The realm of foreign exchange (forex) trading beckons traders from all walks of life with its allure of high returns and exhilarating market dynamics. However, embarking on this financial adventure requires a thorough grasp of one crucial aspect: margin money. Like a turbocharged engine for your trading strategies, margin trading empowers you to amplify your profit potential by employing borrowed capital. However, it’s not a tool to be wielded without understanding – enter this comprehensive guide to margin money in forex trading.

Image: speedtrader.com

Demystifying Margin Money: A Trader’s Lifeline

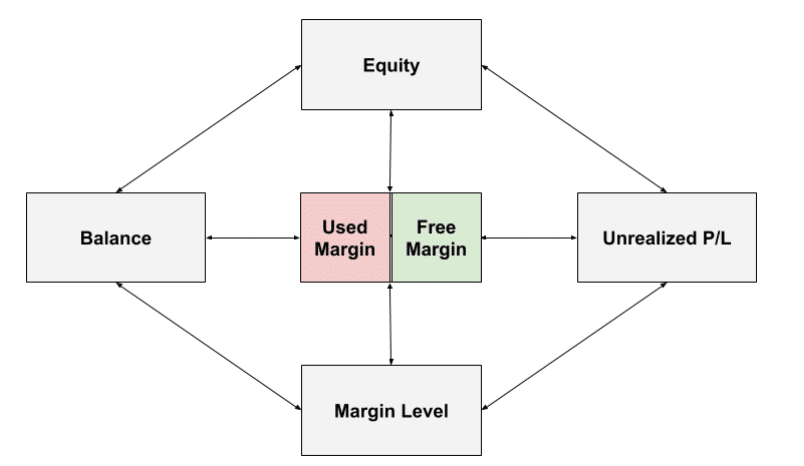

Simply put, margin money is the deposit you pledge with your broker to gain access to a larger sum of money, known as leverage. This leverage allows you to control a position worth multiples of your initial investment. It’s like using a lever to move a heavy object – margin money acts as the fulcrum, enabling you to lift market positions far beyond your immediate financial capabilities.

Take the example of a 1:100 leverage ratio. By depositing just $1,000 as margin, you can control a staggering $100,000 worth of forex assets. This amplifies your potential profits significantly. Imagine buying a currency pair at €1.00 with $1,000 and selling it at €1.05. Your $1,000 margin yields a $50 profit – without leverage, you would have made only $5.

The Double-Edged Sword: Risks and Rewards of Margin Trading

Margin trading, while alluring, carries inherent risks. Leverage magnifies not only potential profits but also potential losses. If the market moves against you, your losses can exceed your margin deposit. In the worst-case scenario, you could lose your entire investment and even owe more.

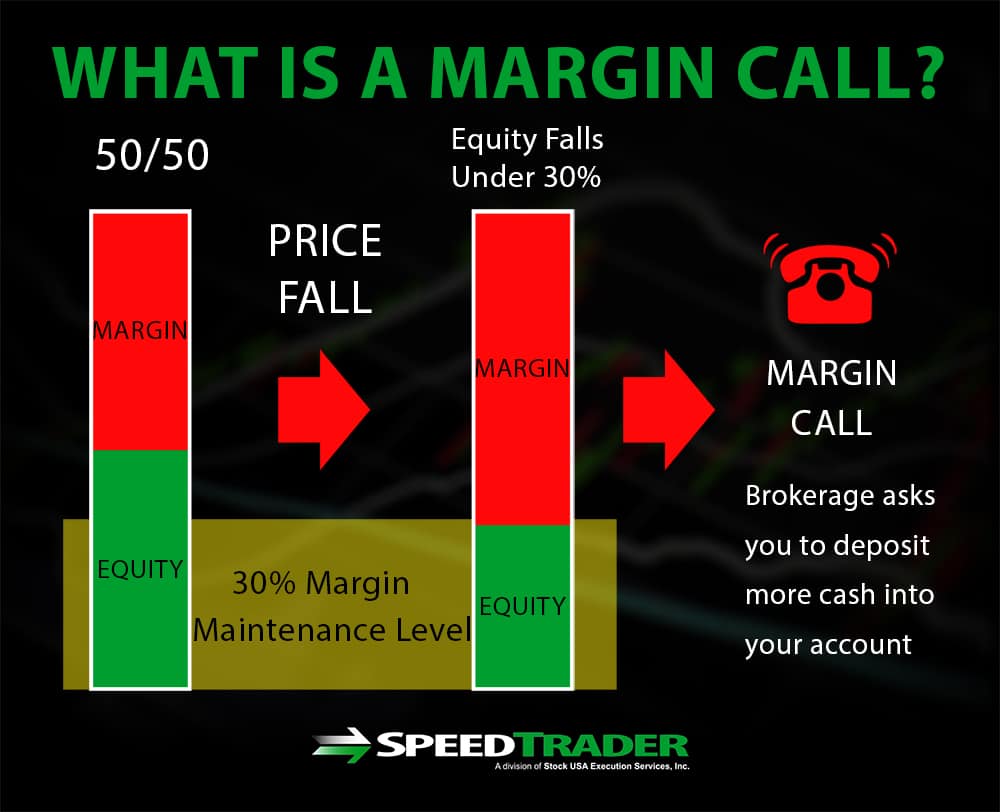

Consider the same 1:100 leverage example, but this time the currency pair drops to €0.95. Your $1,000 margin now covers a loss of $500. If the margin requirement is 10%, as set by many brokers, you will face a margin call, requiring you to top up your account with an additional $100 to maintain your position. If you fail to do so, your broker may liquidate your position, potentially resulting in even greater losses.

Striking the Perfect Balance: Finding Your Margin Sweet Spot

The optimal margin amount is a delicate balance between maximizing profit potential and managing risk. The higher the margin, the greater the leverage and potential profits. However, it also increases the risk of significant losses.

A conservative approach is to maintain a margin level above 50%, meaning you use no more than half of your trading capital as margin. This cushion provides room for adverse price movements without triggering margin calls.

Seasoned traders often adopt dynamic margin management strategies, adjusting their margin levels based on market conditions and their risk tolerance. By closely monitoring market volatility, news events, and their personal trading psychology, they adapt their margin usage to optimize returns while mitigating risks.

Image: forextraders.guide

Margin Money For Forex Trading

Leverage as a Power Tool: Unleashing Market Opportunities

Margin trading is a powerful tool that can amplify returns and unlock market opportunities. By employing leverage wisely, you can:

- Trade larger positions, thereby increasing your earning potential.

- Take calculated risks and capitalize on short-term market movements.

- Hedge your portfolio against adverse currency fluctuations.

Remember, leverage is a double-edged sword. By embracing margin trading responsibly, you empower yourself as a forex trader and enhance your potential for financial success.