Introduction

The foreign exchange market, or Forex, is a vast and lucrative arena where traders buy and sell currencies to profit from fluctuations in their values. However, the market is also rife with individuals and scams seeking to trick novice and unwary traders into losing their hard-earned money. One of the most common methods of scamming involves luring traders with enticing but fraudulent signals – tips claiming to predict the direction of specific currency pairs. To safeguard yourself from these treacherous waters, mastering the art of filtering fake signals is critical.

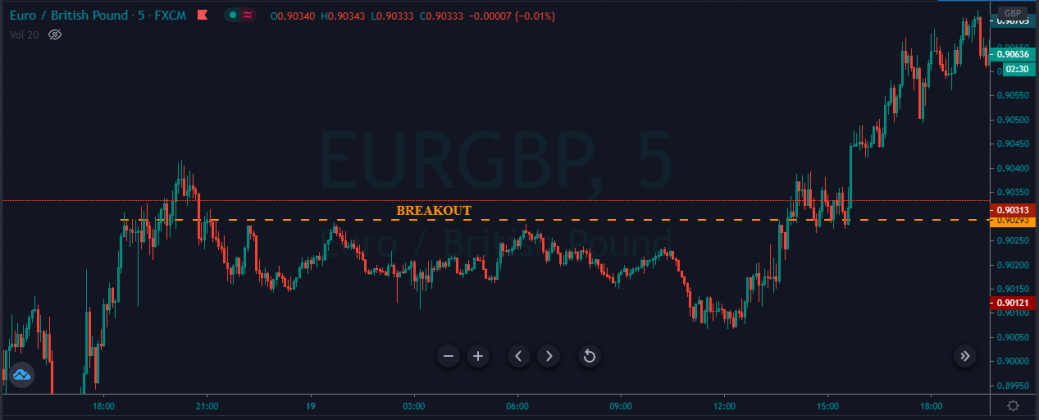

Image: www.forexstrategiesresources.com

Understanding the mechanisms of fake signals is paramount. Fraudsters utilize various platforms and tactics, including social media, instant messaging applications, and dedicated websites, to peddle their deceptive offerings. They present these signals as an easy and profitable solution to the complexities of Forex trading, often promising high returns with minimal effort. However, the reality is far from rosy, with many of these signals being intentionally misleading or simply worthless, resulting in financial losses for unsuspecting victims.

Identifying the Red Flags

Spotting fake signals requires a keen eye and an analytical mindset. Here are some telltale signs to watch out for:

- Exaggerated Results: Con artists love to boast about the mind-boggling profits their signals have generated. Be skeptical of any claims that sound too good to be true. Over-the-top promises often mask a lack of transparency and the absence of substantial performance records.

- High-Pressure Sales Tactics: Legitimate signal providers won’t pressure you into signing up. Scammers employ aggressive language and create a sense of urgency to compel you to act hastily, leaving you with little time to make a well-informed decision.

- Lack of Transparency: Responsible signal providers openly disclose their trading strategies and historical performance. If a vendor shrouds their methodology in secrecy or hesitates to furnish historical results, treat it as a major red flag.

- Positive Reviews from Unknown Sources: Fraudsters often create fake testimonials or purchase positive reviews to bolster their credibility. Genuine providers have a solid reputation built on authentic client experiences.

- Unrealistic Profitability: Remember, Forex trading involves risks. Any signal provider guaranteeing consistent profits without acknowledging potential losses is likely engaging in dishonest practices.

Scrutinizing the Signal Provider

Beyond scrutinizing the signals themselves, evaluating the signal provider is crucial. Here’s what to focus on:

- Reputation and Industry Recognition: Reputable signal providers have a proven track record and are recognized by industry experts. Conduct thorough research, read reviews from trusted sources, and opt for providers who have earned a solid reputation.

- Transparency and Accountability: Responsible signal providers embrace transparency. They publicly disclose their trading strategies, performance records, and the qualifications of their analysts. Transparency breeds trustworthiness.

- Experience and Expertise: Signal trading requires specialized knowledge of Forex markets and trading techniques. Opt for providers with years of experience, strategic expertise, and a deep understanding of financial markets.

- Strong Customer Support: Reliable signal providers are receptive to clients’ queries and offer prompt and helpful support. They are actively involved in building a positive relationship with their users, providing guidance and assistance along the way.

- No Hype, Just Substance: Genuine signal providers refrain from excessive marketing hype. They focus on providing valuable content and educational resources to empower traders. Avoid providers who resort to sensationalistic claims and gimmicks.

Testing the Signals Effectively

Once you have identified a few promising signal providers, testing their signals is the final step before committing. Here’s a practical approach:

- Small-Scale Testing: Begin by testing the signals on a small portion of your trading capital. Monitor the performance for a pre-determined period, keeping detailed records of all trades. Stay objective and avoid letting emotions sway your judgment.

- Stress Testing: Assess how the signals perform under volatile market conditions. Do they generate profitable signals even during market swings? Stress testing highlights the robustness and adaptability of the trading strategies employed.

- Backtesting: Backtesting involves analyzing the performance of a trading strategy against historical data. By replaying the signals against past market conditions, you can gain valuable insights into their effectiveness in diverse market environments.

- Compatibility with Your Trading Style: The signals’ compatibility with your trading style is critical. If you prefer short-term scalping, ensure the signals align with that approach. Choose providers who offer customizable signals, so you can tailor them to suit your trading preferences.

Image: www.forex.academy

How To Filter Fake Signal In Forex

Conclusion

Navigating the Forex market can be challenging, but with the knowledge to filter out fake signals, you can significantly reduce the risks and improve your trading outcomes. By being vigilant, scrutinizing signal providers, and cautiously testing signals, you empower yourself with a shield against deception. Remember, the key to successful Forex trading lies not in blindly following signals, but in cultivating your own skills and conducting due diligence. With the strategies outlined in this article, you can confidently distinguish legitimate opportunities from fraudulent schemes, setting yourself on the path to informed and profitable Forex trading.