Navigating the dynamic world of foreign exchange (forex) trading requires a deep understanding of forward rate calculations. These intricate calculations are the cornerstone of managing risk and optimizing returns in forex transactions. This comprehensive guide will delve into the intricacies of forward rate calculation, empowering you to make informed decisions and maximize your trading potential.

Image: www.chegg.com

What is a Forward Rate?

In foreign exchange, a forward rate is an agreed-upon exchange rate for a future transaction. It represents the price at which a currency pair will be exchanged at a specified date in the future. Forward rates are typically used to hedge against currency fluctuations and facilitate international trade.

Importance of Forward Rate Calculations

Accurate forward rate calculations are crucial for several reasons. They enable traders and businesses to:

- Manage Risk: By locking in a future exchange rate, traders can protect themselves against adverse currency movements and mitigate potential losses.

- Facilitate International Trade: Forward rates allow businesses to plan and budget for future transactions, eliminating the uncertainty associated with fluctuating exchange rates.

- Optimize Returns: Traders can speculate on future currency movements by comparing forward rates with spot rates, using these insights to make profitable trades.

- Avoid Speculation: Forward rates provide a stable benchmark for exchange rates, discouraging excessive speculation and ensuring a more predictable market environment.

Components of Forward Rate Calculation

The calculation of forward rates involves several key components:

- Spot Rate: The current market exchange rate for the currency pair.

- Interest Rates: The interest rates applicable to each currency in the pair.

- Time Horizon: The time period between the current date and the future date of the transaction.

- Currency Convention: The method used to calculate the forward rate based on the currency being bought or sold.

Image: shleeai.blogspot.com

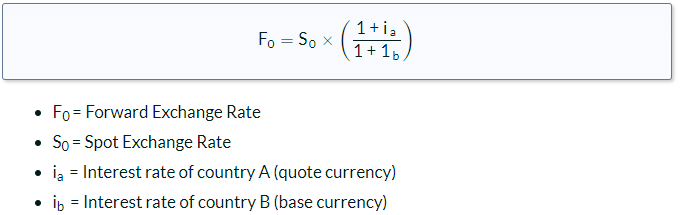

Formula for Forward Rate Calculation

The basic formula for forward rate calculation is:

Forward Rate (F) = Spot Rate (S) x e^(r1 - r2) x twhere:

- S is the spot rate

- r1 is the interest rate for the currency being bought

- r2 is the interest rate for the currency being sold

- t is the time horizon

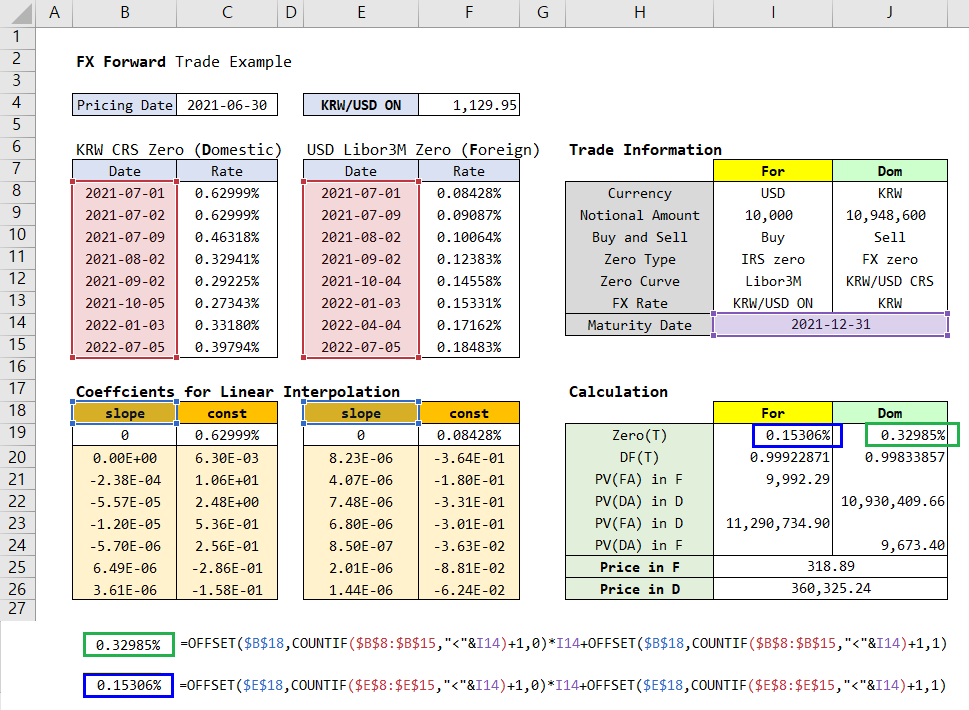

For example, if the current spot rate for the EUR/USD pair is 1.1250 and the one-year interest rate for the euro is 2% while the one-year interest rate for the U.S. dollar is 1%, the one-year forward rate would be:

F = 1.1250 x e^(0.02 - 0.01) x 1

= 1.1263Real-World Applications

Forward rate calculations find numerous applications in the real world, including:

- Hedging Foreign Exchange Risk: Businesses can lock in exchange rates for future payments or receipts, protecting against potential currency losses.

- Facilitating Trade Financing: Importers and exporters use forward rates to secure predictable payment terms and manage currency risks.

- Currency Trading: Traders compare forward rates with spot rates to identify potential trading opportunities and speculate on currency movements.

- Investment Planning: Investors use forward rates to forecast future exchange rates and make more informed investment decisions.

Challenges in Forward Rate Calculation

While forward rate calculation is an essential tool for managing foreign exchange risk, it comes with several challenges:

- Interest Rate Volatility: Interest rate changes can significantly affect forward rates, making accurate calculations difficult.

- Complexity: The formula for forward rate calculation involves multiple variables, which can be challenging to interpret and apply.

- Availability and Reliability of Data: Accurate and timely data on interest rates and spot rates is crucial for reliable forward rate calculations.

- Uncertainty: Forward rates are based on expectations about future events, which can be unpredictable and lead to calculation errors.

Forward Rate Calculation For Forex

Conclusion

Forward rate calculation is a vital skill in the field of foreign exchange. By understanding the concepts, components, and applications of forward rates, you can effectively manage risk, facilitate international trade, and optimize returns in your forex transactions. Remember, accurate forward rate calculations require careful consideration of multiple factors and a keen understanding of the dynamics of the foreign exchange market. Embrace this knowledge to enhance your trading decisions and navigate the complexities of global currency markets with confidence.