As a seasoned Forex trader, I’ve witnessed the transformative power of technology firsthand. One such game-changer is the mechanical trading system, an algorithmic marvel that automates trading decisions based on predefined criteria. Like a virtual compass, it guides traders through the turbulent waters of the Forex market, steering them towards profit-yielding opportunities.

Image: forexwot.com

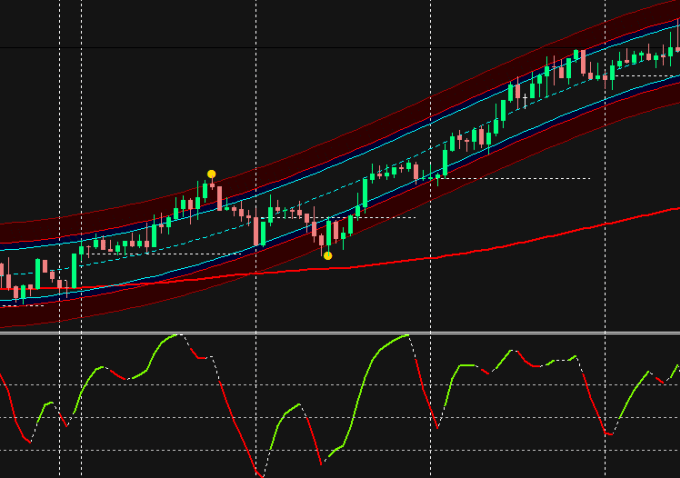

Introducing the Forex Navigator: Mechanical Trading Systems

Imagine a self-driving car navigating the complexities of a bustling city with finesse and precision. Analogously, mechanical trading systems decipher market patterns, identify trading signals, and execute trades autonomously. They rely on sophisticated algorithms programmed with specific rules and market indicators to make informed decisions. By removing emotional biases and automating the decision-making process, these systems offer traders a disciplined approach to Forex trading.

Demystifying Mechanical Trading: A Comprehensive Overview

At their core, mechanical trading systems are pre-defined sets of instructions that govern trading decisions based on logical criteria. They encompass various market analysis techniques, such as technical indicators, price charts, and historical data, meticulously crafted to generate trading signals.

- Systematic Analysis: These systems eliminate subjective judgments by employing data-driven analysis to identify potential trading opportunities.

- Robust Rulebook: Each system is guided by a well-defined set of rules that determine when to enter and exit trades, ensuring consistency and discipline in execution.

- Precision Execution: Leveraging advanced algorithmic capabilities, mechanical trading systems can execute trades with lightning-fast precision.

The advent of mechanical trading has revolutionized Forex trading by empowering both seasoned veterans and novice traders alike with a powerful tool to navigate this dynamic market.

Unleashing Market Opportunities: Latest Trends and Developments

The realm of mechanical trading is constantly evolving, with innovations emerging to enhance its efficacy. Traders across forums and social media platforms buzz with excitement over machine learning and artificial intelligence techniques that are being incorporated into these systems, promising to push the boundaries of trading performance.

Furthermore, cloud computing advancements are enabling real-time data processing and sophisticated analysis, fueling the rise of even more robust mechanical trading systems. This seamless integration of cutting-edge technologies is poised to shape the future of Forex trading, offering unparalleled precision and adaptability.

Image: www.fiverr.com

Expert Insights: Charting a Path to Success

Drawing on my experience as a seasoned blogger, I’ve gleaned valuable insights from seasoned traders who have mastered the art of mechanical trading. Here are three expert tips to guide your trading journey:

- Harness the Power of Backtesting: Before deploying a mechanical trading system in real-time, subject it to rigorous backtesting using historical data. This invaluable exercise unveils its potential profitability and identifies areas for refinement.

- Embrace Dynamic Adaptation: Markets are fluid, and so should your trading strategy. Regularly review and adjust your mechanical trading system’s parameters to accommodate changing market conditions.

- Manage Risk with Discipline: Risk management is paramount in Forex trading. Employ a sensible risk management strategy to protect your capital and ensure long-term success.

By incorporating these expert tips into your trading approach, you’ll be well-equipped to harness the full potential of mechanical trading systems.

FAQs: Unveiling the Mysteries of Mechanical Trading

To further illuminate the intricacies of mechanical trading, let’s delve into a series of frequently asked questions:

- Q: Are mechanical trading systems a magic bullet for success?

A: While these systems offer automation and discipline, their profitability relies on proper implementation, optimization, and trader vigilance. - Q: How do I choose the right mechanical trading system?

A: Explore various systems, backtest their performance, and select one that aligns with your risk appetite and trading style. - Q: Can I create my own mechanical trading system?

A: Absolutely! With programming knowledge, you can design a system tailored to your specific trading objectives.

Mechanical Trading System For Forex

Conclusion: Embark on Your Forex Trading Adventure

Mechanical trading systems have emerged as a formidable force in Forex trading, empowering traders with automation, precision, and an analytical edge. By strategically incorporating these systems into your trading arsenal, you’ll be well-equipped to navigate the market’s complexities and unlock its profit-generating potential.

Are you ready to embrace the world of mechanical trading and conquer the Forex market like a seasoned pro? Let the power of technology be your guide as you embark on an extraordinary trading adventure!