Image: pubs.sciepub.com

The global foreign exchange (forex) market is a colossal financial space where currencies are traded, making it the most liquid market globally. The turnover in this market is nothing short of astronomical, and India has emerged as a significant player in this arena. Let’s delve into the intricacies of the global forex market and explore how India is influencing its trajectory.

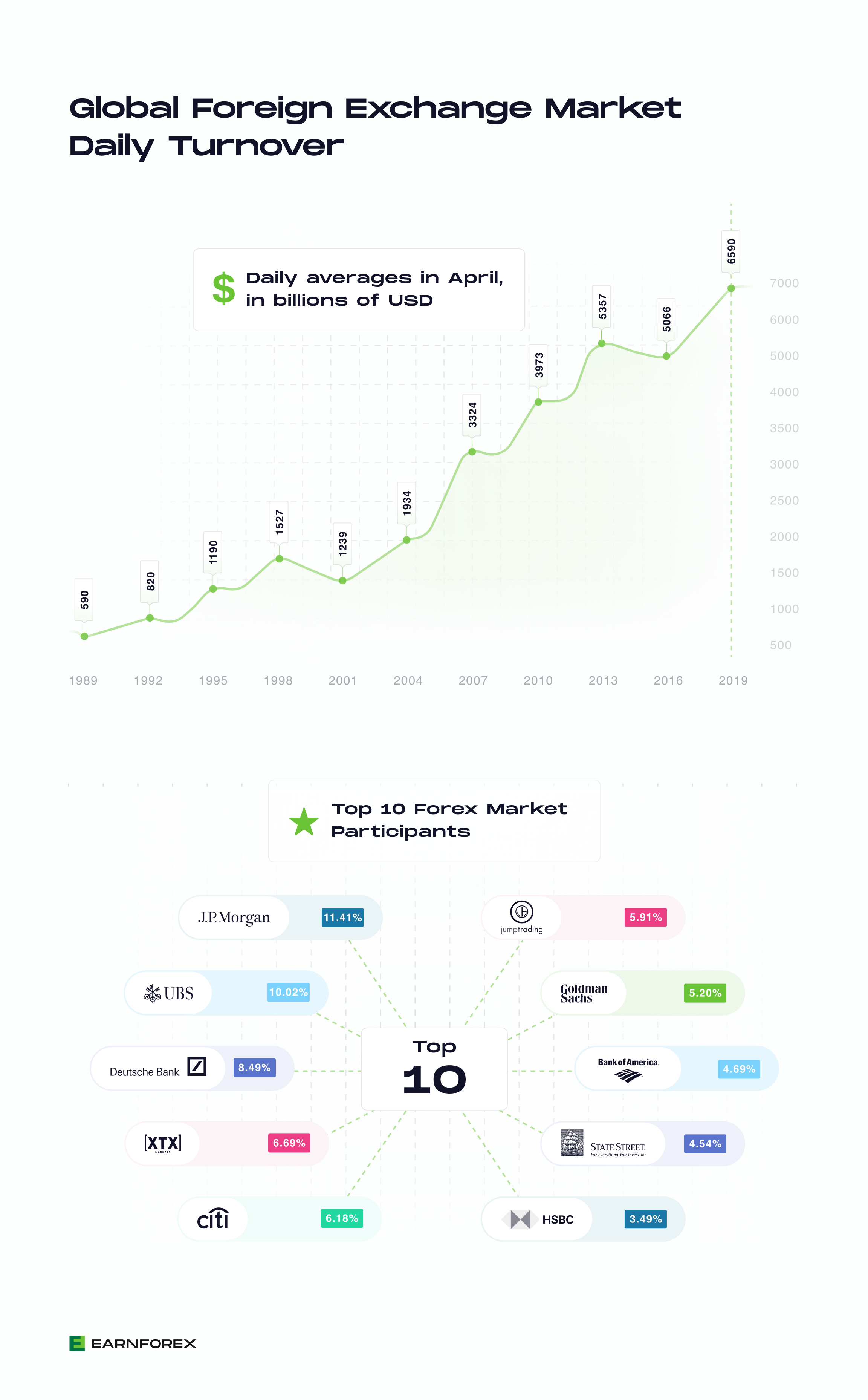

The Rise of the Global Forex Market

The daily turnover in the global forex market is an astounding $6.6 trillion, eclipsing the combined volume of all stock and bond markets worldwide. This massive scale is attributed to the need for currencies in international trade, investments, and tourism. The U.S. dollar remains the dominant currency, accounting for over 80% of global transactions.

India’s Forex Market: A Regional Powerhouse

India’s forex market is the tenth largest globally, boasting a turnover of over $150 billion per day. This considerable presence is driven by the country’s growing economic activity, increasing foreign investment, and the liberalization of its financial sector. The Reserve Bank of India (RBI) plays a crucial role in regulating the market, ensuring stability and protecting the value of the Indian rupee.

Factors Influencing Forex Turnover in India

Several factors contribute to India’s burgeoning forex turnover:

-

Economic Growth: India’s GDP growth has averaged over 7% for the past decade, boosting international trade and investment.

-

Liberalized Financial Sector: The government has eased restrictions on foreign currency transactions, increasing liquidity and attracting foreign capital.

-

Strong Domestic Currency: The Indian rupee has appreciated significantly against the U.S. dollar in recent years, making India an attractive investment destination.

-

Technological Advancements: Online trading platforms and mobile applications have made forex trading more accessible, broadening the market’s reach.

Implications for India

The vibrant forex market in India has far-reaching implications for the country’s economy:

-

Economic Growth and Job Creation: The growth of the forex market fosters economic activity, generating jobs in banking, finance, and technology.

-

Currency Stability: The RBI’s management of the forex market ensures stability in the value of the rupee, shielding the economy from external shocks.

-

International Competition: Indian companies can compete more effectively in global markets by leveraging the forex market to manage currency risks.

Conclusion

The global forex market is a vast and ever-evolving ecosystem, and India has emerged as a prominent player. The country’s growing economic might and attractive investment climate have contributed to the substantial turnover in its forex market. As India continues to develop, the role of its forex market is likely to expand, further fueling economic growth, stability, and competitiveness on the global stage.

Image: www.earnforex.com

Global Forex Market Turnover In Inr