Forex, an abbreviated way of saying foreign exchange, is the world’s most traded market, and for good reason. It provides many opportunities for making money, but realizing the lucrative benefits in the forex market can be difficult without understanding the industry’s nuances and vital concepts – one of the most pivotal of these is leverage.

Image: trading-market.org

In the financial world, leverage refers to the use of borrowed funds or financial instruments to multiply the impact of one’s own investment capital and potentially maximize returns. By offering traders high leverage, forex brokers allow them to control and trade positions much larger than their own capital stock would normally permit – but how is this done?

How Leverage Works in Forex Trading

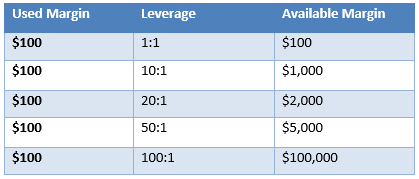

Forex brokers provide leverage by partnering with banks and financial institutions to secure credit lines. This allows them to offer traders access to capital beyond their own means, typically represented as a ratio (e.g., 1:100 leverage indicates that for every $1 of a trader’s own capital, they can trade up to $100 with borrowed credit from the broker).

Benefits of Leverage

Leverage offers several advantages, including:

- Increased potential returns: Amplifying trading positions through leverage can lead to multiplied profits on successful trades.

- Enhanced efficiency: Leverage provides the capacity to trade larger positions without committing excess capital, increasing efficiency in capital allocation.

- Diversification: Leverage allows traders to diversify across a more extensive range of assets, potentially reducing risk and enhancing the stability of their financial portfolio.

Risks of Leverage

While leverage can enhance gains, it also carries inherent risks:

- Increased potential losses: Leverage magnifies not only potential profits but also potential losses. Unsuccessful trades can result in significant capital depletion or even losses exceeding one’s initial investment.

- Margin calls: Forex brokers impose margin level requirements, a minimum balance of equity relative to a trader’s leveraged position. When losses reduce a trader’s account balance below this requirement, requiring a margin call – an additional deposit is necessitated to maintain the position open.

- Stress and emotions: Trading with excessive leverage can amplify stress and emotions during market movements. Psychological factors can hamper trade decisions and lead to poor investment outcomes.

Image: samerahaydyn.blogspot.com

Tips for Using Leverage Effectively and Safely

Properly leveraging forex trading requires responsible use and risk management:

- Start small: It’s advisable for beginners to commence with a modest level of leverage until they acquire proficiency with its mechanisms and effects.

- Understand risk tolerance: Traders should meticulously evaluate their risk tolerance to determine the appropriate leverage ratio aligned with their financial situation and investment goals.

- Use stop-loss orders: Implementing stop-loss orders is pivotal. These pre-set market orders automatically close out positions when certain price levels are hit, preventing significant losses if market fluctuations turn adverse.

- Manage emotions: Leverage can heighten trading excitement and stress. Remaining cognizant, disciplined, and objective in decision-making can mitigate the adverse effects of emotions.

Additionally, it’s vital to employ sound trading strategies and conduct thorough market research. Always prioritize risk management measures, and seek counsel from experienced traders or financial advisors if needed.

Frequently Asked Questions About Forex Leverage

- Q: Is leverage essential for forex trading?

A: While leverage can boost profit potential, it’s not an obligatory requirement. Some traders opt for lower leverage or trade without leveraging to reduce risk. - Q: What leverage ratio is best for beginners?

A: Forex brokers typically provide a range of leverage ratios, typically ranging from 1:10 to 1:1000. Newcomers should start conservatively, for instance, with 1:10 or 1:50, until they gain experience and knowledge of leveraging’s effects. - Q: How do I manage the risks of leverage?

A: Effective risk management in leveraged forex trading entails setting realistic profit goals, employing stop-loss orders, diversifying investments, and maintaining a disciplined trading approach. - Q: Is there a maximum leverage limit?

A: Yes. The specific limits vary by broker and jurisdiction. Regulatory bodies often impose restrictions to mitigate excessive risk in the forex market.

How Forex Brokers Give Such Amount Of Leverage

Conclusion

Forex brokers grant traders access to leverage, enabling them to maximize their profit potential. Understanding how leverage functions and managing it responsibly is paramount for success. Prudent risk management is necessary to offset potential losses and safeguard against excessive risk exposure.

Would you like to find out more about leverage in forex trading and how to use it effectively? Leave a comment below, and I’ll do my best to answer your questions!