Embarking on an international escapade requires meticulous planning, and managing your finances efficiently is paramount. With its convenience and global acceptance, the HDFC Forex Card stands out as an indispensable tool for savvy travelers. If you’re seeking a comprehensive guide on how to reload your HDFC Forex Card, look no further. This article will delve into the various methods available, making the reloading process a breeze.

Image: isycihe.web.fc2.com

Understanding HDFC Forex Card Reloading

An HDFC Forex Card is a prepaid card that allows you to store and utilize foreign currency. It provides a secure and convenient way to manage your expenses while traveling abroad, eliminating the need for carrying cash or exchanging currencies at unfavorable rates. Reloading your card is crucial to ensure you have sufficient funds for your trip.

Reload Methods for HDFC Forex Card

HDFC Bank offers multiple reload options to cater to diverse traveler needs. Here’s a breakdown of each method:

1. Online Reload through NetBanking

- Log in to HDFC Bank’s NetBanking portal.

- Select ‘Cards’ from the menu and choose ‘Forex Card Reload/Add-on Card.’

- Enter your HDFC Forex Card number, reload amount, and source account details.

- Confirm the transaction and your card will be instantly reloaded.

Image: www.youtube.com

2. Mobile Banking App Reload

- Download the HDFC Mobile Banking app on your smartphone.

- Log in to your account and navigate to the ‘Forex Card’ section.

- Choose ‘Reload Forex Card’ and enter your card number, reload amount, and source account details.

- Complete the transaction to reload your card conveniently.

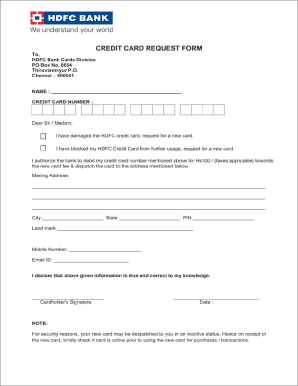

3. Reload at HDFC Bank Branches

- Visit any HDFC Bank branch with your Forex Card and valid identification.

- Submit a duly filled ‘Forex Card Reload’ form to the cashier.

- Provide the necessary cash or cheque for the reload amount.

- The card will be reloaded promptly after verification.

4. Reload through Western Union

- Visit a Western Union agent location near you.

- Provide your Forex Card details and the reload amount.

- Pay for the transaction and collect a receipt for future reference.

- The reload amount will be credited to your card within 24-48 hours.

Benefits of Reloading Your HDFC Forex Card

- Global Acceptance: Your HDFC Forex Card is accepted at millions of merchants and ATMs worldwide, providing you with peace of mind and flexibility.

- Competitive Exchange Rates: HDFC Bank offers competitive exchange rates, ensuring you get the most value for your money.

- Secure Transactions: All reload transactions are securely processed, protecting your financial information and preventing unauthorized access.

- Real-Time Balance Updates: Keep track of your card balance and transaction history in real-time through NetBanking, the Mobile Banking app, or SMS alerts.

- No Cash Handling: Reloading your card eliminates the hassle of carrying and managing cash during your travels, enhancing your safety and convenience.

Tips for Efficient Reloading

- Check your card’s daily and monthly reload limits to avoid any transaction delays.

- Allow sufficient time for the reload to process, especially if you’re reloading closer to your departure date.

- Consider reloading your card in smaller amounts frequently to optimize your funds availability.

- Keep your HDFC Forex Card and NetBanking/Mobile Banking credentials secure and confidential.

- Contact HDFC Bank customer service if you encounter any issues or have any specific queries related to reloading your card.

How To Reload Hdfc Forex Card

Conclusion

Reloading your HDFC Forex Card is an essential step to ensure a seamless travel experience. By utilizing the convenient and secure reload methods outlined in this article, you can effectively manage your finances abroad. Whether you choose online, mobile, branch, or Western Union reload options, HDFC Bank provides a hassle-free and efficient way to keep your card loaded and ready for your global adventures. So, pack your bags, reload your HDFC Forex Card, and embark on your journey with confidence and financial security.