In the realm of global finance, the foreign exchange market, fondly known as forex, stands as a behemoth, orchestrating an intricate dance of currency values. Navigating its ever-changing landscape can seem daunting, but grasping the factors that govern price movements can empower traders and investors alike.

Image: www.forexearlywarning.com

The Intricate Web of Supply and Demand

At the heart of forex price fluctuations lies the fundamental principle of supply and demand. When demand for a particular currency outstrips supply, its value rises. Conversely, if supply surpasses demand, the currency’s value depreciates. This interplay is influenced by myriad factors, shaping the volatile nature of forex markets.

Economic Indicators: A Barometer of Confidence

The release of economic indicators provides the market with a vital glimpse into the health and prospects of economies around the world. Strong economic data, such as robust GDP growth or low unemployment rates, bolsters confidence in a country’s currency, driving up its demand. Conversely, weak economic indicators can erode confidence, leading to a loss of value.

Central Bank Actions: Shaping the Monetary Landscape

Central banks play a pivotal role in influencing forex prices through their monetary policies. By managing interest rates, they can alter the attractiveness of a currency. Higher interest rates tend to attract foreign investment, strengthening the currency, while lower rates can make it less appealing, leading to a decline in value.

Image: www.forexschoolonline.com

Global Events: A Catalyst for Currency Swings

Unforeseen global events, such as political crises, natural disasters, or trade disputes, can trigger dramatic price movements in forex markets. These events introduce uncertainty into the equation, leading to shifts in investor sentiment and currency demand.

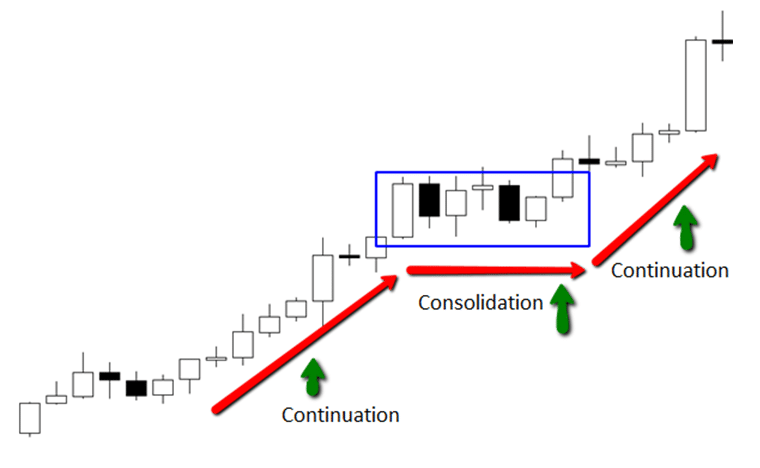

Technical Analysis: Unveiling Patterns in Price Movements

While fundamental factors provide a crucial foundation for understanding currency movements, technical analysis delves into the historical price data to identify patterns that may indicate future price trends. By studying charts and employing various analytical tools, technical traders aim to predict market direction and make informed trading decisions.

Staying Informed and Adapting to the Market’s Rhythms

In the ever-evolving arena of forex trading, staying abreast of the latest news and economic data is paramount. By meticulously monitoring market indicators, traders can anticipate potential price shifts and adjust their strategies accordingly. Adaptability is essential, as market conditions can change rapidly, demanding a flexible approach.

How Does Price Move In Forex Maret

https://youtube.com/watch?v=1O-WDrmCUUc

Conclusion: Embracing the Dynamic Nature of Forex

Grasping the nuances of price movements in forex markets requires a multi-faceted approach that encompasses both fundamental analysis and technical knowledge. By unlocking the intricate dance of supply and demand, economic indicators, central bank actions, global events, and technical patterns, traders and investors alike can navigate the volatile waters of forex with confidence.

Remember, the journey of understanding forex markets is an ongoing endeavor that requires patience, diligence, and a deep fascination with the world’s financial heartbeat. By embracing the dynamic nature of these markets, one can unveil the secrets that lie within, empowering themselves in the pursuit of financial success.