Navigating the complexities of international currency exchange can be daunting, especially when dealing with large financial institutions like ICICI Bank. Understanding their forex buy rates is crucial for travelers, businesses, and anyone seeking to manage their foreign currency transactions effectively.

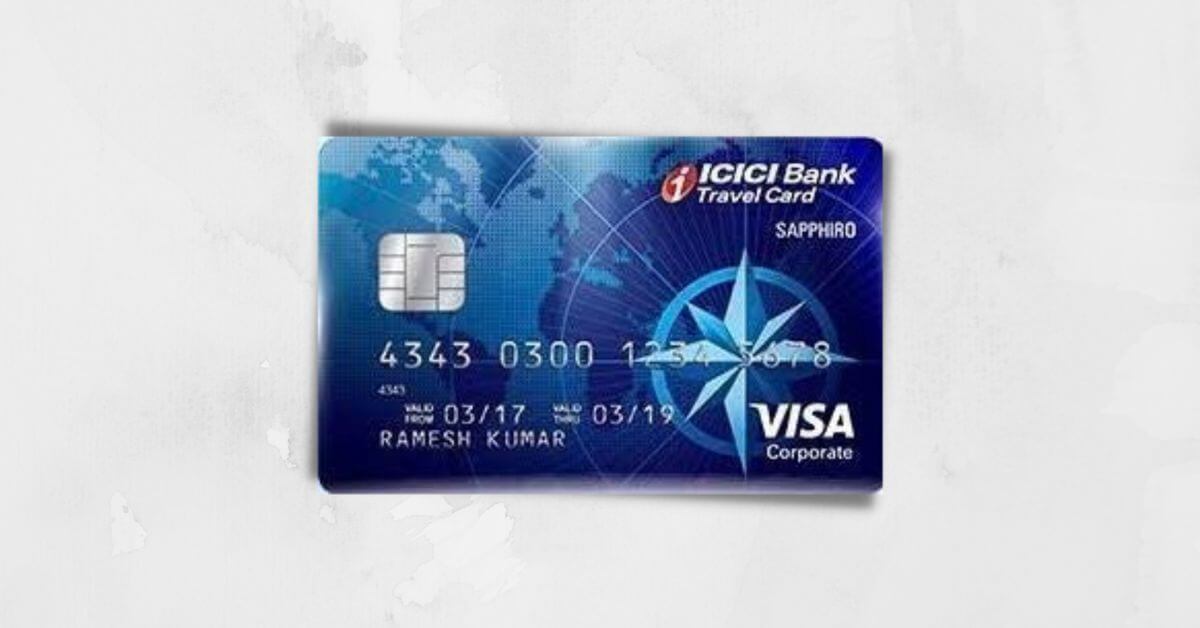

Image: fincards.in

deciphering Forex Buy Rates: A simplified approach

Forex buy rates, as the name suggests, represent the rate at which ICICI Bank purchases foreign currencies from its customers. These rates fluctuate constantly based on various factors, including market conditions, supply and demand, and economic indicators. Being aware of these rates empowers you to make informed decisions and maximize your currency conversions.

Understanding the factors influencing Forex Buy Rates

A myriad of factors influences ICICI Bank’s forex buy rates. These include:

- Market Conditions: Global economic events and political developments can significantly impact currency exchange rates.

- Supply and Demand: The availability and demand for a particular currency influence its value.

- Economic Indicators: Interest rates, inflation, and GDP growth affect the strength of a currency.

- Speculation: Currency traders and investors can also influence rates through speculation.

tips for Getting the Best Forex Buy Rates from ICICI Bank

Several strategies can help you secure the most favorable forex buy rates from ICICI Bank:

- Monitor Market Trends: Stay updated with currency market news and analysis to anticipate rate fluctuations.

- Compare Rates with Other Banks: Obtain quotes from multiple banks to find the best deals.

- Negotiate with ICICI Bank: For large currency conversions, you may be able to negotiate a better rate.

- Avoid Weekends and Holidays: Rates tend to be less favorable during these periods.

Image: www.forex.academy

Frequently Asked Questions about ICICI Bank Forex Buy rates

Here are some common questions and answers to clarify any further inquiries:

- Q: How often do ICICI Bank forex buy rates change?

A: Rates are subject to constant fluctuations throughout the day, influenced by market conditions.

- Q: What is the best time to buy foreign currency from ICICI Bank?

A: There is no specific “best” time. Monitor market trends and compare rates to identify opportune moments.

- Q: Can I negotiate forex buy rates with ICICI Bank?

A: Yes, for substantial currency conversions, you may be able to negotiate a more favorable rate.

Icici Bank Forex Buy Rates

Conclusion: Empowering you in the world of Currency Exchange

Understanding ICICI Bank forex buy rates is essential for navigating international currency exchanges confidently. By leveraging the insights provided in this comprehensive guide, you can make informed decisions, optimize your currency conversions, and stay ahead in the ever-evolving global financial landscape. Are you ready to embrace the world of forex and unlock the benefits it holds?