Losing a travel essential like your HDFC Bank Forex Card can be a stressful experience, especially when you’re abroad. Don’t panic, though! With the right steps, you can report the loss promptly and minimize the potential risks. Here’s a comprehensive guide to help you navigate this situation:

Image: jilllextre.blogspot.com

Act Fast: Immediate Actions to Take

Time is of the essence when you lose your HDFC Forex Card. Taking immediate action can help prevent unauthorized transactions and safeguard your funds:

- Freeze Your Card Instantly: Dial HDFC Bank’s 24×7 customer care number (+91-22-61606161) and request immediate freezing of your lost card. This will stop all transactions associated with it.

- Report the Loss: Report the lost card to HDFC Bank’s Forex Helpdesk (+91-11-41887120, +91-9886322412). Provide details like the card number, date of issue, and the circumstances of the loss.

- File an FIR (First Information Report): If you lost your card abroad, consider filing an FIR with the local police. This will provide you with a documented record of the incident.

Applying for a Replacement Card

Once you have reported the loss and frozen your old card, you can apply for a replacement card. Here’s how:

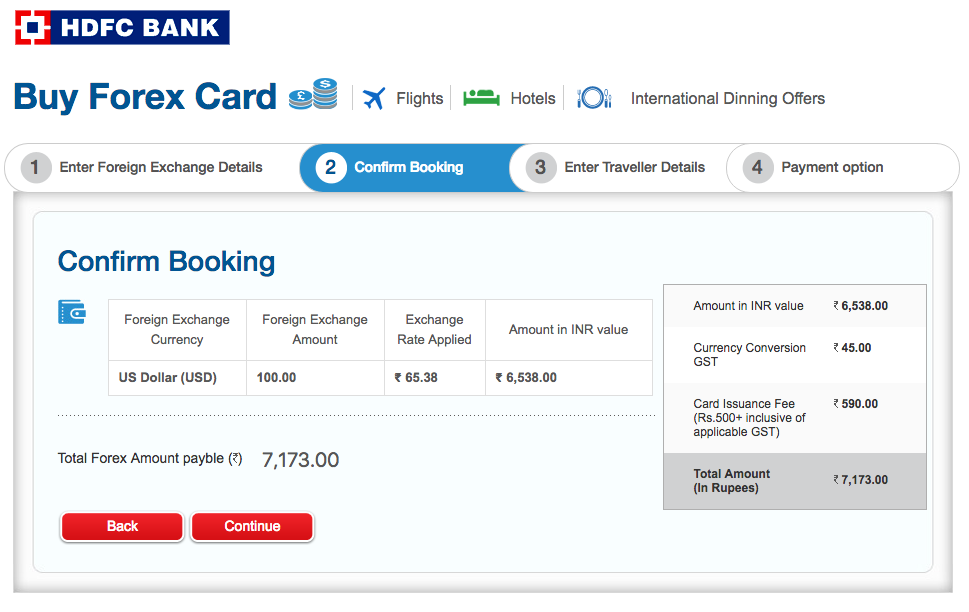

- Submit an Application: Visit your nearest HDFC Bank branch or submit an online application. You will need to provide your ID proofs, address proof, and a fee for the replacement card.

- Provide Details: Fill in all the required information accurately, including your personal details, lost card details, and a preferred pickup address.

- Track Your Application: Once you submit the application, you can track its progress online or through the HDFC Bank mobile banking app.

Protecting Your Money and Identity

Losing a Forex Card also raises concerns about your financial security. Here’s how to protect your funds and personal information:

- Monitor Your Bank Account: Keep a close eye on your linked bank account for any unauthorized activity. Report any suspicious transactions immediately.

- Change PIN and Passwords: Change your PIN and password for HDFC Bank’s net banking and mobile banking services. This will prevent unauthorized access to your accounts.

- Contact the Embassy (If Abroad): If you’re overseas and have lost your card, contact the Indian embassy or consulate for assistance. They can provide you with local support and guidance.

Image: www.forex.academy

Expert Advice and Additional Tips

HDFC Bank’s Forex Helpdesk representative, Ms. Anita Singh, advises travelers to:

- Carry Multiple Cards: Reduce the risk by carrying multiple Forex Cards, preferably from different banks.

- Keep Cards Separate: Store your Forex Cards separately from your wallet to avoid losing all at once.

- Register Your Card Online: Register your card with HDFC Bank’s online portal for convenient card management and enhanced security.

Hdfc Bank Forex Card Lost

Conclusion

Losing your HDFC Bank Forex Card can be an unsettling experience, but it’s crucial to stay calm and act promptly. Follow the steps outlined above to protect your funds and initiate the process of obtaining a replacement card. With vigilance and the support of HDFC Bank’s dedicated Forex Helpdesk, you can recover from this inconvenience and continue your travels with peace of mind.