Introduction:

Image: panasonicdvdvcrcombofreeshippingg.blogspot.com

The allure of forex trading lies in its potential for substantial financial gains, but it’s crucial to approach it with realistic expectations and a thorough understanding of the risks involved. Ambitious traders often embark on this journey with grand aspirations of daily profits, but the reality is far more complex. In this comprehensive article, we will delve deep into the intricacies of forex trading, exploring the factors that influence daily earnings and debunking common misconceptions.

Understanding the Forex Market:

Forex, short for foreign exchange, is the global marketplace where currencies are traded. It operates 24 hours a day, five days a week, facilitating trillions of dollars in transactions worldwide. Traders buy and sell currencies against each other, hoping to profit from fluctuations in exchange rates.

Factors Affecting Daily Forex Earnings:

The amount you can earn per day in forex trading depends on numerous factors, including:

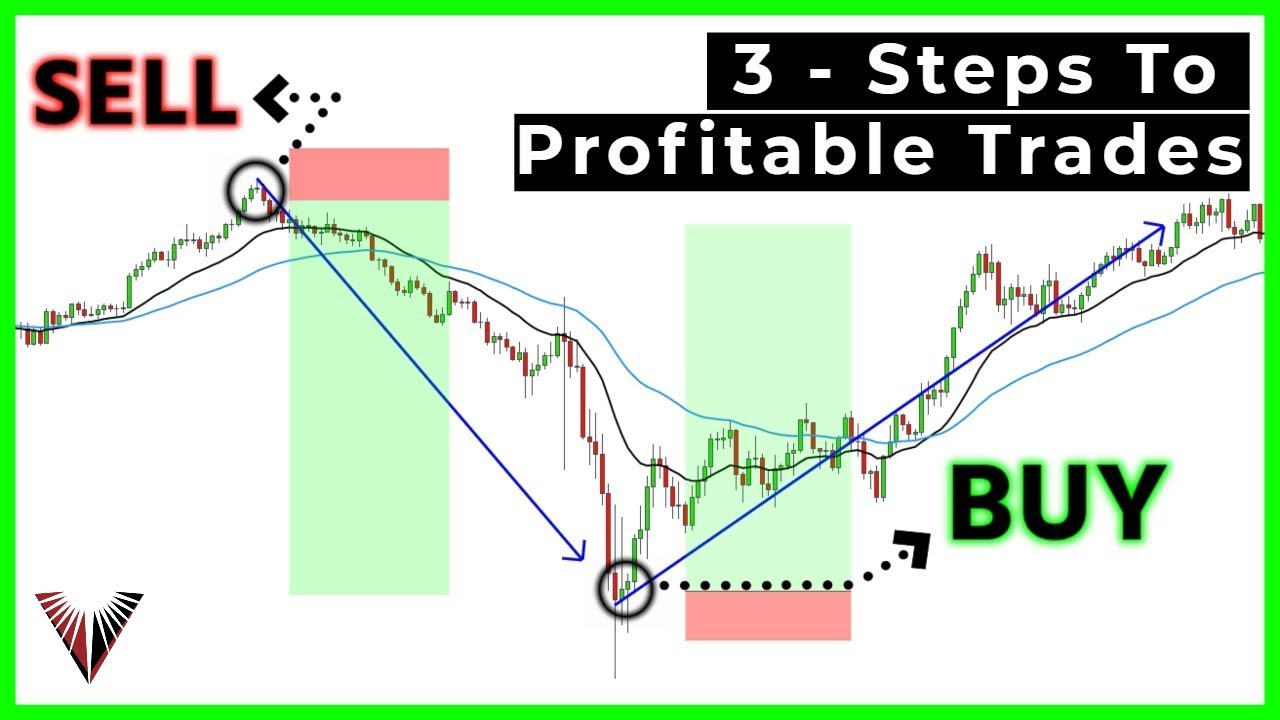

- Trading Strategy: Different trading strategies, such as scalping, day trading, and swing trading, have varying profit potentials.

- Market Conditions: Market volatility and liquidity play a significant role in determining profit opportunities.

- Risk-to-Reward Ratio: Traders must carefully manage their risk appetite by setting appropriate stop-loss and take-profit levels.

- Account Balance: The amount of capital available for trading directly impacts potential earnings.

Misconceptions and Realistic Expectations:

It’s essential to dispel some common misconceptions surrounding forex trading:

- Get-Rich-Quick Scheme: Forex trading is not a get-rich-quick scheme. Consistent profits require discipline, patience, and significant effort.

- Guaranteed Profits: There are no guaranteed profits in forex trading. Losses are inherent to the market, and traders must be prepared for them.

- High Daily Earnings: Exceptional traders may earn substantial daily profits, but for beginners, modest returns are more realistic.

Realistic Income Potential:

The realistic income potential for forex traders varies greatly depending on factors such as experience, skill, and risk tolerance.

- Beginners: With proper education and mentorship, beginners can aim for modest daily profits ranging from $10 to $100.

- Intermediate Traders: With consistent practice and a sound trading strategy, intermediate traders can expect higher earnings, potentially reaching $500 to $2,000 per day.

- Advanced Traders: Skilled and experienced traders with robust risk management strategies may generate daily profits exceeding $5,000.

Conclusion:

While substantial daily earnings are possible in forex trading, it’s vital to approach it with realistic expectations and a comprehensive understanding of the risks involved. By implementing a well-defined strategy, managing risk effectively, and continuously developing your skills, you can unlock the income-generating potential of the forex market.

Image: www.youtube.com

How Much I Will Per Day In Forex Trading