Introduction:

Image: www.pinterest.com

The foreign exchange (forex) market is the largest and most liquid financial market in the world. It is a decentralized market where traders can buy and sell currencies from all over the globe. The market is open 24 hours a day, 5 days a week, which provides ample opportunities for traders to profit.

If you are new to forex trading, it is important to develop a trading strategy before you start trading. A trading strategy is a set of rules that will guide your trading decisions. It will help you to determine when to enter and exit trades, and how much risk to take.—

Developing a Trading Strategy

There are many different ways to develop a trading strategy.

Some of the most popular methods include:

· Technical analysis: Technical analysis is the study of past price data to identify trends and patterns. Traders use technical analysis to predict future price movements.

· Fundamental analysis: Fundamental analysis is the study of economic news and data to identify factors that may affect the value of currencies. Traders use fundamental analysis to predict the long-term direction of currency pairs.

· Quantitative analysis: Quantitative analysis is the use of mathematical models to analyze financial data. Traders use quantitative analysis to identify trading opportunities.

Once you have chosen a trading method, you need to develop a set of trading rules.

These rules should include:

· Entry criteria: The conditions that must be met before you enter a trade.

· Exit criteria: The conditions that must be met before you exit a trade.

· Risk management rules: The rules that you will follow to manage your risk.

Your trading rules should be clear and concise. They should be easy to follow and should not leave any room for interpretation.

Once you have developed a trading strategy, you need to test it.

You can do this by using a demo account or by paper trading. Demo accounts are accounts that allow you to trade with virtual money. Paper trading is a simulation of live trading.

Testing your trading strategy will help you to identify any weaknesses and make adjustments before you start trading with real money

Building an Expert Advisor

Once you have a profitable trading strategy, you can build an expert advisor (EA) to automate your trading. An EA is a computer program that executes trades according to a set of pre-defined rules.

EAs can be very helpful for traders who do not have the time or experience to trade manually.

To build an EA, you will need to:

-

Choose a programming language.

-

Learn the basics of the programming language.

-

Develop a set of trading rules.

-

Code the EA.

-

Test the EA.

Building an EA can be a complex process, but it is worth it if you have a profitable trading strategy. An EA can help you to automate your trading and free up your time so that you can focus on other things.

Conclusion:

Developing a trading strategy is an important step for any forex trader. By following the steps outlined in this article, you can develop a profitable trading strategy that will help you to achieve your financial goals.

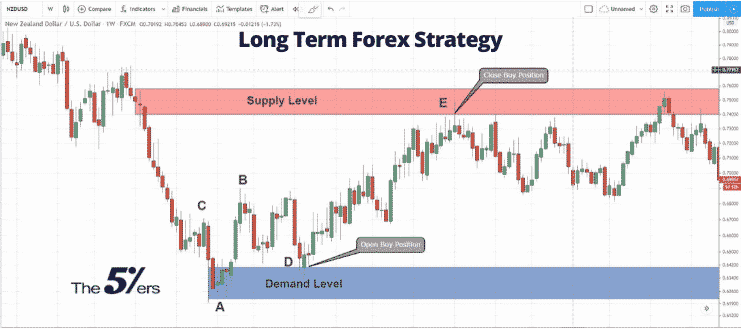

Image: the5ers.com

How We Develop Trading Strategy To Build An Forex Ea