In the labyrinthine world of finance, currency trading, or forex trading as it’s known, operates as a global marketplace where individuals and financial institutions exchange currencies. This dynamic realm, with its constant ebb and flow, presents a lucrative opportunity for savvy traders to tap into the relentless surge of currency valuations. If you aspire to become a forex virtuoso, this comprehensive guide will serve as your beacon, illuminating the intricacies of this exhilarating yet challenging market.

Image: pedangsantri.blogspot.com

Before embarking on this currency odyssey, it’s imperative to establish a solid foundation. Forex trading traces its genesis to the bustling streets of ancient cities, where merchants bartered goods using varying currencies. Fast forward to the advent of the gold standard, which pegged currencies to the yellow metal’s intrinsic value. However, the gold standard’s reign was short-lived, surrendering to the free-floating exchange rates we witness today. This evolution has propelled forex trading to the forefront of financial markets, with the daily turnover exceeding an astonishing $5 trillion.

Understanding the Forex Market Dynamics

Picture the forex market as an online marketplace, except instead of physical goods, currencies are the objects of desire. Traders seek to profit from the fluctuations in exchange rates between currency pairs, which are denoted as “base currency” (the one being sold) and “quote currency” (the one being purchased). For instance, in the EUR/USD currency pair, the euro serves as the base currency, while the US dollar represents the quote currency. If you believe the euro will appreciate against the US dollar, you would buy EUR/USD, hoping to sell it later at a higher price.

The forex market operates under a decentralized framework, meaning there’s no central exchange or authority overseeing the transactions. Instead, numerous financial institutions, banks, and brokers facilitate currency exchanges electronically. This decentralized setup allows for 24-hour trading, five days a week, following the opening of markets in Sydney, Australia.

Major Currency Pairs: The Lions of the Forex Jungle

In the vast forex market, a select group of currency pairs command the lion’s share of trading volume, aptly dubbed “majors.” These mighty pairs, accounting for approximately 80% of all transactions, include:

- EUR/USD (Euro vs. US Dollar): The undisputed heavyweight champion, accounting for nearly half of the forex market’s colossal volume. This pair gauges the relative economic strength between the Eurozone and the United States.

- USD/JPY (US Dollar vs. Japanese Yen): Nicknamed “Ninja,” this pair stands out due to Japan’s substantial influence on global trade and investment dynamics.

- GBP/USD (British Pound vs. US Dollar): Known as “Cable,” this pair mirrors the economic fortunes of the United Kingdom and the United States, two of the world’s leading economies.

- USD/CHF (US Dollar vs. Swiss Franc): The “Swissy” reflects the shifting fortunes of the US economy and the traditional safe-haven status of the Swiss franc.

- USD/CAD (US Dollar vs. Canadian Dollar): Often dubbed the “Loonie,” this pair tracks the intertwined economic dance between the US and Canada, heavily influenced by commodity prices, particularly oil.

The Alchemy of Currency Trading

While currency trading may appear alluring in its promise of lucrative returns, remember that it’s a double-edged sword. Just as there’s potential for profit, there’s also the inherent risk of loss. To navigate this treacherous terrain successfully, it’s crucial to master the art of risk management and employ prudent trading strategies.

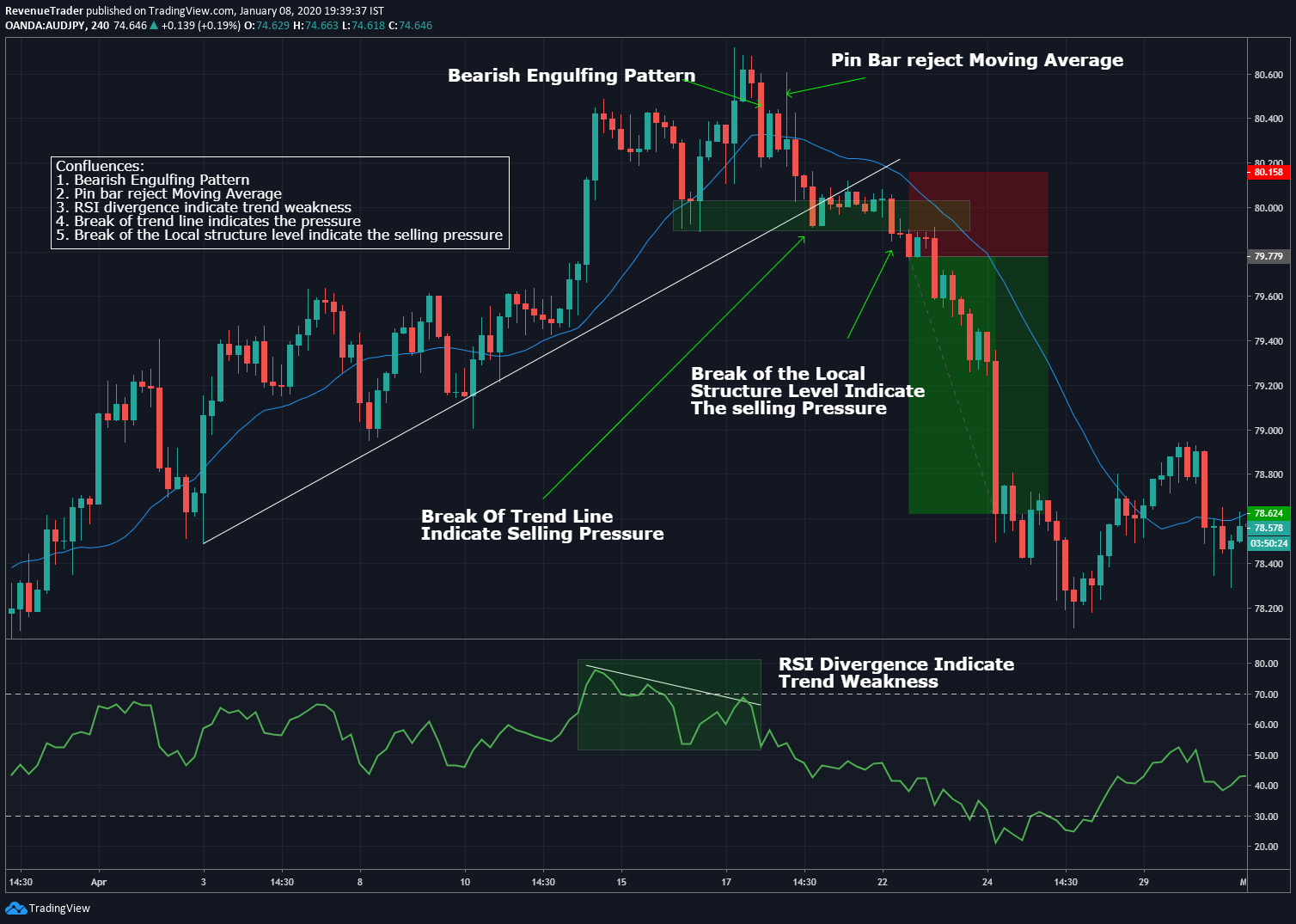

Technical analysis and fundamental analysis serve as two guiding lights for forex traders, offering insights into both short-term and long-term market trends. Technical analysts scrutinize historical price patterns and technical indicators to predict future price movements, while fundamental analysts delve into economic data and geopolitical events to assess the underlying value of currencies.

Image: traderevenuepro.com

Choosing Your Trading Tools

In the forex trading arena, an array of tools awaits to empower your decision-making:

- Forex Brokers: These intermediaries provide traders access to the forex market, offering trading platforms, execution services, and research support.

- Trading Platforms: These software interfaces serve as your command center, enabling you to place orders, track market movements, and manage your trades.

- Forex Charts: Visual representations of historical price data, indispensable for technical analysis and identifying trading opportunities.

- Trading Indicators: Mathematical formulas applied to price data, providing insights into market trends and potential trading signals.

The Path to Forex Trading Mastery

As in any pursuit, the road to forex trading mastery demands dedication, continuous learning, and a disciplined approach. Here are a few time-honored tips to guide your journey:

- Seek Education: Immerse yourself in forex trading knowledge, studying books, articles, and online courses to grasp the intricacies of the market.

- Practice with a Demo Account: Before venturing into live trading, hone your skills on a demo account, which simulates real-market conditions without risking real capital.

- Start Small: Resist the allure of quick riches, and begin trading with a modest amount of capital that you can afford to lose.

- Manage Risk: Always adhere to sound risk management principles, setting stop-loss orders to limit potential losses and protect your capital.

- Stay Informed: Keep your finger on the pulse of the forex market, monitoring economic news, geopolitical events, and central bank decisions that could impact currency valuations.

How To Trade With Forex

Conclusion

The world of forex trading is a vast and ever-evolving realm, brimming with both opportunities and challenges. By understanding the market dynamics, employing prudent strategies, and wielding the right tools, you can harness the potential of currency trading to achieve your financial aspirations. Remember, the journey to forex trading mastery requires patience, perseverance, and a relentless pursuit of knowledge. Embark on this adventure with an open mind, a calculated approach, and the unwavering belief in your abilities, and the foreign exchange market may unveil its secrets, leading you towards financial success.