In the realm of financial markets, inflation rates serve as crucial indicators that profoundly influence the dynamics of forex trading. As an experienced trader, I have witnessed firsthand how shifts in inflation levels can trigger significant market fluctuations, creating both opportunities and challenges for investors.

Image: avistone.com

Understanding the relationship between inflation rates and forex is essential for effective trading strategies. In this comprehensive guide, we will delve into the mechanisms through which inflation affects forex markets, explore recent trends and developments, and provide practical advice to help you navigate these dynamic conditions.

Inflation: A Primer

Simply put, inflation refers to the rate at which the general price level of goods and services in an economy increases over time. It gauges the erosion of purchasing power, as each unit of currency becomes able to purchase fewer goods and services.

Inflation’s Impact on Currency Value

When inflation rates rise, the purchasing power of a currency decreases, making it less valuable relative to other currencies. This depreciation can lead to a fall in the foreign exchange rate of that currency as traders seek out more stable and inflation-resistant investments.

Conversely, when inflation rates fall, the currency’s purchasing power increases, leading to an appreciation in its foreign exchange rate. This is because investors become more confident in the currency’s value and are willing to pay a higher price for it.

Recent Trends and Developments

In recent years, global inflation rates have been climbing at an elevated pace. Factors such as supply chain disruptions, geopolitical tensions, and COVID-19 pandemic fallout have contributed to this trend.

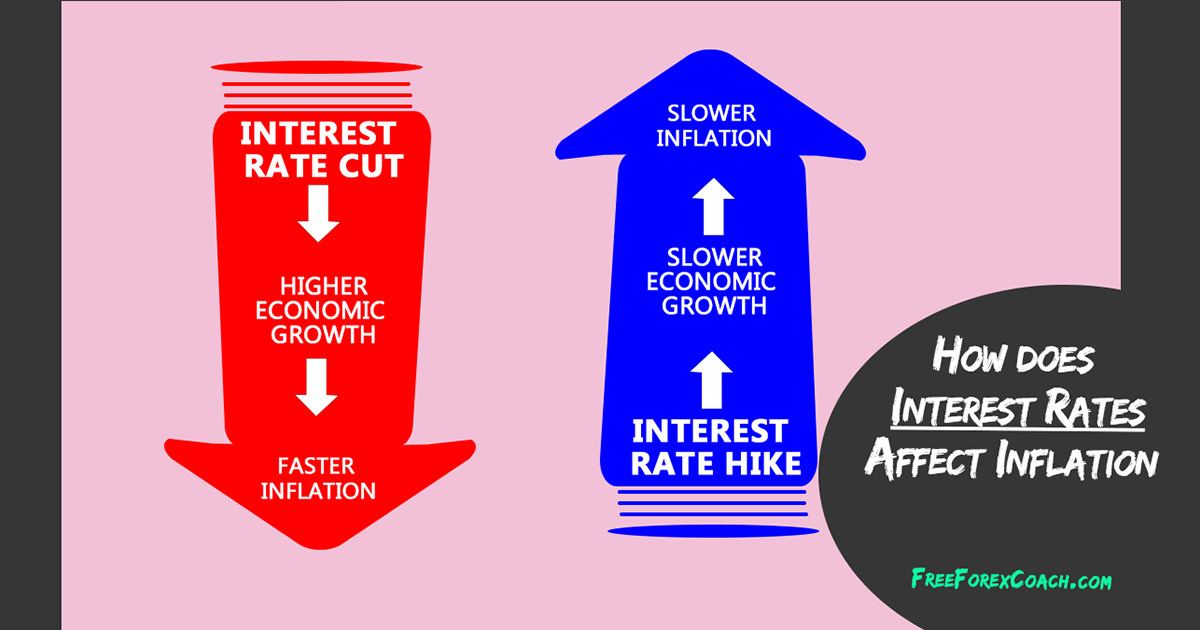

Central banks worldwide have responded to rising inflation by hiking interest rates to curb economic activity and temper price growth. While this strategy can be effective in the long run, it may also lead to short-term market volatility as investors weigh the potential impact on economic growth and corporate earnings.

Image: www.freeforexcoach.com

Tips for Forex Traders

Navigating the complexities of inflation requires a combination of understanding the underlying drivers and adopting agile trading strategies:

- Monitor Economic Indicators: Keep tabs on inflation data, consumer confidence indices, and other economic indicators to stay informed about the market’s response to changing inflation dynamics.

- Diversify Your Portfolio: Allocate your investments across different currency pairs to mitigate the impact of inflation on any single currency.

Conclusion

Inflation rates are a significant factor that every forex trader needs to be aware of. By understanding the mechanisms through which inflation affects currency values, monitoring economic indicators, and adopting prudent strategies, you can make informed decisions that can help you navigate the ever-changing forex market and potentially capitalize on inflation-induced price movements.

Do you find the topic of inflation rates and forex trading interesting and informative? Please share your thoughts and questions in the comments below.

FAQ

Q: How can I protect my forex investments from inflation?

Diversification is key. Spread your investments across different currency pairs, commodities, and other assets to reduce the impact of inflation on any single investment.

How Inflation Rates Affect Forex

Q: What are the risks of trading forex during high inflation?

Currency volatility can intensify during high inflation, leading to amplified market fluctuations. This can increase the risk of losses for inexperienced traders who do not adequately assess the potential impact of inflation on their trading strategies.