The foreign exchange market, abbreviated as Forex (or simply FX), is an interconnected marketplace where the world’s currencies are traded. It encompasses spot trading, forward trading, and options, allowing for the exchange of currencies between various countries and institutions. Navigating the Forex market requires an understanding of the major currencies that dominate its activity.

Image: ownfx.blogspot.com

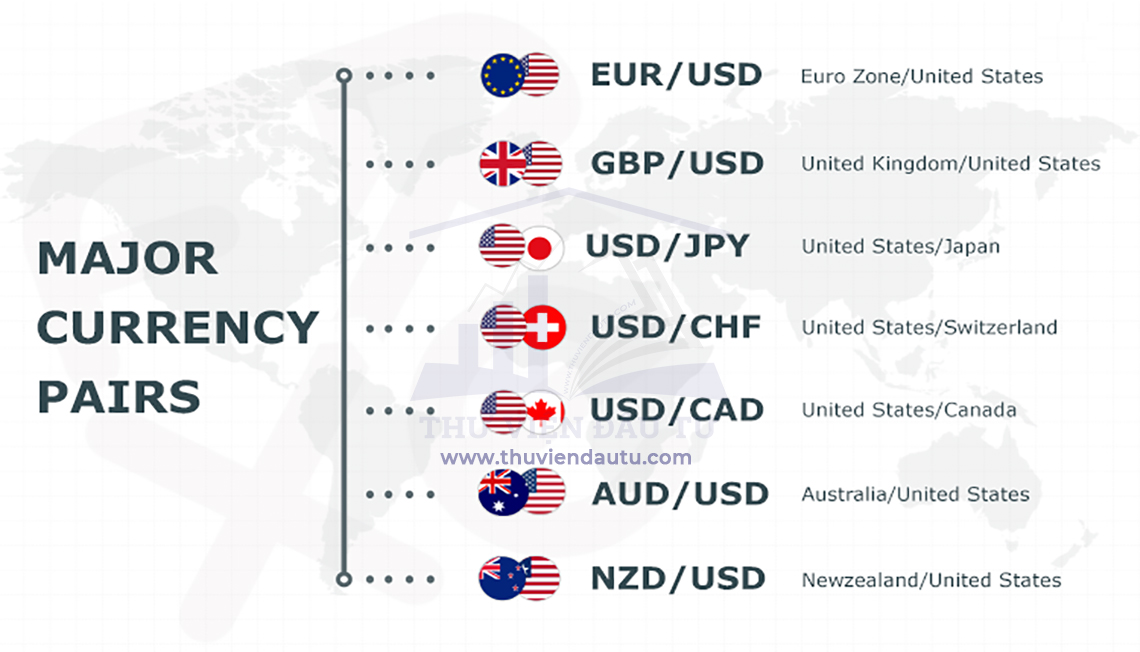

The United States dollar (USD) stands tall as the world’s most traded currency, a testament to the economic and political strength of the United States. It plays a dominant role in international trade, serving as the benchmark for other currencies. The Euro (EUR), a collective currency for the Eurozone countries, stands as the second most traded currency, demonstrating the economic integration and stability of the European Union.

Pound sterling (GBP), also known as the British pound, holds its standing as the world’s third most traded currency, reflecting the economic significance of the United Kingdom. Japanese yen (JPY), the currency of Japan, ranks fourth in global trading volume, highlighting the country’s economic stability and technological prowess.

The Swiss franc (CHF), the currency of Switzerland, occupies the fifth position in trading volume. Its stability and association with safe-haven assets make it highly sought-after during periods of economic uncertainty. Completing the list of major currencies, we have the Australian dollar (AUD), regarded as a commodity currency due to Australia’s abundant natural resources.

These major currencies serve as anchors for global financial transactions, influencing exchange rates and dictating trade patterns. Delving deeper into the characteristics and economic factors driving their fluctuations provides invaluable insights for Forex traders and global economic analysts.

Image: thuviendautu.com

Major Currencies In Forex M