Momentum in forex trading, the measure of price movement over time, holds immense significance for grasping the direction and strength of currency market trends. By understanding how to gauge momentum effectively, traders can make informed decisions, ride the market’s wave, and capitalize on profitable opportunities.

Image: www.pinterest.com

Unraveling the Concept of Momentum

Momentum, by definition, quantifies the speed and magnitude of price changes in a currency pair. It essentially measures the difference between the current price and a previous price, over a specific time interval. Visualized on price charts, areas of high momentum indicate rapid price movements, while low momentum periods depict relatively stable price action.

Precisely, momentum captures the force behind market moves. Whether propelled by macroeconomic data releases, geopolitical events, or sentiment-driven sentiment shifts, identifying and quantifying momentum can help traders distinguish between potential trend continuations and potential reversals. This knowledge empowers traders to position themselves accordingly, aiming to ride the momentum or anticipate potential breakouts.

Momentum Indicators: A Trader’s Eye for Detail

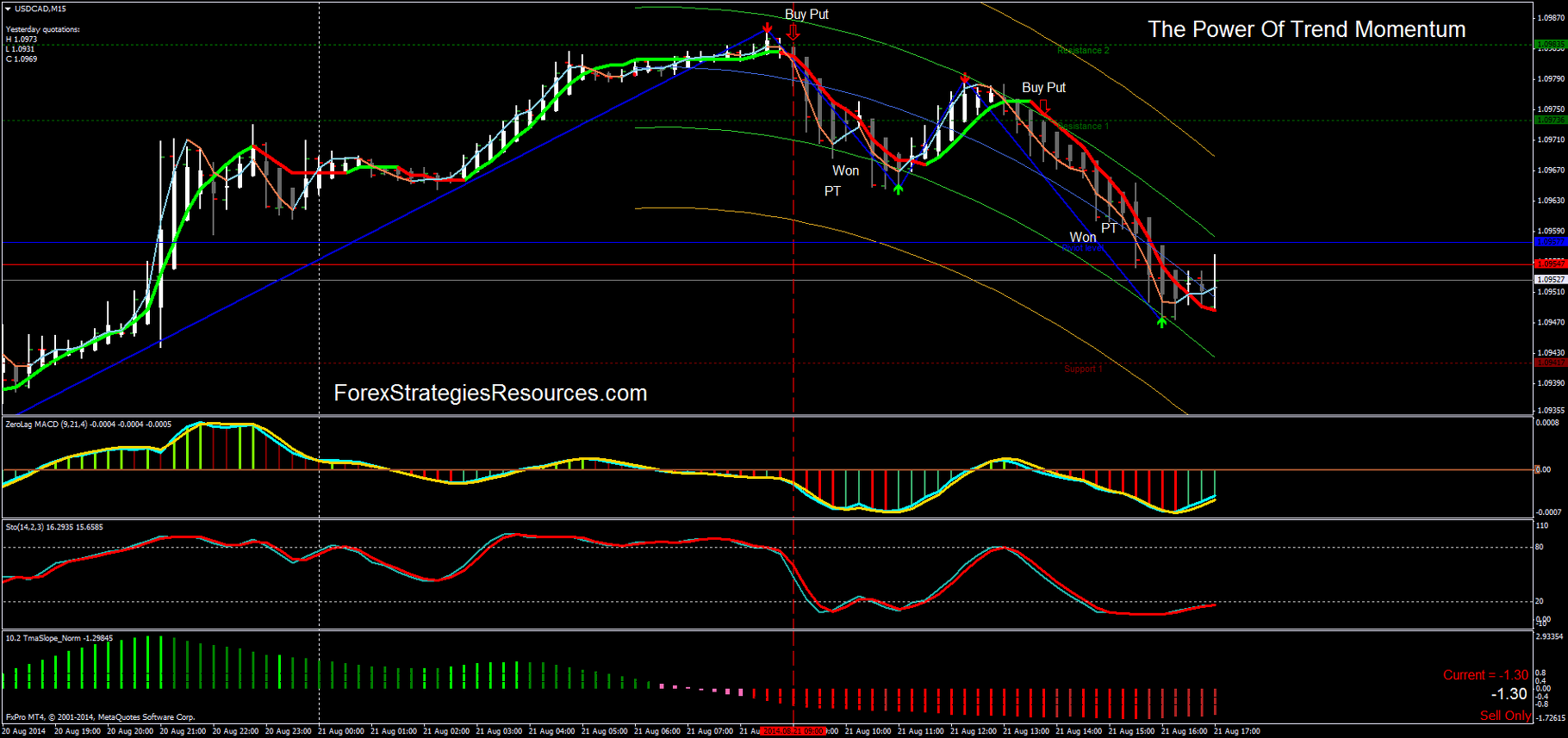

To effectively gauge momentum in forex trading, traders commonly employ technical indicators specifically designed to measure momentum’s strengths and weaknesses. They include popular tools such as the Relative Strength Index (RSI), Stochastic Oscillator, and Moving Average Convergence Divergence (MACD).

The RSI measures the magnitude of recent price changes on a scale from 0 to 100, with readings above 70 indicating overbought conditions and below 30 indicating oversold conditions. The Stochastic Oscillator similarly measures momentum on a scale from 0 to 100, but it considers the closing price in relation to the range of prices over a specific period. The MACD, on the other hand, subtracts a longer-period moving average from a shorter-period moving average, creating a histogram that portrays momentum, trend, and potential reversals.

Trading with Momentum: Strategies for Success

Equipped with the understanding of gauging momentum and armed with momentum indicators, traders can implement strategies to capitalize on market trends, including:

-

Trend Following: Identifying areas of high momentum can help traders determine the direction of a trend and capitalize on its continuation. By entering trades in line with the momentum, traders can ride the wave of a trend and potentially secure significant profits.

-

Momentum Reversals: Momentum indicators can detect divergences between price action and the associated momentum indicator, potentially signaling a trend reversal. Traders utilizing this technique can anticipate the end of a trend and enter countertrend trades to exploit market reversals.

-

Overbought/Oversold Trading: Momentum indicators also identify overbought and oversold conditions, indicating potential pullbacks or trend reversals. Traders can enter trades against the momentum, in anticipation of a correction or reversal, seeking to profit from market volatility.

Image: www.forexstrategiesresources.com

Gauging Momentum In Forex Trading

Conclusion: Mastering Momentum for Forex Success

Gauging momentum in forex trading empowers traders with the knowledge and tools to decipher market movements more precisely. By leveraging momentum indicators and implementing effective trading strategies, traders can align their decisions with the tide of the market, maximizing profit potential while managing risk. It is essential to approach momentum with a comprehensive understanding and cautious approach, always considering other market factors and managing risk accordingly.