Introduction

Image: cardinsider.com

In today’s interconnected globe, international travel has become a seamless part of our lives. Whether exploring exotic destinations or conducting business ventures abroad, a reliable and convenient way to manage your finances is paramount. Enter the HDFC Forex Travel Card and Axis Bank Forex Travel SBI, two compelling options that empower travelers with a world of possibilities.

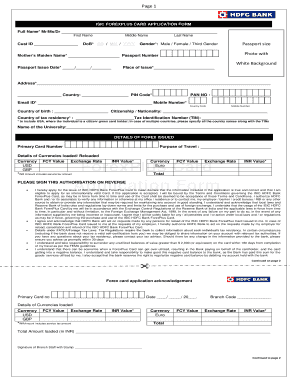

HDFC Forex Travel Card: A Global Gateway

Endorsed by the esteemed HDFC Bank, the HDFC Forex Travel Card is designed to simplify your financial planning for global adventures. It offers a host of benefits, including:

-

Zero transaction fees: Enjoy complete peace of mind as you conduct transactions at any foreign establishment without incurring additional charges.

-

Multiple currency option: The card allows you to carry up to 26 foreign currencies, providing flexibility and eliminating the hassle of exchanging currencies multiple times.

-

Competitive exchange rates: Benefit from competitive exchange rates to maximize your purchasing power and get the most bang for your buck.

-

Safety and security: Rest assured that your funds are secure with the card’s advanced chip-and-PIN technology and 24/7 fraud monitoring.

Axis Bank Forex Travel SBI: A Comprehensive Companion

Axis Bank Forex Travel SBI is another formidable contender in the travel card market, backed by the stability and credibility of Axis Bank. It offers an array of advantages:

-

Airport access: Access your cash at any designated Axis Bank outlet within the airport, even post baggage claim, making it convenient for last-minute travel needs.

-

Easy fund transfer: Load and reload your card conveniently through internet banking, mobile banking, or authorized Axis Bank branches, giving you complete control over your finances.

-

Exclusive rewards: Earn reward points on each transaction, which can be redeemed for exciting travel perks, such as discounts on flights or hotel stays.

-

Global network: Enjoy the convenience of using your card at any Visa-accepting merchant or ATM worldwide, ensuring financial freedom wherever your travels take you.

Expert Insights: Navigating the Best Option for You

Choosing between these two exceptional options ultimately depends on your individual needs and preferences. Here’s a quick guide:

-

For frequent travelers with multiple currencies: The HDFC Forex Travel Card offers a more versatile option with its extensive foreign currency options.

-

For those seeking rewards and airport accessibility: The Axis Bank Forex Travel SBI is an ideal choice, offering attractive rewards and convenient airport cash access.

Conclusion

Whether you’re a seasoned globe-trotter or an adventurous spirit embarking on your first international escapade, the HDFC Forex Travel Card and Axis Bank Forex Travel SBI are indispensable tools to elevate your travel experience. With their competitive exchange rates, unparalleled security, and tailored features, these cards empower you to explore the world with confidence and financial ease. Embrace the global adventure with these reliable companions by your side!

Image: forexretro.blogspot.com

Hdfc Forex Travel Card Or Axis Bank Forex Travel Sbi