Introduction

Forex trading encompasses buying and selling different currencies, where traders speculate on the fluctuations of exchange rates for profits. Key to understanding forex trading is comprehending the concept of a lot, a standard contract size that underlies every trade.

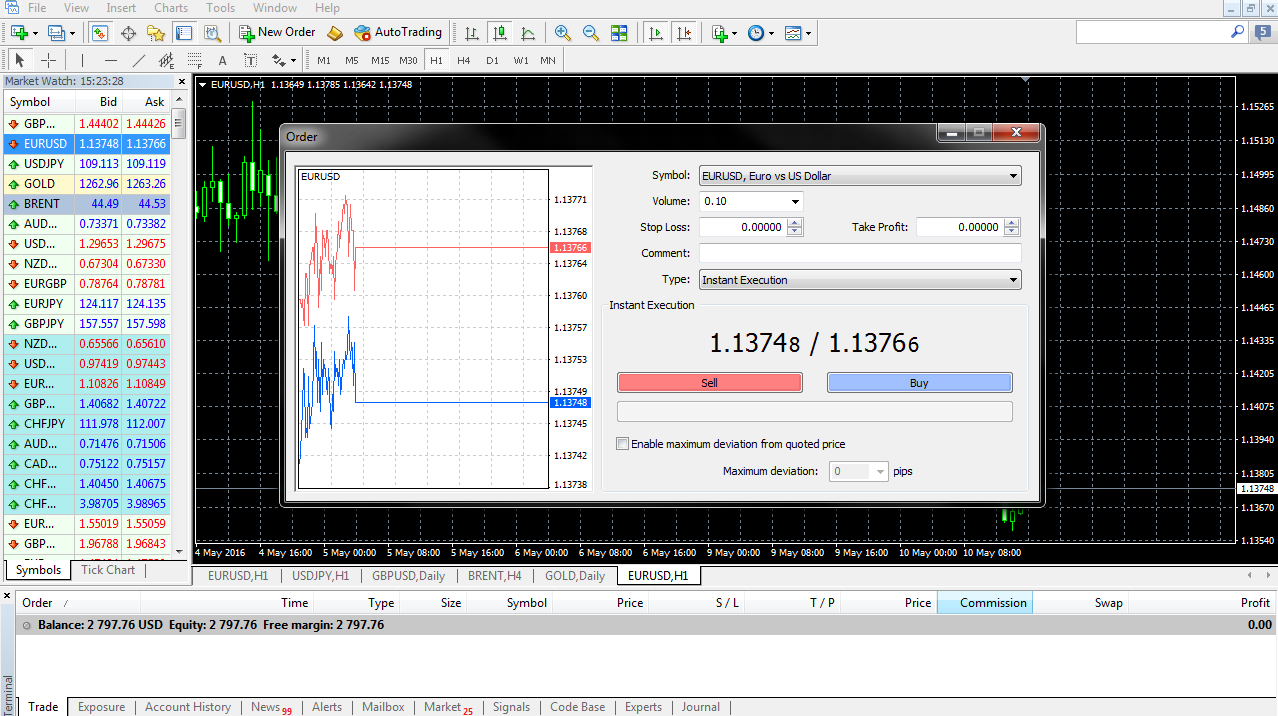

Image: forextraininggroup.com

Defining a Lot: The Basic Concept

In forex trading, a lot represents a standardized unit of currency that defines the volume or amount of the underlying currency being traded. The most common lot sizes are:

- Standard Lot: 100,000 units of the base currency

- Mini Lot: 10,000 units of the base currency

- Micro Lot: 1,000 units of the base currency

- Nano Lot: 100 units of the base currency

Thus, when a trader buys or sells 1 standard lot of EUR/USD, they are essentially agreeing to buy or sell 100,000 euros against US dollars.

Leverage: Enhancing Gains and Risks

Leverage is an essential aspect of forex trading, allowing traders to control a significant amount of capital with only a small deposit. Forex brokers offer leveraged accounts, which magnify trading positions, enabling traders to potentially multiply their profits. However, it’s crucial to remember that while leverage enhances gains, it also amplifies losses.

Impact of Lot Size on Leverage

The lot size directly influences the leverage. For example, let’s assume a trader with a $1,000 account trades EUR/USD with a leverage of 100:1. If they buy 1 standard lot, their total exposure is $100,000 (1 lot x 100,000 units x $1/€). On the contrary, buying 1 mini lot reduces their exposure to $10,000 (1 mini lot x 10,000 units x $1/€).

Image: ar.pinterest.com

Essential Considerations for Choosing a Lot Size

Traders should carefully consider several factors when determining the appropriate lot size:

- Account Size: The account size dictates the maximum leverage that can be used without exceeding the Margin Call threshold.

- Risk Tolerance: Traders with a low risk tolerance should opt for smaller lot sizes to minimize potential losses.

- Trading Strategy: Scalpers and day traders may prefer smaller lot sizes for quicker execution and risk management, while long-term traders can utilize larger lot sizes to capitalize on market trends.

Practical Application: Example

Suppose a trader has a $5,000 account and a risk tolerance that permits a maximum exposure of $1,000. If they plan to trade EUR/USD with a leverage of 50:1, the appropriate lot size would be:

Exposure = Lot Size x Contract Size x Leverage

$1,000 = Lot Size x 100,000 x 50

Lot Size = $1,000 / (100,000 x 50)

Lot Size = 0.2

Therefore, the trader should buy or sell 0.2 standard lots (2 mini lots or 20 micro lots) of EUR/USD.

In Forex 1 Lot Equals

Conclusion

Understanding the concept of a lot and its impact on leverage is vital in forex trading. Traders should carefully assess their account size and risk tolerance to determine the optimal lot size that aligns with their trading strategy. By appropriately managing lot size and leverage, traders can enhance their profit potential while managing risks effectively.