Introduction

Forex, the foreign exchange market, presents a vast and alluring landscape for investors seeking financial growth. Yet, to partake in this realm of currency trading, obtaining permission is paramount. Understanding the process of acquiring permission for forex trading is essential for anyone aspiring to navigate this complex domain.

Image: eatradingacademy.com

Permission for forex trading varies from one jurisdiction to another. In this article, we will delve into the key steps and considerations for navigating the authorization process in different regions. By understanding the regulatory requirements, aspiring forex traders can embark on their trading journey with confidence and compliance.

Understanding Regulatory Requirements

The United States: In the realm of forex trading, the United States stands as a global powerhouse. Aspiring traders must navigate the regulatory framework established by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). Obtaining a license from the NFA is imperative for entities engaging in forex brokerage services.

The United Kingdom: The United Kingdom, renowned for its robust financial sector, imposes stringent regulations on forex trading. The Financial Conduct Authority (FCA) serves as the primary regulatory body, overseeing all aspects of this market. Securing an FCA license is a prerequisite for operating a forex brokerage within the UK.

The European Union: Forex trading within the European Union falls under the purview of the Markets in Financial Instruments Directive (MiFID II). This directive harmonizes regulations across EU member states, ensuring a consistent approach to financial market oversight. Forex brokers seeking to operate within the EU must comply with MiFID II requirements.

Other Jurisdictions: Beyond these major jurisdictions, forex trading regulations vary considerably across the globe. In regions like the Middle East and Asia, aspiring traders should familiarize themselves with specific local regulations and seek guidance from qualified professionals.

Steps for Obtaining Permission

The process of obtaining permission for forex trading typically involves several steps:

- Establish a Legal Entity: Determine the appropriate legal structure for your forex trading business, be it a sole proprietorship, partnership, or corporation.

- Obtain a Registered Address: Secure a physical address for your business that meets regulatory requirements.

- Appoint Key Personnel: Identify qualified individuals to serve in key roles within your organization, including compliance officers and risk managers.

- Develop a Business Plan: Outline the objectives, strategies, and financial projections of your forex trading business.

- Apply for a License: Submit a formal application to the relevant regulatory authority, providing detailed information about your business and operations.

- Meet Ongoing Obligations: Once permission is granted, ongoing compliance with regulatory requirements is crucial, including maintaining accurate records, submitting periodic reports, and adhering to ethical guidelines.

Considerations for Forex Traders

Beyond obtaining permission, forex traders should consider several factors to enhance their success in this dynamic market:

- Education and Training: Develop a solid understanding of forex trading principles, technical analysis, and risk management strategies.

- Risk Management: Implement robust risk management practices to mitigate potential losses and preserve capital.

- Market Analysis: Continuously monitor economic and political events that may impact currency prices, utilizing fundamental and technical analysis to inform trading decisions.

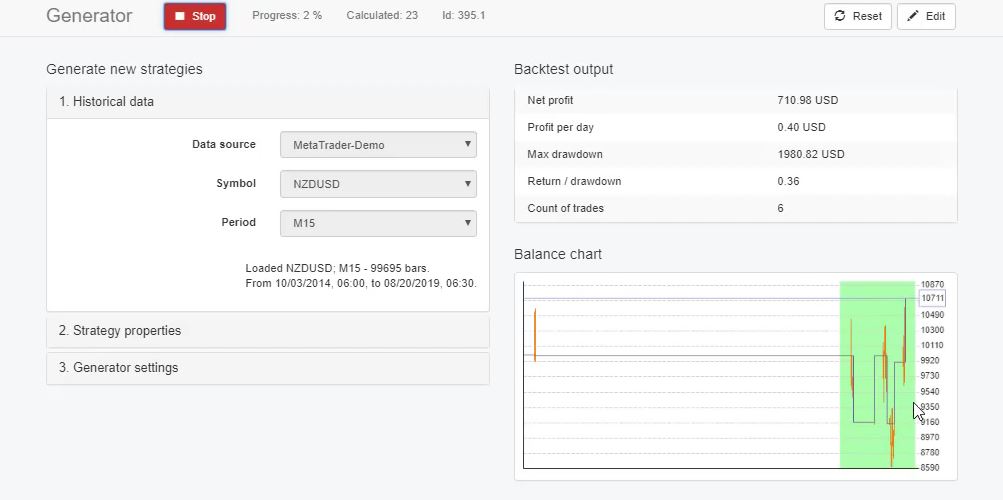

- Technology and Software: Leverage reliable trading platforms and analytical tools to execute trades efficiently and monitor market conditions.

- Customer Support: Ensure prompt and effective support to clients, addressing inquiries and resolving issues in a timely manner.

Image: ibkrcampus.com

How To Tsake Permission For Forex

Conclusion

Obtaining permission for forex trading is a crucial step for aspiring traders seeking to operate within a regulated environment. By understanding the regulatory landscape and following the established procedures, individuals can establish a legitimate and compliant forex trading business. Moreover, continuous education, risk management, and adaptation to evolving market conditions are essential elements for long-term success in this dynamic and lucrative realm of financial markets.