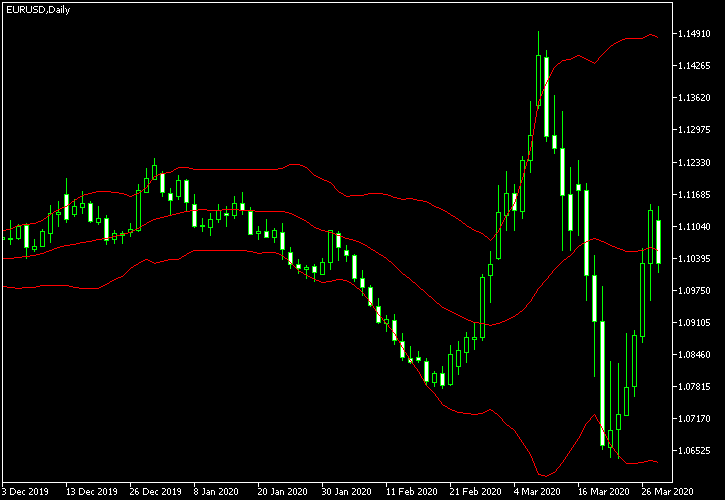

The SRP Channel Indicator, crafted by the esteemed trader and analyst Steve Nison, represents a pivotal tool in the realm of price channel identification. Conceived in 1994, this indicator has won accolades for its remarkable ability to gauge market direction and forecast potential price movements. At its core, the SRP leverages three lines to delineate a channel within which price oscillates:

-

Upper Channel (UC): Calculated as the highest price reached within a specific period, typically ten days, the UC sets the ceiling for the channel.

-

Middle Channel (MC): Serving as the equilibrium line, the MC represents the average price over the same ten-day period.

-

Lower Channel (LC): Determined as the lowest price within the ten-day window, the LC establishes the channel floor.

Collectively, these lines create a visual framework that captures the ebb and flow of price action, aiding traders in identifying trends, support and resistance levels, and potential reversal points.

The Art of Trading with the SRP Channel Indicator: Unveiling Market Dynamics

Mastering the SRP Channel Indicator empowers traders with an array of strategic advantages:

1. Trend Identification: The SRP inherently reveals prevailing market trends. When price remains consistently above the MC, an uptrend is signaled, while prices consistently below the MC indicate a downtrend. This clarity enables traders to align their strategies with the underlying market momentum.

2. Support and Resistance Levels: The UC and LC serve as dynamic support and resistance levels. Price tends to bounce off these boundaries, creating opportunities for entering and exiting trades at advantageous points.

3. Reversal Points: Deviations from the channel boundaries often herald potential price reversals. For instance, a break above the UC suggests a bullish reversal, while a break below the LC signals a bearish reversal.

4. Volatility Assessment: The width of the SRP channel provides insights into market volatility. Wider channels indicate higher volatility, while narrower channels suggest lower volatility. This understanding helps traders adjust their trading strategies accordingly.

Expert Insights and Actionable Tips: Empowering Your Trading Journey

To harness the full potential of the SRP Channel Indicator, heed the wisdom of seasoned traders:

– Embrace Dynamic Adjustments: The SRP parameters can be fine-tuned to match different markets and trading styles. Experiment with varying timeframes and periods to find the optimal settings for your specific needs.

– Incorporate Multiple Indicators: Combine the SRP with other technical indicators to enhance your trading analysis. Convergence among multiple indicators strengthens trading signals and reduces the likelihood of false signals.

– Manage Risk: The SRP, while a valuable tool, should not be employed in isolation. Implement prudent risk management strategies, such as stop-loss orders, to mitigate potential losses.

Image: www.earnforex.com

Forex Volatility Strp Channel Indicator

Embracing the SRP Channel Indicator: A Path to Forex Trading Mastery

In the ever-evolving landscape of forex trading, the SRP Channel Indicator stands as an invaluable ally. Its ability to illuminate market trends, identify support and resistance levels, and gauge volatility empowers traders with a comprehensive understanding of price dynamics. By embracing the insights it provides, traders can navigate the volatile forex market with greater confidence and precision, paving the way for informed trading decisions and ultimately, trading success.