The foreign exchange market, known colloquially as forex, is the world’s largest and most liquid market, with daily trading volumes exceeding $5 trillion. Forex trading has evolved significantly over the years, driven by technological advancements and changing market dynamics. In this article, we will explore the latest trends in forex trading that are reshaping the landscape and offering traders new opportunities for profit.

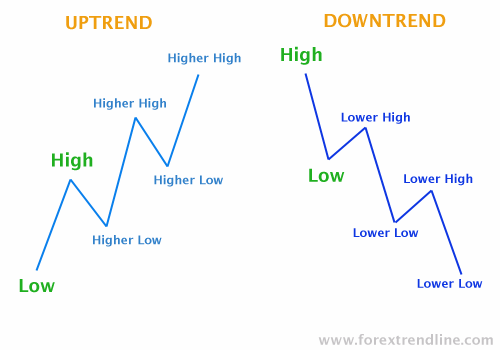

Image: www.forextrendline.com

Leveraging Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are revolutionizing forex trading by providing traders with sophisticated tools for market analysis, risk management, and trade execution. AI-powered trading algorithms can analyze massive amounts of data, identify patterns, and make complex decisions in real time. ML enables algorithms to adapt and learn from market conditions, improving accuracy and efficiency. Traders can harness these technologies to develop automated trading strategies, optimize trade parameters, and make more informed decisions.

The Rise of Social Trading

Social trading platforms have emerged as a significant trend in forex, connecting traders globally. These platforms allow traders to share their trading ideas, follow and copy the strategies of successful traders, and collaborate with like-minded individuals. Social trading provides beginners with a valuable learning environment and experienced traders with access to a pool of potential trade followers. It fosters a sense of community and facilitates the exchange of knowledge and insights.

Mobile and Cloud-Based Trading

The proliferation of mobile devices and cloud computing has made forex trading more accessible and convenient. Mobile trading apps allow traders to execute trades and manage their accounts from anywhere with an internet connection. Cloud-based platforms provide traders with access to market data, analysis tools, and trading platforms from any device. This has extended the trading day, enabling traders to capitalize on market opportunities even when away from their desks.

Growth of Micro-Lot Trading

Recent years have seen a surge in the popularity of micro-lot trading, which enables traders to trade with smaller amounts of currency. This has opened up forex trading to a broader audience, including retail investors and traders with limited capital. Micro-lot trading allows traders to test strategies, gain experience, and manage risk more effectively while minimizing potential losses.

Data Science and Big Data

Forex traders are increasingly analyzing large volumes of data to gain insights into market behavior. Data science techniques, combined with advanced statistical models, enable traders to identify trends, predict market movements, and quantify risks. Big data analytics provide traders with a comprehensive view of market dynamics, uncovering hidden relationships and patterns that can translate into better trading decisions.

Decentralized Forex Trading

Blockchain technology has introduced the concept of decentralized forex trading, where transactions are recorded on a distributed ledger instead of a centralized exchange. Decentralized forex trading offers greater security, transparency, and autonomy. It eliminates the need for intermediaries, reduces transaction costs, and empowers traders to retain full control over their funds.

Conclusion

The forex trading landscape is constantly evolving, with the latest trends offering traders new opportunities and enhanced trading capabilities. By embracing AI, leveraging social trading, accessing mobile and cloud-based platforms, exploring micro-lot trading, analyzing big data, and considering decentralized forex trading solutions, traders can stay ahead of the curve and unlock the full potential of this dynamic market. With careful research, strategic implementation, and a keen understanding of these latest trends, traders can position themselves for success in the ever-changing world of forex trading.

Image: es.fxssi.com

Latest Trend In Forex Trading

https://youtube.com/watch?v=26mkfDDO5fU