In the fast-paced world of forex trading, every edge counts. A well-crafted Excel sheet can be an invaluable tool for traders, providing them with real-time data, charts, and analysis to make informed decisions. In this comprehensive guide, we will explore every step of creating a professional Forex Excel sheet, empowering you to enhance your trading performance.

Image: www.exceldemy.com

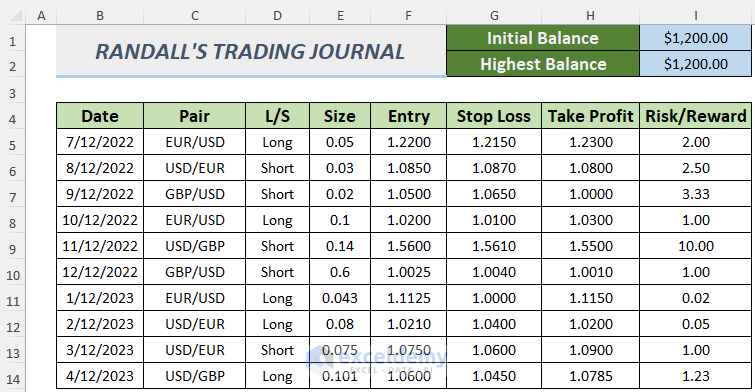

Forex Excel sheets allow traders to track multiple currency pairs, calculate profit and loss, perform technical analysis, and automate trading strategies. The benefits are immense, including improved accuracy, reduced time consumption, and a structured approach to trading. Get ready to unlock the full potential of Excel and elevate your forex trading game.

Step 1: Setting Up Your Spreadsheet

Begin by creating a new Excel workbook and naming it appropriately. This will be your dedicated Forex analytics hub. Next, establish your currency pairs and relevant data columns. For each pair, include fields for bid, ask, spread, and historical data.

To populate real-time data, utilize Excel’s data import functions. Connect to forex data providers like Oanda or MetaTrader, ensuring you have access to the most up-to-date market information. Once your spreadsheet is set up, you can customize it to suit your specific trading needs and preferences.

Step 2: Calculating Profit and Loss

Accurately tracking your trading results is crucial for understanding your performance and making adjustments. In your Excel sheet, create a section for calculating profit and loss. Define the entry and exit prices for each trade and use Excel’s built-in functions like SUMIF or VLOOKUP to calculate the profit or loss on each trade.

Don’t forget to factor in any applicable commissions or fees. By keeping a clear record of your trading history, you can identify profitable strategies, pinpoint areas for improvement, and make informed decisions about your trading approach.

Step 3: Performing Technical Analysis

Technical analysis is a valuable tool for identifying trading opportunities. Incorporate technical indicators into your Excel sheet to analyze price trends, identify support and resistance levels, and forecast future market movements. Popular indicators like Moving Averages, Relative Strength Index (RSI), and Bollinger Bands can be easily added using Excel’s built-in functions or custom formulas.

By visualizing these indicators on charts, you can gain insights into market sentiment, momentum, and potential price reversals. Use this information to make informed trading decisions and improve your chances of success.

Image: unbrick.id

Step 4: Automating Trading Strategies

Excel’s automation capabilities can streamline your trading process, saving time and reducing the risk of human error. Use conditional formatting to highlight specific market conditions, such as when a particular indicator crosses a certain threshold.

You can also create automated trading rules using Excel’s macro programming capabilities. Macros allow you to execute predefined actions based on specific criteria, such as placing trades when certain conditions are met. By automating your trading strategies, you can respond to market movements quickly and efficiently, maximizing your trading potential.

Tips and Expert Advice

To further enhance your Forex Excel sheet, consider these tips from seasoned traders:

- Keep it organized: Maintain a clear and structured layout for your spreadsheet, ensuring easy navigation and quick access to critical information.

- Customize to your needs: Tailor your Excel sheet to your specific trading style and requirements. Include the features and functionality that are most valuable to you.

- Monitor in real-time: Set up alerts or notifications to stay updated on market movements and ensure you don’t miss any critical trading opportunities

Frequently Asked Questions

- Q: What are the benefits of using an Excel sheet for forex trading?

- A: Enhanced accuracy, reduced time consumption, structured trading approach, real-time data analysis, technical analysis capabilities, automation of trading strategies, and improved profitability.

- Q: How do I import real-time data into my Excel sheet?

- A: Use Excel’s data import functions to connect to forex data providers like Oanda or MetaTrader.

- Q: Can I automate my trading strategies using Excel?

- A: Yes, you can use Excel’s macro programming capabilities to create automated trading rules based on specific criteria.

How To Create Forex Excel Sheet

Conclusion

Creating a professional Forex Excel sheet empowers you to make informed trading decisions, streamline your trading process, and maximize your potential for profitability. By following the steps outlined in this guide and implementing the expert tips provided, you can unlock the full capabilities of Excel and elevate your forex trading journey. Remember, the key to success lies in continuous learning and adaptation. Stay updated with market trends, refine your trading strategies, and embrace the power of technology to enhance your trading performance.

Are you excited to dive into the world of Forex Excel sheets and transform your trading game? Share your thoughts and experiences in the comments below, and let’s embark on this exciting journey together.