As a forex trader, embarking on a journey to conquer the financial markets, unearthing the intricacies of various technical indicators is paramount to achieving consistent success. One such indicator that has garnered immense popularity and proven its efficacy in identifying profitable trading opportunities is the Average Directional Index (ADX).

Image: thediaryofatrader.com

Embark on an in-depth exploration of ADX, unraveling its intricacies and honing your skills to wield it as a potent tool in your forex trading arsenal. Discover the secrets of harnessing the power of ADX to identify market trends with remarkable accuracy, enabling you to make informed decisions and maximize your profits.

Understanding the Average Directional Index (ADX)

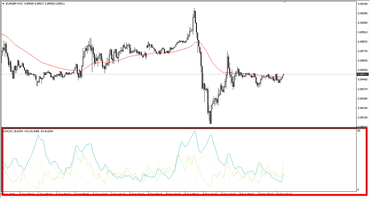

The Average Directional Index (ADX), conceived by renowned technical analyst J. Welles Wilder, serves as a non-directional indicator, providing invaluable insights into the strength and direction of the prevailing trend. Calculated using a combination of positive directional indicators (+DI) and negative directional indicators (-DI), ADX offers traders a clear understanding of market momentum and trend.

ADX oscillates between 0 and 100, with readings below 20 indicating a ranging market, while values above 20 suggest the presence of a trend. Higher ADX values signify a stronger trend, offering traders greater confidence in identifying profitable trades.

Identifying Trend Strength and Direction using ADX

Harnessing the power of ADX lies in its ability to identify the strength and direction of a prevailing trend. When ADX values are below 20, it suggests that the market is consolidating or ranging, indicating a lack of clear direction. In such scenarios, traders are advised to exercise caution and refrain from initiating new positions.

Conversely, ADX values above 20 signal the presence of a trend, empowering traders to identify potential trading opportunities. A rising ADX line, coupled with a positive +DI crossing above the -DI, suggests the emergence of a bullish trend. Conversely, a falling ADX line accompanied by a negative -DI crossing below the +DI indicates a bearish trend.

Combining ADX with Other Technical Indicators

To enhance the accuracy of your forex trading strategies, consider combining ADX with other technical indicators. Employing ADX in conjunction with moving averages, support and resistance levels, or momentum indicators, such as the Relative Strength Index (RSI), can provide a comprehensive view of market conditions, enabling you to make informed trading decisions.

By combining multiple indicators, you can validate your trading signals, reducing the likelihood of false entries and maximizing your profit potential. Integrating ADX into your trading arsenal empowers you to identify strong trends, determine optimal entry and exit points, and minimize risk.

Image: www.youtube.com

Tips and Expert Advice for Using ADX in Forex Trading

Embracing ADX into your forex trading repertoire can dramatically enhance your profitability. Here are some expert tips and advice to guide you:

- Identify Strong Trends: Seek out trading opportunities with ADX values consistently above 20, indicating a strong trend.

- Confirm Trend Direction: Ensure the +DI and -DI lines align with the ADX trend. For instance, a rising ADX accompanied by a positive +DI crossing above the -DI suggests a bullish trend.

- Avoid False Signals: Beware of ADX readings that spike briefly above 20 but quickly retreat. Such false signals may indicate a temporary surge in volatility rather than a genuine trend.

- Manage Risk: ADX can identify profitable trends, but it does not predict price reversals. Employ stop-loss orders and position sizing strategies to mitigate risk.

- Combine with Other Indicators: Enhance your trading accuracy by incorporating ADX with other technical indicators, such as moving averages or momentum indicators.

By adhering to these expert recommendations, you can harness the full potential of ADX, navigating the forex markets with greater confidence and achieving consistent profitability.

Frequently Asked Questions about ADX in Forex Trading

Q: What is the optimal ADX value for identifying strong trends?

A: ADX values consistently above 20 indicate the presence of a strong trend.

Q: How do I determine the direction of the trend using ADX?

A: A rising ADX line and a positive +DI crossing above the -DI signal a bullish trend, while a falling ADX line and a negative -DI crossing below the +DI suggest a bearish trend.

Q: Can ADX be used as a standalone indicator?

A: While ADX provides valuable insights into trend strength and direction, it is advisable to combine it with other technical indicators for enhanced accuracy.

Q: How do I avoid false signals generated by ADX?

A: Exercise caution when ADX values briefly spike above 20 but quickly retreat, as these may indicate temporary volatility rather than a genuine trend.

Q: Can ADX predict price reversals?

A: ADX does not predict price reversals but rather identifies the strength and direction of the current trend. Utilize other indicators to identify potential turning points.

How To Use Adx In Forex

Conclusion: Empowering Forex Traders with the Power of ADX

Incorporating ADX into your forex trading arsenal is a transformative step towards achieving greater profitability. Its ability to identify trend strength and direction, combined with its versatility as a complementary indicator, provides traders with a formidable tool for navigating the financial markets.

Embrace the power of ADX, master its intricacies, and unlock the secrets to making informed trading decisions. Enhance your understanding of market dynamics, seize lucrative trading opportunities, and elevate your forex trading journey to new heights of success. Are you ready to harness the power of ADX and conquer the forex markets?