In our increasingly globalized economy, it’s not uncommon to make purchases in foreign currencies. However, when it comes to settling your credit card bill, you’ll want to be aware of potentially costly foreign exchange (forex) charges that can add up over time. Here, we delve into the intricacies of paying your credit card without incurring these charges, comparing the popular payment service PayPal with other alternatives.

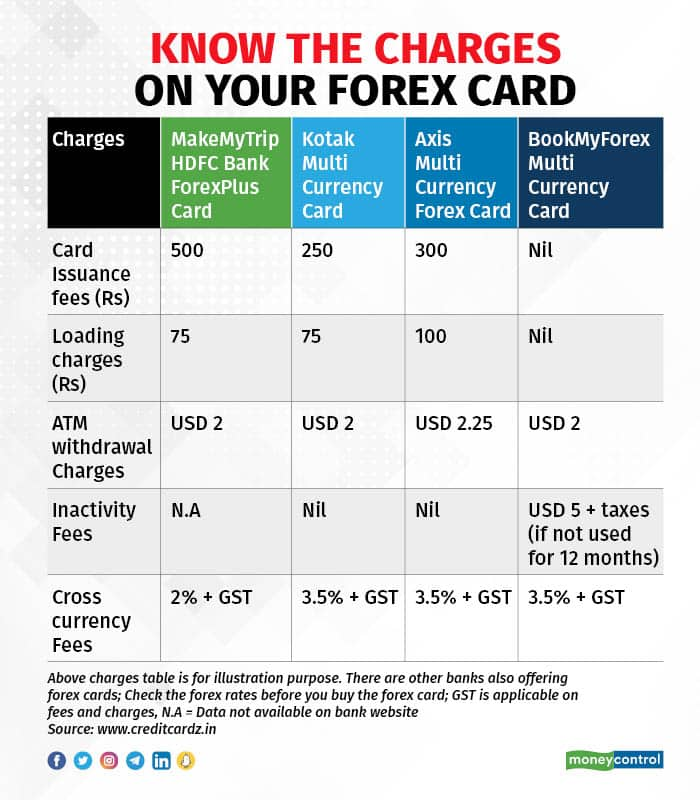

Image: www.moneycontrol.com

What are Forex Charges and How They Affect You

Forex charges are essentially fees imposed by banks or credit card companies when you make transactions involving different currencies. These fees can vary significantly depending on the financial institution and the currency involved. For instance, a typical forex charge for converting US dollars to euros can range from 2% to 4% of the transaction amount. This means that if you purchase a product worth €100 using your US credit card, you may incur an additional charge of up to €4. While these fees may seem small, they can add up over time if you frequently make international purchases.

PayPal vs. Other Options: A Comparative Analysis

PayPal, a global online payment platform, offers a convenient way to send and receive payments in different currencies. Let’s compare PayPal’s forex exchange rates and fees with alternative options:

**PayPal**

PayPal’s currency exchange rates are typically higher than those of banks or direct currency brokers. In addition to these less favorable rates, PayPal charges a transaction fee that varies depending on the currency and the transaction type. For example, when converting US dollars to euros, the exchange rate will be around 2-3% higher than the mid-market rate, and there’s an additional 3.5% transaction fee.

Image: economictimes.indiatimes.com

**Banks**

Banks generally offer more competitive exchange rates than PayPal. However, they may charge a flat fee for each currency conversion. For instance, a bank may charge a flat fee of $10 for every transaction involving a currency other than US dollars. If you frequently make small international purchases, this flat fee can be more cost-effective than PayPal’s percentage-based fees.

**Direct Currency Brokers**

Specializing in foreign currency exchange, these brokers typically offer the most competitive rates for larger transactions. They charge a small flat fee or a percentage of the transaction amount, depending on the amount you are exchanging. Direct currency brokers may be a suitable option for individuals or businesses making substantial cross-border payments.

Choosing the Best Option for Your Needs

The best option for paying your credit card without forex charges depends on several factors, including the size and frequency of your international transactions. If you make frequent small purchases in foreign currencies, a bank with a flat fee may be more cost-effective than PayPal. For larger transactions or businesses dealing with significant international payments, a direct currency broker may offer the most favorable rates and fees.

Tips for Minimizing Forex Charges

- Use a credit card that offers no or low forex fees. Some credit card issuers offer cards that waive or reduce forex charges. Research and choose a credit card that aligns with your international spending habits.

- Set up a multi-currency account. If you frequently make purchases in multiple currencies, consider opening a multi-currency account. This will allow you to hold different currencies in one account, eliminating the need for frequent currency conversions and associated fees.

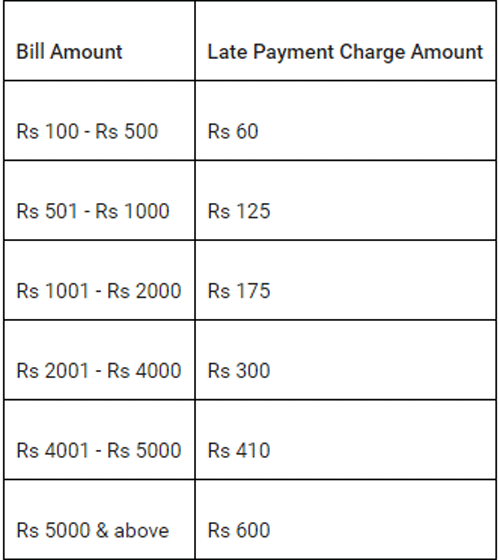

- Pay your credit card bill in full and on time. Late payments and insufficient funds can result in additional fees, which can outweigh any savings you may have made by avoiding forex charges.

How To Pay Credit Card Without Forex Charges Vs Papyal

Conclusion

Understanding how to pay your credit card without incurring forex charges is essential for managing your finances wisely. By comparing PayPal with other options and considering factors such as transaction size and frequency, you can make informed decisions to minimize these charges. Remember to use a credit card with favorable forex rates, explore multi-currency accounts for multiple currencies, and prioritize bill payments to maintain optimal financial health.