Introduction:

Image: jimidisu.com

The complex world of finance is rife with acronyms and intricate concepts that can often be daunting to grasp. One such concept, which has garnered significant attention in recent times, is OMO, or Open Market Operations. OMOs play a crucial role in influencing foreign exchange (forex) rates, shaping the macroeconomic landscape. This article delves into the impact of OMOs on forex rates, exploring their mechanisms, effects, and implications.

Understanding OMOs and their Role in Monetary Policy:

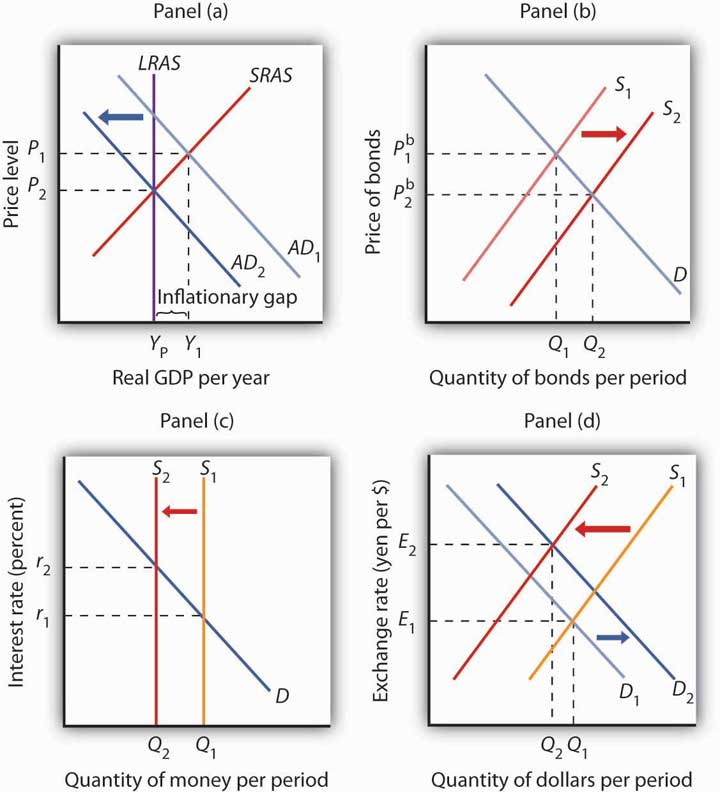

OMO, a key tool in the arsenal of central banks, involves the buying and selling of government securities in the open market. Central banks can inject liquidity into or withdraw it from the financial system through OMOs, thereby controlling the money supply and influencing interest rates. When central banks purchase securities, they provide money to the market, leading to a reduction in interest rates. Conversely, when they sell securities, money is removed from the market, increasing interest rates.

Interplay between Interest Rates and Forex Rates:

Interest rates play a pivotal role in determining the attractiveness of a currency to foreign investors. Higher interest rates in a country often make its currency more attractive, as foreign investors seek higher returns on their investments. This increased demand for the currency then leads to its appreciation in the forex market.

Impact of OMOs on Interest Rates and Forex Rates:

By manipulating interest rates through OMOs, central banks can influence the exchange rates of their currencies. By providing liquidity and lowering interest rates, central banks make their currency less attractive to foreign investors, which can lead to its depreciation. On the other hand, by withdrawing liquidity and raising interest rates, they make their currency more attractive, potentially leading to its appreciation.

Real-World Applications of OMOs in Forex Markets:

Central banks around the world utilize OMOs to achieve various macroeconomic objectives. For instance, the US Federal Reserve has used OMOs to stabilize the US dollar during times of market volatility. Similarly, the Bank of Japan has employed OMOs to weaken the value of the yen in order to boost exports and stimulate the economy.

Conclusion:

OMO plays a significant role in influencing forex rates by affecting interest rates. Central banks use OMOs as a tool to manage the money supply and achieve their respective economic goals. Understanding the impact of OMOs is crucial for businesses engaged in international trade, investors with global portfolios, and policymakers seeking to mitigate currency fluctuations. By comprehending the dynamics between OMOs, interest rates, and forex rates, individuals and organizations can navigate the complexities of the financial markets more effectively.

Image: saylordotorg.github.io

Impact Of Omo On Forex Rate