In the realm of forex trading, the quest for a successful strategy leads traders down various paths; one such path is naked forex trading. Stripped of technical indicators, this minimalist approach relies solely on price action. However, skepticism looms large: can a strategy stripped to the bare essentials truly yield desirable outcomes?

Image: fxtechlab.com

To unravel the enigma, let’s embark on an exploration of naked forex trading, scrutinizing its intricacies, assessing its potential, and ultimately determining its merit.

Naked Forex Trading: A Closer Look

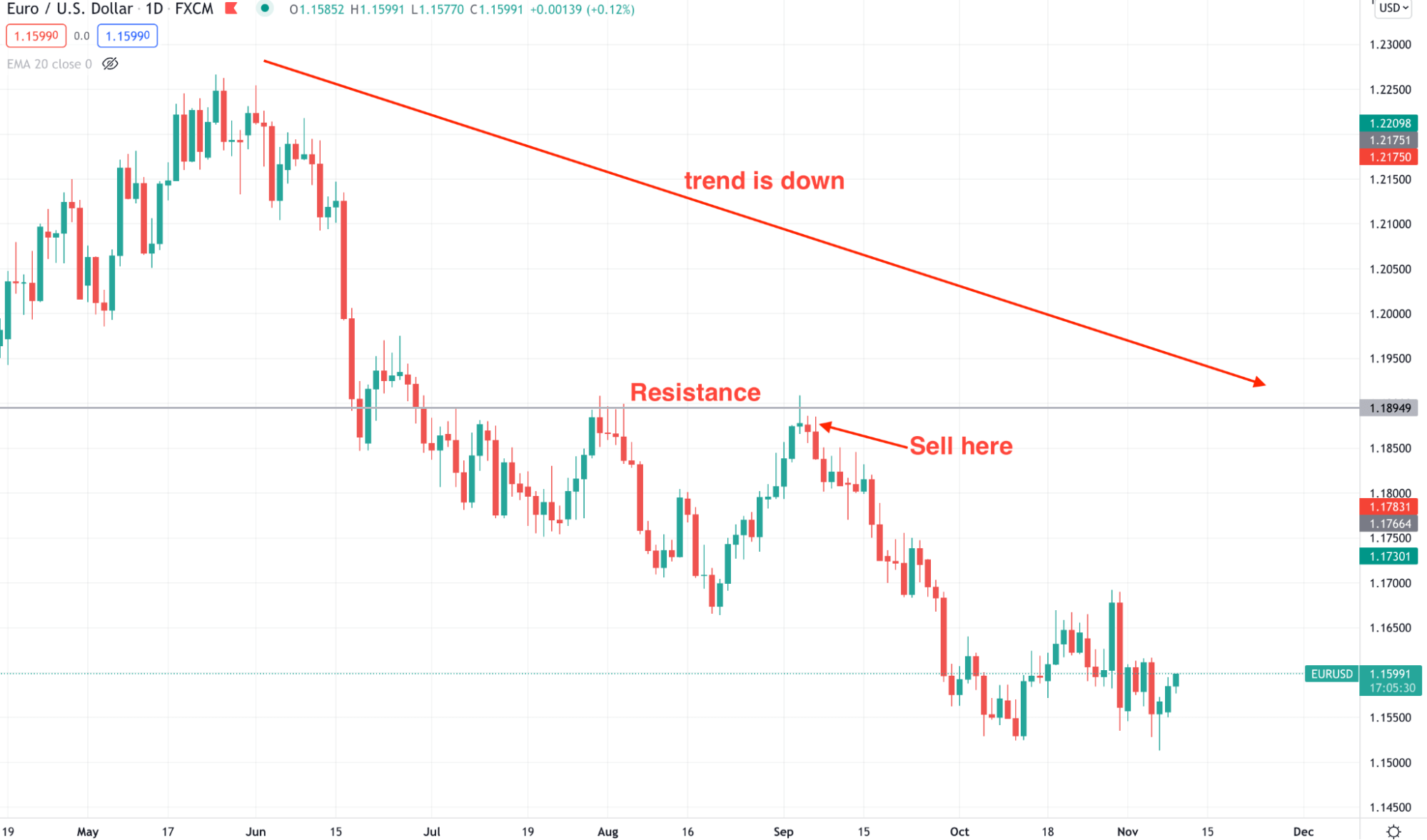

Naked forex trading, as the name suggests, involves trading without the aid of technical indicators. This stripped-down approach places exclusive emphasis on price action, utilizing chart patterns, support and resistance levels, and subjective interpretation of market trends.

Proponents of naked forex trading extol its simplicity and the elimination of distracting indicators. They argue that price action encapsulates all the necessary information, allowing traders to make informed decisions based on objective observation rather than subjective indicators.

Navigating the Naked Forex Labyrinth

Embracing naked forex trading requires a firm grasp of chart patterns. Recognizing patterns such as double tops, triangles, and flags enables traders to identify potential price reversals or continuations. Additionally, pinpointing support and resistance levels provides insights into potential price barriers.

Moreover, traders must possess exceptional risk management skills. Without the safety net of technical indicators, traders must rely on intuition and disciplined money management strategies. Careful position sizing, stop-loss placement, and risk-to-reward ratios are paramount.

Tips and Expert Insights

1. Focus on Major Currency Pairs: While tempting to venture into exotic pairs, beginners should prioritize major pairs like EUR/USD and GBP/USD, which exhibit greater stability and liquidity.

2. Leverage a Demo Account: Practice naked forex trading in a simulated environment before risking real capital. This provides a safe space to test strategies and develop confidence.

3. Seek Guidance from Experienced Traders: Engage with experienced traders through forums or mentorship programs to glean insights and learn from their successes and failures.

Image: www.youtube.com

Frequently Asked Questions

Q: Is naked forex trading suitable for beginners?

A: While naked forex trading emphasizes simplicity, it demands a deep understanding of market dynamics. Beginners should approach it cautiously.

Q: Can naked forex trading be profitable?

A: Profitability hinges on the trader’s skill and consistency. While possible, it’s not a guaranteed path to success.

Is Naked Forex Trading Strategy Work

Conclusion

Naked forex trading presents a unique approach to the forex market, testing the limits of traders’ price action interpretation skills. Its minimalist nature unveils both the allure of purity and the daunting absence of quantitative confirmation. Whether the allure of simplicity and the elimination of distractions outweigh the necessity of technical indicators remains a matter of subjective preference and trading philosophy.

Dear readers, have we piqued your curiosity about the enigmatic world of naked forex trading? Emboldened by the knowledge herein, are you ready to embark on a journey of price action mastery? Share your thoughts and experiences in the comments below.