Introduction

In today’s globalized world, foreign exchange (forex) cards have become essential for travelers, businesses, and individuals who engage in international transactions. These cards offer a convenient and secure way to manage foreign currency, eliminating the need for cash exchanges and minimizing transaction fees. However, it’s crucial to understand how to accurately enter forex card transactions into tally, a popular accounting software, to maintain financial accuracy and ensure compliance with accounting standards.

Image: www.ujjivansfb.in

Understanding Forex Card Transactions

A forex card is a prepaid card that’s loaded with a specific amount of foreign currency. When a transaction is made using the card, the funds are deducted from the card’s balance and converted into the local currency at the prevailing exchange rate. This eliminates the need for travelers to carry large amounts of cash or incur high conversion fees at exchange bureaus.

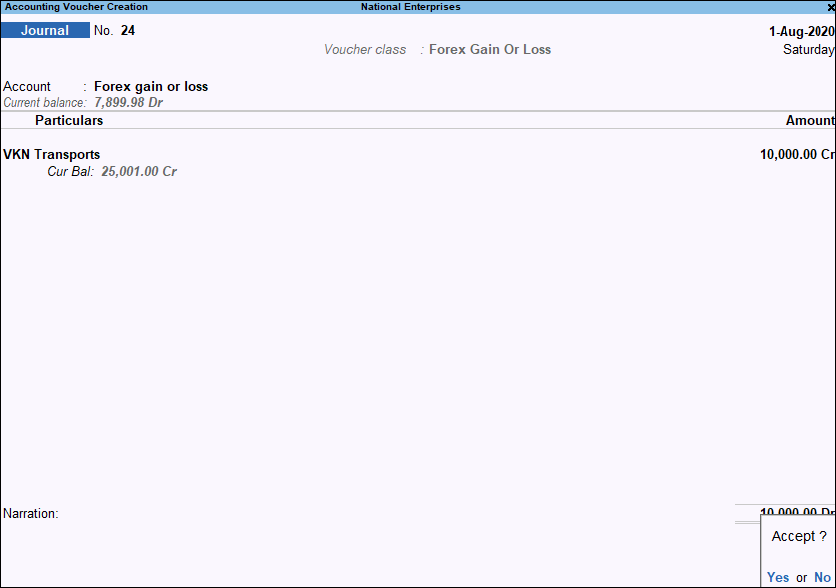

Steps for Forex Card Tally Entry

To ensure proper accounting of forex card transactions, it’s essential to follow specific steps:

-

Create a Dedicated Expense Head: Establish a separate expense head or account specifically for forex card transactions to track these expenses effectively.

-

Accurate Date Entry: Record the transaction date accurately to maintain a chronological record of expenses and facilitate easy reconciliation.

-

Specify Transaction Details: Clearly indicate the nature of the transaction, whether it’s for travel expenses, business purchases, or personal expenses.

-

Record Original Currency: Enter the amount of the transaction in the original currency in which it was made.

-

Convert to INR: Convert the original currency amount to Indian Rupees (INR) using the prevailing exchange rate on the transaction date.

-

Capture Conversion Fees: If applicable, include any conversion fees or transaction charges levied by the forex card provider.

-

Detailed Payments: Enter a detailed payment breakdown for the transaction, mentioning the vendor or recipient’s name and contact information.

Advantages of Tally Entry for Forex Card Transactions

Properly recording forex card transactions in tally offers several advantages:

-

Accurate Financial Reporting: Tally entry ensures accurate financial reporting and enables the reconciliation of forex card transactions with bank statements.

-

Historical Records: Recording forex card transactions creates a historical record of expenses for audit purposes and future analysis.

-

Expense Tracking: It provides a centralized view of expenses incurred using the forex card, allowing businesses to track and control their foreign exchange costs.

Image: caknowledge.com

Tax Implications and Forex Card Statements

It’s important to be aware of the tax implications of forex card transactions. In India, forex card transactions are tax-exempt for personal expenses but may be subject to taxes for business expenses. Maintaining accurate tally records facilitates easy identification of taxable transactions.

Money Spent On Forex Card Tally Entry

Conclusion

Understanding the process of forex card tally entry is essential for businesses and individuals who use these cards for international transactions. By carefully following the steps outlined above, businesses can ensure accurate accounting and tax compliance, while individuals can keep track of their expenses and maintain their financial records. Forex card tally entry plays a critical role in effective financial management, allowing businesses to make informed decisions and individuals to manage their finances effectively.