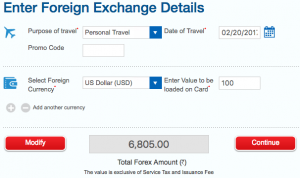

Are you gearing up for an exhilarating escapade abroad? Navigating foreign currency exchanges can be daunting, but HDFC Bank offers a seamless solution with its Multicurrency Forex Card. Designed to simplify your international financial transactions, this card empowers you to spend in multiple currencies without the hassle of carrying cash or exchanging it at unfavorable rates.

Image: www.forex.academy

With the freedom to load up to 11 different currencies simultaneously, the HDFC Bank Multicurrency Forex Card grants you the flexibility to explore the world, one destination at a time. Enjoy the convenience of managing your finances effortlessly and avoid unexpected hidden charges or fluctuating exchange rates.

Indulge in Effortless Global Transactions

HDFC Bank meticulously created the Multicurrency Forex Card to shield you from exchange rate volatility. Once loaded with the currencies of your travel destinations, the card allows you to seamlessly pay for goods and services without encountering hidden fees or unfavorable charges. This eliminates the need for multiple currency conversions, saving you time and money.

Not only does the card enhance your financial experience abroad, but it also ensures peace of mind. Rest assured that your funds are safe and secure, protected by the latest encryption technologies. Additionally, the card is widely accepted at ATMs, retail stores, and online marketplaces, providing you with endless possibilities to explore and indulge during your travels.

Exploring the Multicurrency Forex Card in Depth

The HDFC Bank Multicurrency Forex Card offers an array of benefits that make it an indispensable companion for international travelers:

- Multicurrency Loading: Load up to 11 foreign currencies simultaneously, providing unmatched flexibility and convenience.

- Exceptional Exchange Rates: Enjoy competitive exchange rates, ensuring you get the most value for your money.

- Zero Forex Markup: Avoid hidden charges and unfavorable markups, making every transaction transparent and cost-effective.

- Global Acceptance: Widely accepted at millions of merchant outlets and ATMs worldwide, providing seamless access to your funds.

- Chip and PIN Security: State-of-the-art chip and PIN technology safeguards your transactions, ensuring peace of mind.

Unveiling the Perks of HDFC Bank’s Multicurrency Forex Card

In addition to its core benefits, the HDFC Bank Multicurrency Forex Card offers a host of exclusive perks that elevate your travel experience:

- Airport Lounge Access: Enjoy complimentary access to select airport lounges, offering a relaxing haven before your departure.

- Exclusive Discounts: Receive exclusive discounts on travel-related services, such as flight bookings and hotel accommodations.

- 24/7 Customer Support: Access dedicated customer support round-the-clock, ensuring prompt assistance anytime, anywhere.

- Free SMS Alerts: Stay informed with real-time transaction alerts, providing continuous monitoring of your account.

Image: www.cardexpert.in

Expert Tips for Maximizing Your Forex Card Experience

To optimize your experience with the HDFC Bank Multicurrency Forex Card, consider these expert tips:

- Plan Ahead: Determine the currencies you’ll need and load them onto the card before your trip to secure the best exchange rates.

- Monitor Exchange Rates: Stay updated on currency fluctuations and load the card when rates are favorable.

- Utilize Multiple Currencies: Take advantage of the ability to load multiple currencies to avoid unnecessary conversions and save on transaction fees.

- Be Vigilant: Keep a close eye on your transactions and report any unauthorized activities promptly.

- Embrace the Convenience: Enjoy the ease of cashless transactions, eliminating the need to carry large amounts of cash and reducing the risk of theft.

Common Questions about the HDFC Bank Multicurrency Forex Card

To address common queries, we’ve compiled a comprehensive FAQ section:

Q: Can I load any currency onto the card?

A: Yes, you can load up to 11 foreign currencies onto the card, including popular currencies like the US dollar, Euro, and British pound.

Q: Are there any transaction fees?

A: The HDFC Bank Multicurrency Forex Card offers zero forex markup, meaning no hidden charges or unfavorable exchange rates.

Q: How do I activate the card before my trip?

A: You can easily activate the card through HDFC Bank’s NetBanking portal or by reaching out to customer support.

Q: Can I use the card for online transactions?

A: Yes, the card is widely accepted for online purchases at millions of merchants worldwide.

Hdfc Bank Multicurrency Forex Card Activate

Conclusion

Embark on your global adventures with confidence, empowered by the HDFC Bank Multicurrency Forex Card. Experience the unparalleled convenience of seamless multicurrency transactions, exceptional exchange rates, and a suite of exclusive perks. Whether you’re traversing continents or exploring hidden gems, this card serves as your financial compass, enabling you to navigate the world with ease and financial savvy. Join the countless travelers who have discovered the transformative power of HDFC Bank’s Multicurrency Forex Card. Are you ready to unlock a world of financial freedom and embark on your travel adventures with confidence?