Embark on the Transformative Journey of Mastering Forex Loss Management

Foreign exchange trading, a high-stakes realm where currency values ebb and flow, calls for both agility and the astute management of risk. Among the myriad challenges encountered in this dynamic arena lies the crucial need to adjust for forex gain loss. In this comprehensive guide, we delve into the intricacies of this fundamental adjustment process, unveiling the strategies and techniques that empower traders to navigate the fluctuating tides of the forex market with precision and confidence.

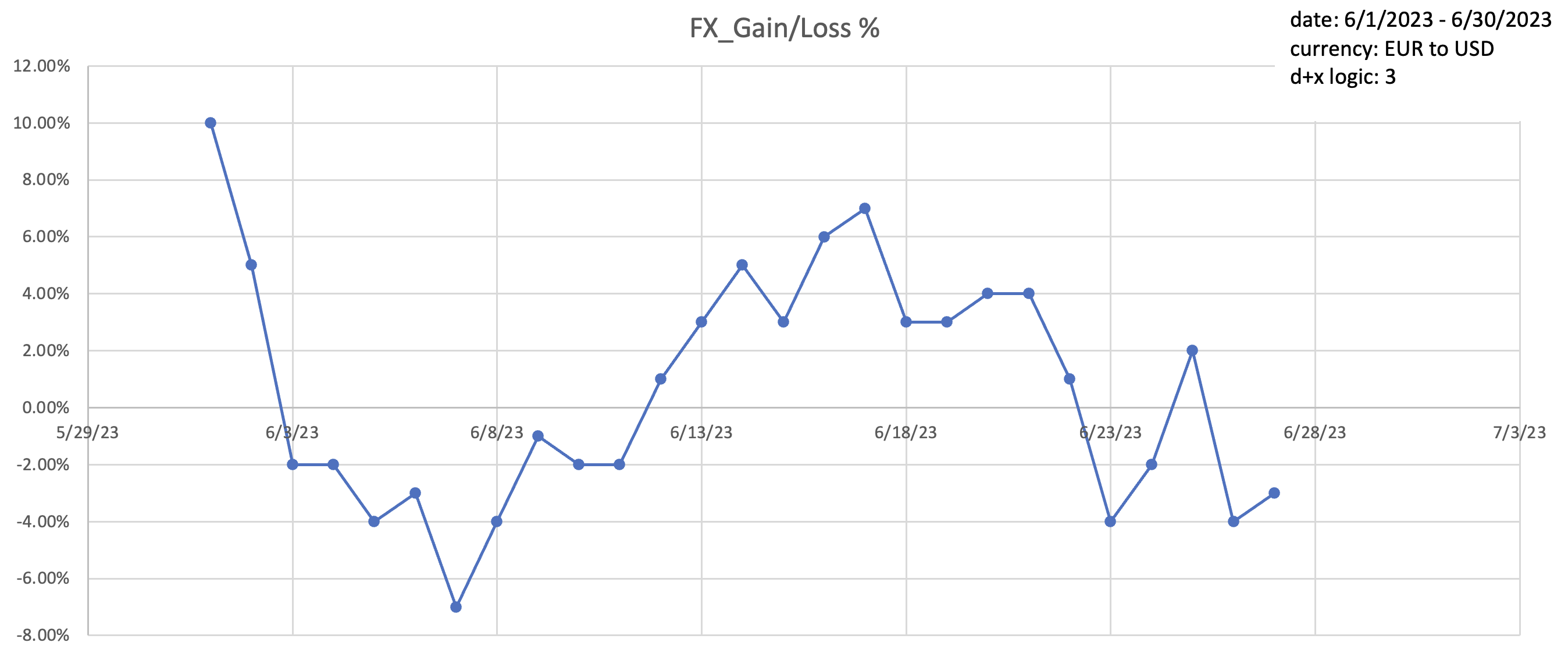

Image: www.chegg.com

Understanding the Essence of Forex Gain Loss

Forex gain or loss encapsulates the difference between a trader’s entry and exit currency values when closing a trade. This concept lies at the core of successful forex trading, as it directly impacts a trader’s profitability and overall market positioning. Comprehending the intricacies of gain loss adjustment equips traders with the analytical tools necessary to make informed decisions, minimize losses, and maximize their earnings potential.

The Role of Exchange Rate Fluctuations

Exchange rates, the cornerstone of forex trading, are inherently susceptible to constant fluctuations. These shifts in value are primarily influenced by a multitude of economic factors, such as interest rates, inflation, global economic conditions, and geopolitical events. Forex gain loss adjustment plays a pivotal role in accounting for these fluctuations, ensuring that traders accurately assess their financial performance and adapt their strategies accordingly.

Techniques for Adjusting Forex Gain Loss

Recognizing the importance of gain loss adjustment, traders employ a diverse range of techniques to fine-tune their trading strategies. These techniques include:

-

Real-Time Gain Loss Tracking: Monitoring currency price movements in real-time enables traders to make timely adjustments and minimize potential losses. Technological advancements, such as live forex charts and trading platforms, provide invaluable tools for staying abreast of market dynamics and proactively adjusting positions.

-

Utilizing Stop-Loss and Take-Profit Orders: Implementing stop-loss orders empowers traders to limit the extent of potential losses by automatically closing a trade when a predefined threshold is reached. Conversely, take-profit orders facilitate the locking of profits when a predetermined target is achieved.

-

Hedging Strategies: Hedging involves offsetting the risk associated with one investment with an opposing investment strategically. By employing hedging mechanisms, traders can mitigate the impact of adverse currency movements and preserve their overall capital.

Image: www.metatrader4indicators.com

Enhancing Precision with Automated Systems

The advent of advanced trading technologies has revolutionized forex loss management by introducing automated systems that streamline and enhance the accuracy of the adjustment process. These systems leverage sophisticated algorithms to constantly monitor market dynamics and adjust trading positions based on predefined parameters. Automation reduces the risk of human error and enables traders to maintain a disciplined approach to gain loss management.

The Psychology of Gain Loss Adjustment

While mastering the technical aspects of gain loss adjustment is of paramount importance, traders must also navigate the psychological challenges it presents. Emotions, often heightened in the fast-paced world of forex trading, can influence decision-making. Psychological techniques, such as mindfulness, emotional detachment, and risk tolerance assessment, empower traders to manage their emotions effectively and make rational decisions in the face of both profits and losses.

Resources for Further Exploration

How To Adjusted Forex Gain Loss

Conclusion

Empowering oneself with the knowledge and tools to adjust forex gain loss is a journey of both financial prudence and self-mastery. By understanding the mechanisms of exchange rate fluctuations, mastering the techniques of gain loss adjustment, and embracing the psychological aspects of trading, traders can transform themselves into confident market navigators, armed with the precision and composure to capitalize on market opportunities while minimizing risk. Remember, the true mark of a successful trader lies not in the absence of losses, but in the ability to manage those losses effectively and emerge as a resilient force in the ever-evolving forex market.