Taming the Temporal Tapestry of Global Currency Trading

In the ever-pulsating arteries of global finance, understanding the rhythm of the international forex market is paramount for successful navigation. For traders operating from India’s time zone, aligning their strategies with the ebb and flow of global market hours is crucial. Delving into this comprehensive guide, we will unveil the complexities of international forex market time as per IST, empowering you to unlock its temporal secrets and seize trading opportunities.

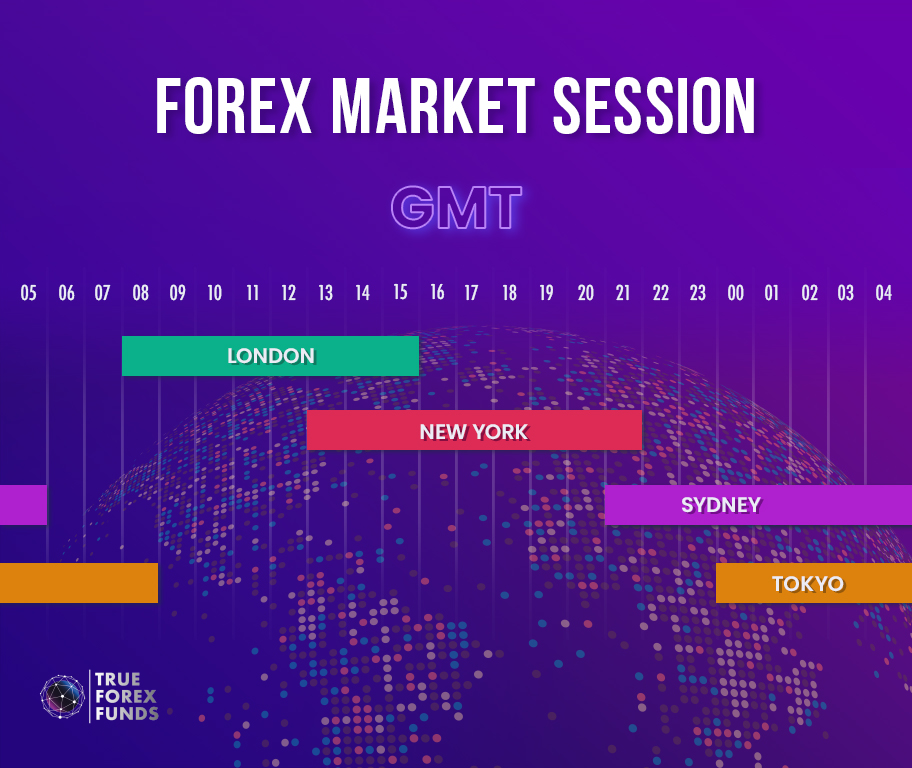

Image: trueforexfunds.com

Deciphering Forex Market Time Zones

The foreign exchange market, unlike traditional financial exchanges, operates 24 hours a day, traversing the globe from east to west. This perpetual cycle stems from the fact that currencies are traded across different time zones, mirroring the ceaseless heartbeat of global commerce.

The IST Time Zone: India’s Forex Market Rhythms

Standing six and a half hours ahead of Coordinated Universal Time (UTC), India occupies a distinctive temporal niche in international forex trading. Here’s a precise breakdown of how forex market hours align with IST:

-

07:30 AM – 12:00 PM IST: The Asian trading session commences, led by financial hubs like Hong Kong and Tokyo. Activity peaks during the early hours of the Indian day, reflecting the strength of the Asian economies in currency exchanges.

-

12:00 PM – 04:00 PM IST: Overlapping with the Asian session, the European trading session gains momentum. London, Zurich, and Frankfurt serve as pivotal forex centers, injecting substantial liquidity into the market.

-

04:00 PM – 09:00 PM IST: As the European session winds down, the North American session takes center stage. New York, Chicago, and Toronto emerge as pivotal hubs, driving significant market volatility.

-

09:00 PM – 07:30 AM IST: During the overnight hours in India, the Australian trading session assumes prominence. Sydney and Melbourne anchor this session, providing a crucial bridge between the Asian and European markets.

Trading Strategies Tailored to IST Time Zone

Harnessing the temporal dynamics of the forex market allows IST-based traders to optimize their trading strategies. Here are some insights to guide your approach:

-

Early Morning Activity: The Asian trading session often presents opportunities for exploiting price gaps and trading with lower volatility.

-

Overlapping Sessions: The overlap between Asian and European sessions creates a period of increased liquidity and volatility, offering potential for both intraday trading and longer-term strategies.

-

European Session: The European trading session, coinciding with daytime hours in India, is ideal for active trading due to its high liquidity and market depth.

-

North American Session: The North American session offers peak volatility and trading opportunities but may require extra attention to managing risk due to larger price swings.

Image: blog.dhan.co

International Forex Market Time As Per Ist

Conclusion: Mastering the Temporal Symphony

By comprehending the intricacies of international forex market time as per IST, you acquire a potent tool for unlocking trading potential. Tailoring your strategies to the rhythm of the global markets empowers you to capture opportunities throughout the 24-hour forex trading cycle. Remember, knowledge is the key to navigating the temporal tapestry of the forex markets, paving the way for profitable and well-timed trades.