Unveiling the Secrets of Contrary Investing

In the ever-volatile realm of forex trading, opposite trading, also known as counter-trend trading, stands as an unconventional but potentially lucrative strategy. By understanding the counter-intuitive nature of financial markets, traders can capitalize on market sentiment and profit from price reversals. Embark on this in-depth exploration as we demystify the intricacies of opposite trading and empower you with the knowledge to harness its potential.

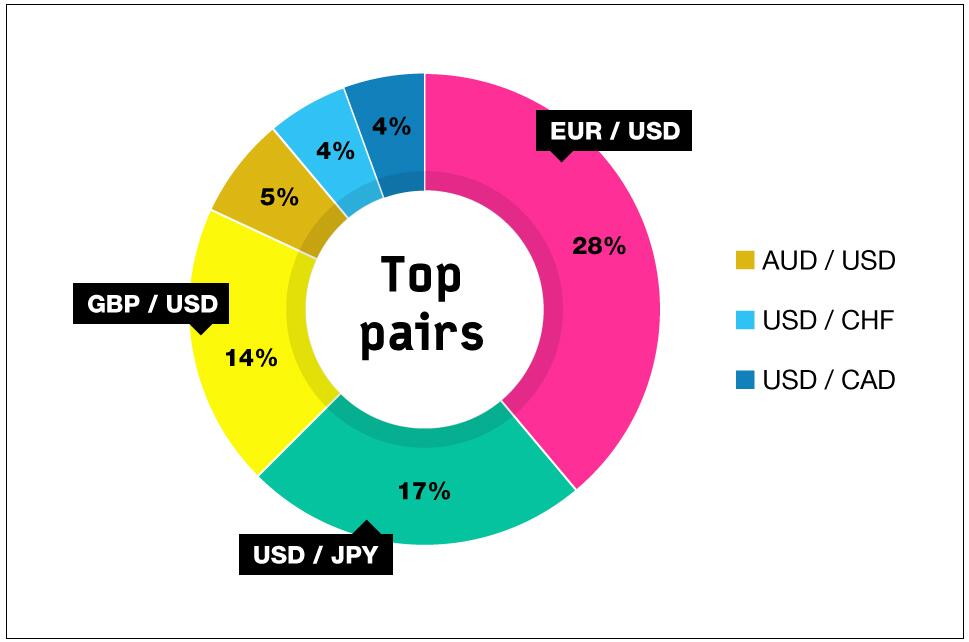

Image: www.litefinance.org

Navigating the Unpredictable: Opposite Trading Unveiled

Contrary to conventional trading wisdom, opposite trading involves identifying and betting against prevailing market trends. While most traders chase current momentum, opposite traders seek to anticipate market reversals and capture profits as the pendulum swings. This contrarian approach challenges conventional wisdom and demands a deep understanding of market psychology and technical analysis.

The Psychological Edge: Unraveling Market Sentiment

At the heart of opposite trading lies a profound understanding of market sentiment. By meticulously observing the collective emotions and behaviors of market participants, traders can uncover potential turning points. Herd mentality and fear-driven decisions often lead to market inefficiencies, creating opportunities for opposite traders to exploit.

Technical Proficiency: Master the Art of Chart Analysis

Technical analysis serves as the cornerstone of opposite trading. Through the study of historical price data and chart patterns, traders seek to identify potential areas of price exhaustion or reversal. By analyzing candlestick patterns, support and resistance levels, and momentum indicators, they develop informed trading strategies.

Image: howtotradeonforex.github.io

Indicators and Oscillators: Your Trusted Tools

A plethora of technical indicators and oscillators aid opposite traders in their quest for market anomalies. Moving averages, Bollinger Bands, the Relative Strength Index (RSI), and the Stochastic oscillator provide valuable insights into trend strength, overbought or oversold conditions, and potential turning points.

Risk Management: The Cornerstone of Success

In the dynamic world of opposite trading, risk management is paramount. Implementing strict stop-loss orders to limit potential losses and defining clear profit targets ensures longevity in this challenging trading environment. By adhering to disciplined risk management principles, traders can safeguard their capital and maximize their profits.

Leveraging the Power of Experts

Seek counsel from seasoned opposite traders to gain invaluable insights and refine your trading strategies. Attend industry conferences, engage in online forums, and study the approaches of successful contrarians. Learning from those who have mastered this art can accelerate your progress and enhance your profitability.

Emotional Discipline: Mastering the Inner Game

The psychological challenges of opposite trading cannot be overstated. Resisting the allure of chasing trends and overcoming fear and greed are essential for success. Developing emotional discipline and adhering to a well-defined trading plan will empower you to navigate the emotional rollercoaster of the markets.

How To Trade Opposite In Forex

Conclusion: Embracing the Counter-Trend Mindset

Opposite trading offers a unique approach to forex trading, challenging conventional wisdom and harnessing the power of market contrarianism. By understanding the psychological underpinnings of market behavior, employing technical analysis, and implementing sound risk management strategies, traders can exploit market inefficiencies and achieve consistent profits. Remember, mastering the art of trading opposite requires patience, discipline, and a willingness to challenge market orthodoxy. Embrace the counter-trend mindset, and you will unlock the potential to thrive in the ever-changing forex landscape.