HDFC Forex Rates: Unlocking Lucrative Currency Exchanges on November 2, 2019

Image: howtotradeonforex.github.io

Embark on a journey of financial empowerment as we delve into the intricate world of foreign exchange rates, with a particular spotlight on the HDFC forex rates as of November 2, 2019. Our comprehensive guide will unveil the intricacies of this dynamic market, enabling you to navigate its complexities with confidence and precision.

The Significance of Forex Rates: A Gateway to Global Prosperity

In today’s interconnected economy, the ability to exchange currencies seamlessly is vital. Forex rates serve as the fundamental framework for international transactions, influencing everything from travel expenses to global trade. Understanding these rates is key to unlocking opportunities and mitigating potential risks when engaging in cross-border exchanges.

HDFC Bank: A Beacon of Trust in the Forex Arena

HDFC Bank, renowned for its financial prowess and commitment to customer service, is a leading provider of forex services in India. Its extensive network of branches, coupled with its robust online platform, empowers individuals and businesses alike to access competitive exchange rates and expert guidance.

November 2, 2019: A Pivotal Day in Forex Markets

November 2, 2019, marked a significant day in forex markets. The ongoing trade tensions between the US and China, coupled with geopolitical uncertainties, created a volatile landscape. Amidst this market turbulence, HDFC Bank’s forex rates offered a beacon of stability and transparency.

Decoding HDFC Forex Rates: A Comprehensive Analysis

HDFC’s forex rates are meticulously determined by a combination of factors, including demand and supply, global economic conditions, and central bank policies. By closely monitoring these variables, HDFC ensures that its customers receive the most favorable rates possible.

Unveiling the Inner Workings of Currency Pairs

Forex rates are typically quoted in currency pairs, such as USD/INR (US dollar against Indian rupee). The first currency is known as the base currency, while the second is called the counter currency. The rate indicates the amount of counter currency required to purchase one unit of the base currency.

Live Exchange Rates: Stay Ahead of the Market

HDFC Bank’s website and mobile application provide real-time updates on forex rates, allowing you to stay attuned to the market’s dynamic nature. This empowers you to make informed decisions and capitalize on favorable exchange rate fluctuations.

Expert Insights: Unleashing the Power of Forex Knowledge

Harness the expertise of HDFC’s seasoned forex advisors to gain valuable insights into market trends and geopolitical factors that influence exchange rates. Their guidance will illuminate the path to profitable currency conversions.

Unlocking Forex Potential: A Wealth of Opportunities

Understanding HDFC’s forex rates opens up a world of financial opportunities. From hedging against currency risks to capitalizing on favorable exchange rates for international travel or investments, the power of Forex is at your fingertips.

Conclusion: Embracing Financial Empowerment

Mastering HDFC’s forex rates empowers you to navigate the complexities of global currency exchanges with confidence. Embrace this knowledge to unleash financial opportunities, mitigate risks, and make informed decisions that will propel you towards financial prosperity. HDFC Bank stands as your unwavering partner, providing the tools and guidance you need to succeed in the dynamic realm of forex.

Image: ecpulse.com

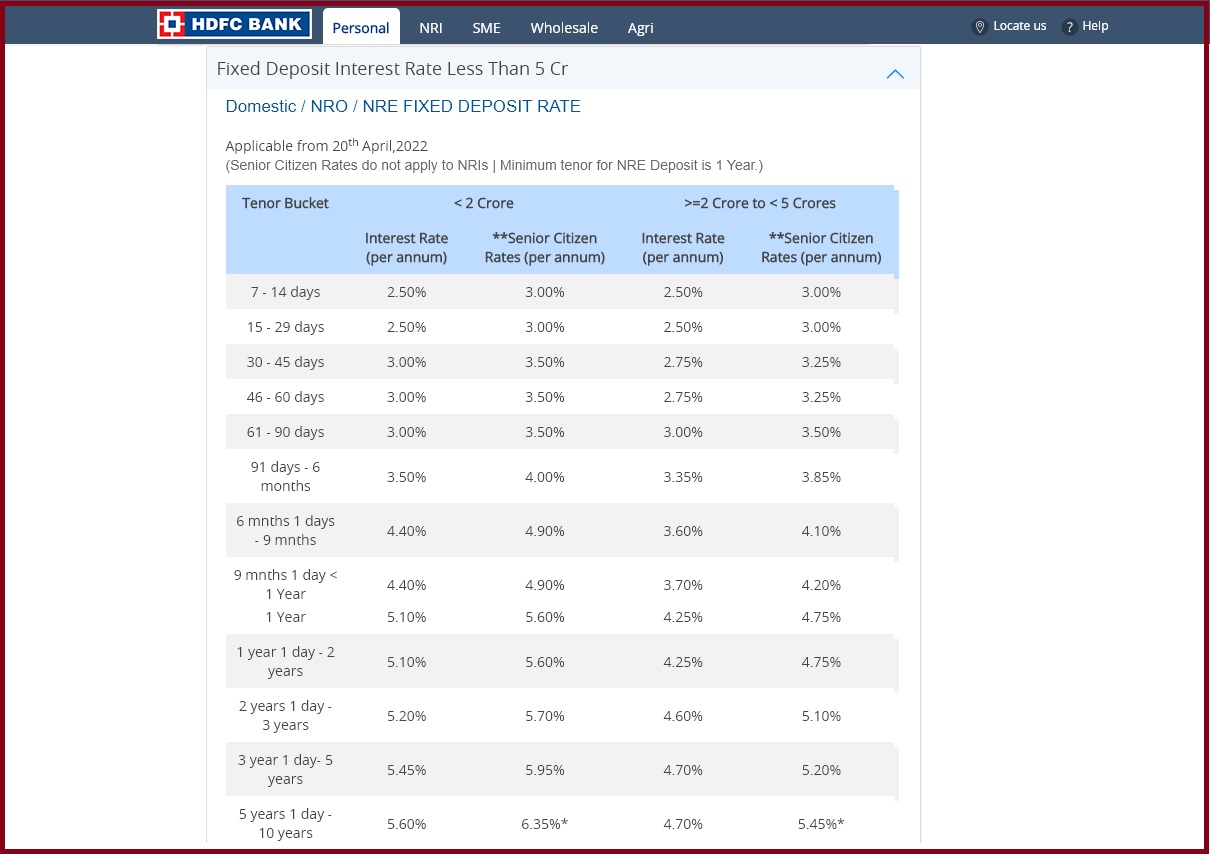

Hdfc Forex Rate 2-11-2019