In the intricate world of currency trading, the elusive concept of “pip” holds a pivotal significance, yet remains veiled in mystery for many. If you’ve ever pondered the intrinsic worth of this financial enigma, you’re not alone. In this article, we embark on an enlightening journey to unravel its meaning and decipher its value, leaving you armed with a profound understanding of this fundamental trading unit.

Image: nas100scalping.com

At its core, a pip, short for “point in percentage,” represents the smallest price movement that a currency pair can experience. It’s akin to the fractional increment of a stock’s value or the microscopic oscillation of a pendulum. Depending on the currency pair in question, a pip may reflect a shift of 0.01%, 0.001%, or even 0.0001%. In the foreign exchange market, the most commonly traded pairs, like EUR/USD, exhibit pips with a value of 0.0001. This minuscule variation may seem insignificant, but its cumulative impact over time can shape the fortunes of traders.

The Currency Pair Conundrum: Navigating Pip Variations

The value of a pip is inextricably intertwined with the currency pair being traded. Different pairs exhibit distinct pip values, often determined by the base and quote currencies involved. For instance, a pip in EUR/USD represents a change of 10 euros for every 100,000 units traded, whereas in GBP/JPY, it corresponds to a shift of 100 Japanese yen for every 100,000 pounds traded.

To calculate the pip value of any currency pair, the following formula serves as a guiding light: 1 pip = (1 / ExchangerRate) x 10,000. Simply substitute the current exchange rate between the two currencies into the formula, and the result will illuminate the pip value with crystal clarity.

Pip Value Variations: A Reflection of Currency Hierarchy

The pip value’s dependence on the currency pair highlights the hierarchical nature of currencies in the foreign exchange market. Major currency pairs, such as EUR/USD and GBP/USD, boast the smallest pip values due to their unwavering stability and liquidity. Conversely, exotic currency pairs, featuring currencies from emerging markets or lesser-known economies, often exhibit larger pip values reflecting their inherent volatility.

Decoding Pips: A Ladder of Value

Pip values ascend in a progressive manner, analogous to a staircase leading to financial enlightenment. 10 pips encompass a micro lot, 100 pips constitute a mini lot, and 1000 pips represent a standard lot, the quintessential unit of currency trading.

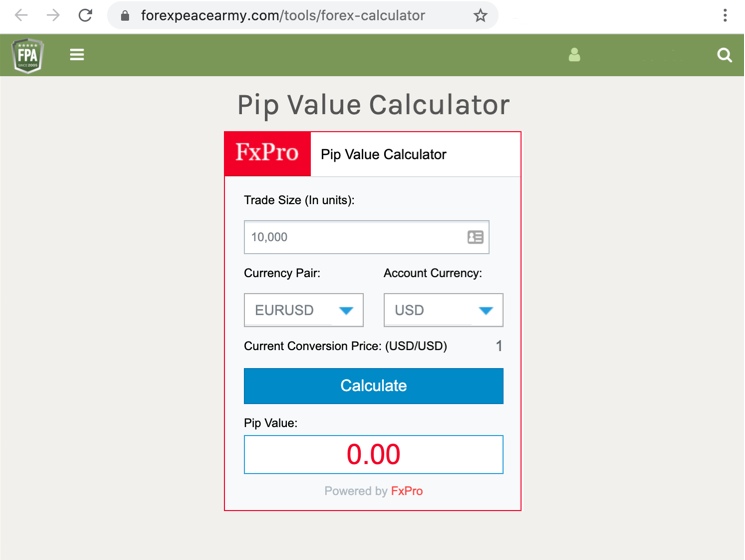

Image: www.forexpeacearmy.com

Case Study: Unveiling the Potential Profits

Let’s delve into a practical realm to illustrate the transformative power of pips. Suppose you’re holding a long position of 100,000 units of EUR/USD and the exchange rate shifts in your favor by a mere 10 pips. This seemingly innocuous movement translates to a profit of 10 pips x 100,000 units x 10 euros per pip = 1000 euros. While a single pip may appear inconsequential, its collective impact over time can cultivate substantial returns, especially for traders employing high leverage.

Mastering the Pip: A Skill Worth Cultivating

Understanding the concept of pips and their value is paramount for forex traders seeking consistent success. By embracing this knowledge, you’ll gain a deeper comprehension of price movements, enabling you to make informed trading decisions. Become an astute interpreter of pip fluctuations, and you’ll unlock the potential to navigate the foreign exchange market with precision and profitability.

How Much Is A Pip

Beyond Forex: Pips in the Celestial Realm

It’s worth noting that pips extend beyond the confines of forex trading. In astrophysics, the concept of pi