In the ever-changing world of global finance, foreign exchange (forex) trading plays a critical role in facilitating international transactions and investments. HDFC Bank, one of India’s leading private sector banks, offers a range of forex services, including currency exchange and forex trading. Understanding the HDFC Bank CAD (Canadian Dollar) forex rate is crucial for individuals and businesses seeking to trade in Canadian currency.

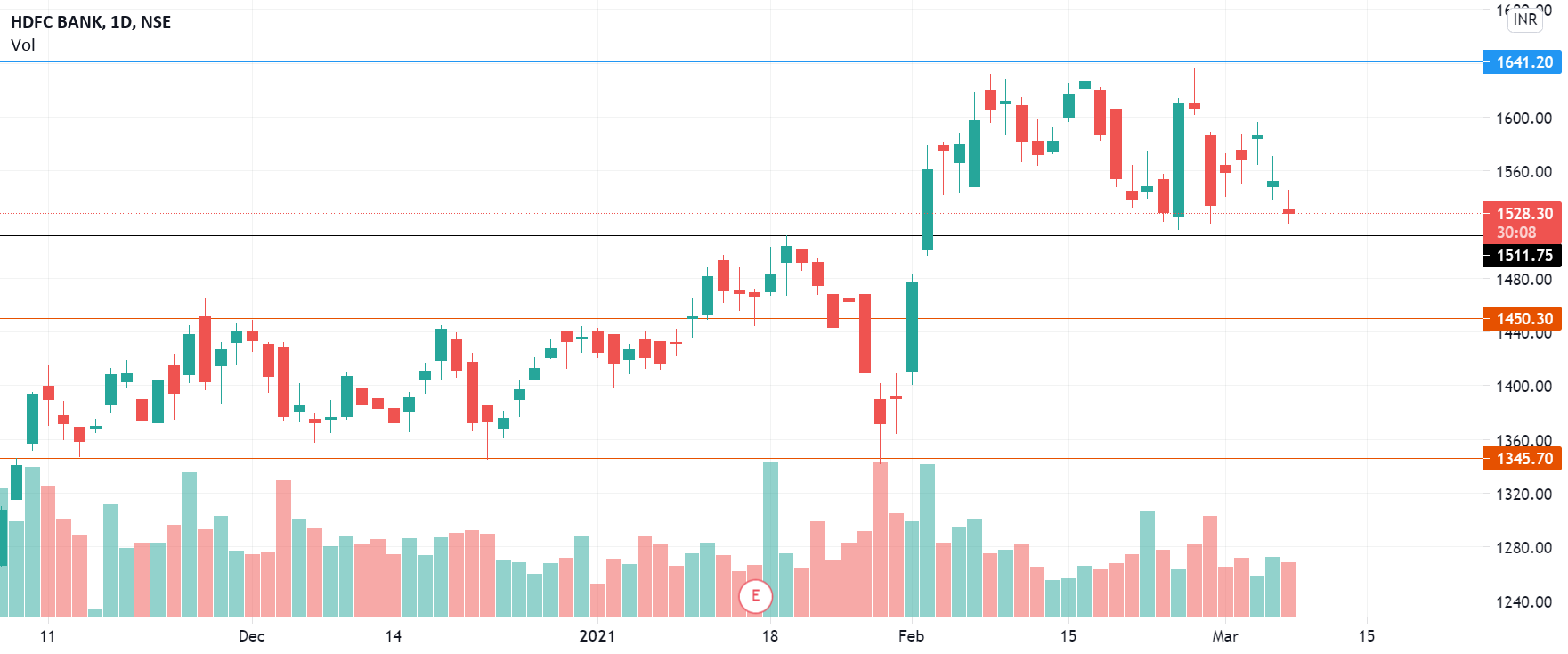

Image: in.tradingview.com

The Canadian Dollar: A Global Currency

The Canadian dollar (CAD) is the official currency of Canada, the world’s tenth-largest economy. Its stability and purchasing power have made it a popular choice for international investors and traders. The value of the CAD is influenced by various factors, including economic growth, interest rates, and geopolitical events.

HDFC Bank CAD Forex Rate: A Gateway to Canadian Dollars

HDFC Bank offers competitive forex rates for CAD, allowing customers to convert Indian rupees (INR) to Canadian dollars and vice versa at a reasonable cost. The HDFC Bank CAD forex rate is updated regularly to reflect market conditions, ensuring that clients receive the latest exchange rates.

Benefits of Trading CAD through HDFC Bank

Trading CAD through HDFC Bank offers several advantages:

-

Reliability and Credibility: HDFC Bank is a reputable financial institution with a long-standing track record of providing dependable forex services.

-

Competitive Rates: HDFC Bank strives to offer competitive forex rates to its customers, ensuring they get the best value for their money.

-

Real-Time Updates: The HDFC Bank CAD forex rate is updated in real-time, allowing customers to stay informed about market fluctuations and make informed decisions.

-

Convenience and Accessibility: With a wide network of branches and online platforms, HDFC Bank makes trading CAD convenient and accessible to customers across India.

Image: www.forex.academy

Applications of HDFC Bank CAD Forex Rate

Understanding the HDFC Bank CAD forex rate is essential for various purposes, including:

-

International Trade: Businesses engaged in importing or exporting to/from Canada can use the HDFC Bank CAD forex rate to calculate costs and determine profit margins.

-

Investment and Travel: Individuals investing in Canadian assets or planning trips to Canada can use the HDFC Bank CAD forex rate to forecast expenses and optimize their investments.

-

Personal Forex Transactions: People sending or receiving funds to or from Canada can access the HDFC Bank CAD forex rate for personal currency transfers.

Expert Insights: Unlocking the Potential of CAD Trading

-

“The Canadian dollar’s stability and global recognition make it an attractive currency for international transactions,” says Mr. X, a financial expert at HDFC Bank.

-

“By understanding the factors influencing the HDFC Bank CAD forex rate, traders can make informed decisions and potentially capitalize on market movements,” explains Ms. Y, a leading forex analyst.

Hdfc Bank Cad Forex Rate

https://youtube.com/watch?v=GaRw_vXU2WM

Conclusion

The HDFC Bank CAD forex rate is a crucial tool for individuals and businesses involved in international trade, investments, or personal finance transactions. By utilizing HDFC Bank’s competitive rates, real-time updates, and expert insights, customers can navigate the forex market with confidence and optimize their financial outcomes. Whether you’re a business seeking to expand globally or an individual planning a trip abroad, understanding the HDFC Bank CAD forex rate empowers you to make sound financial decisions and connect with the global economy.