Navigating the dynamic forex market demands an astute understanding of its ebb and flow. Identifying overbought and oversold areas provides invaluable insights into price trends and paves the way for profitable trading opportunities. This comprehensive guide will delve into the intricacies of this crucial concept, offering practical techniques and strategies that will empower traders to master this technique.

Image: www.forexstrategiesresources.com

Defining Overbought and Oversold Conditions

In the financial realm, overbought and oversold conditions refer to price levels where an asset is considered either extremely overvalued or undervalued. Overbought typically indicates a period when the price has risen sharply and is expected to experience a pullback or correction. Conversely, oversold represents instances where the price has significantly declined and is likely to reverse direction.

Importance of Identifying Overbought and Oversold Areas

Discerning overbought and oversold areas is pivotal for several reasons. Firstly, it alerts traders to potential market reversals. Just as high tides are often followed by low tides, overbought conditions often precede downtrends, while oversold conditions signal possible price rebounds. Secondly, it aids traders in identifying potential trading entry and exit points. By anticipating price movements, traders can capitalize on favorable market conditions and minimize losses. Thirdly, it helps traders manage risk effectively. By understanding overbought and oversold levels, traders can adjust their trading strategies to avoid entering trades during unfavorable market conditions.

Technical Indicators for Detecting Overbought and Oversold Zones

A plethora of technical indicators exist to assist traders in identifying overbought and oversold areas. Each indicator employs a unique set of algorithms to measure price behavior, providing varying perspectives on market conditions. Let’s explore some of the most popular indicators:

Image: www.mql5.com

1. Relative Strength Index (RSI)

The RSI compares the magnitude of recent gains to the magnitude of recent losses, producing a value between 0 and 100. Overbought conditions are typically signaled when the RSI rises above 70, while oversold conditions occur when it falls below 30.

2. Stochastic Oscillator (%K and %D Lines)

The Stochastic Oscillator gauges price momentum by comparing the current closing price to the price range over a specific period. Overbought conditions are often indicated when the %K and %D lines cross above 80, while oversold conditions arise when they cross below 20.

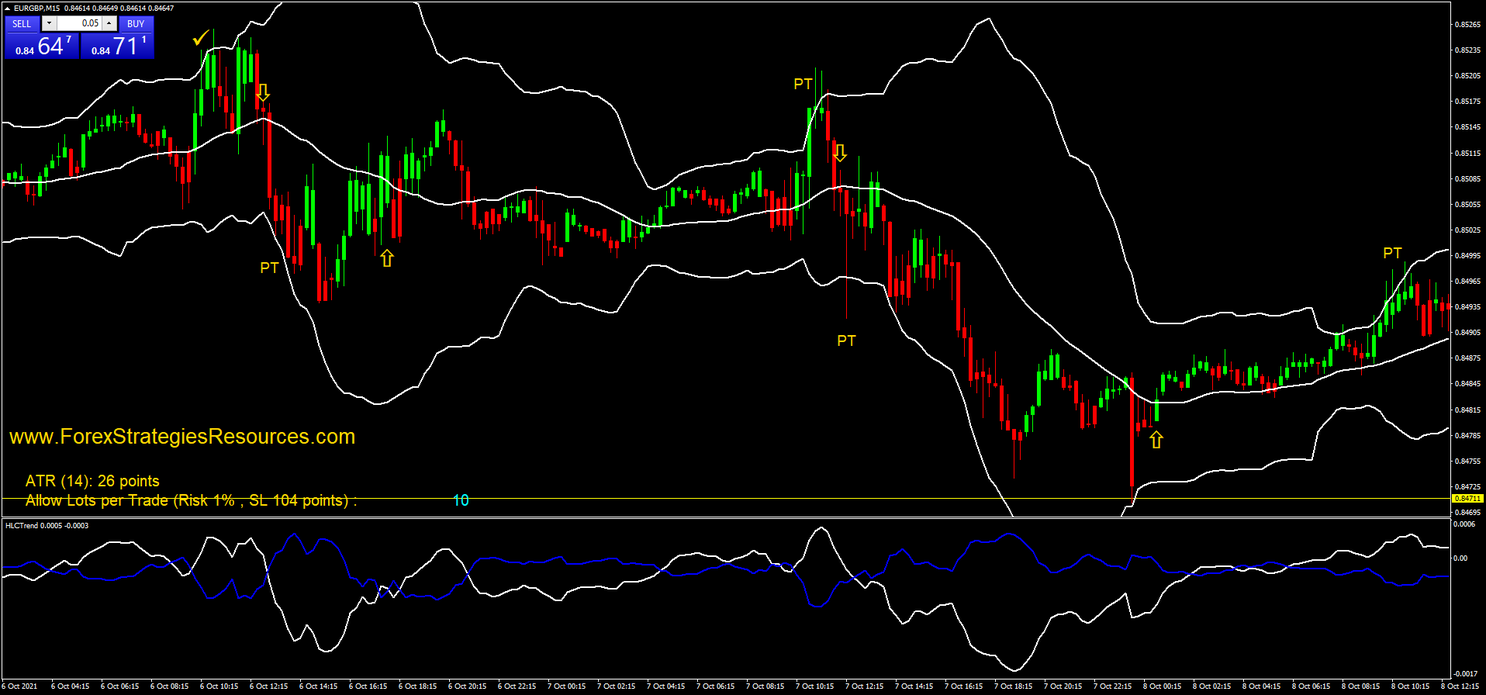

3. Bollinger Bands

Bollinger Bands create an envelope around the price chart. When the price trades near the upper Bollinger Band, it suggests overbought conditions. Conversely, when the price approaches the lower Bollinger Band, oversold conditions may be present.

4. Parabolic SAR (Stop and Reverse)

The Parabolic SAR is a trend-following indicator that prompts traders to buy when the price rises above the indicator and sell when the price falls below it. When the indicator reverses direction, it may signal a potential overbought or oversold zone.

Trading Strategies Using Overbought and Oversold Indicators

Once overbought and oversold areas have been identified, traders can apply various strategies to profit from the market’s momentum. Several popular strategies are as follows:

1. Mean Reversion Strategy

Mean reversion strategies capitalize on the tendency of prices to revert to their average over time. Traders enter trades when prices reach overbought or oversold levels, anticipating a subsequent reversal towards the mean.

2. Breakout Strategy

Breakout strategies seek to identify price patterns that suggest a breakout from an overbought or oversold condition. Traders enter trades when prices break above resistance levels (in overbought conditions) or below support levels (in oversold conditions).

3. Contrarian Strategy

Contrarian strategies involve taking positions that oppose the prevailing market sentiment. When prices are overbought, contrarians may sell, while when prices are oversold, they may buy, betting on a reversal of the trend.

Cautions and Considerations

While overbought and oversold indicators provide valuable insights, traders should exercise caution and consider additional factors before making trading decisions. No indicator is infallible, and market conditions can change rapidly. Traders should:

• Use multiple indicators to confirm their observations.

• Consider market context, such as news events and economic indicators.

• Set realistic profit targets and stop-loss levels to manage risk.

• Avoid overtrading and stick to their trading plan.

How To Find Overbought And Oversold Area In Forex

Conclusion

Identifying overbought and oversold areas in forex is a crucial skill that can enhance a trader’s chances of success. By harnessing the power of technical indicators and applying sound trading strategies, traders can navigate market fluctuations with greater confidence. Remember, trading involves both potential profits and risks, and traders should always conduct thorough research and manage their investments wisely.