Imagine embarking on an exhilarating international journey, filled with the promise of adventure and discovery. But your excitement is dampened when you realize your HDFC Forex Card is not registered, leaving you stranded amidst foreign lands. Fret not, for this comprehensive guide will empower you with the knowledge and steps to ensure your Forex Card is ready for use, unlocking a world of seamless international transactions.

Image: cardinsider.com

Jumpstart your hassle-free registration process by delving into the following sections, where you’ll uncover the nuances of Forex Card registration and the benefits it entails.

Benefits of Forex Card Registration

Registering your HDFC Forex Card is not merely a formality but a gateway to a plethora of benefits that will elevate your international experience. Unleash the following advantages:

- Secure Transactions: Protect your funds with advanced security measures, ensuring peace of mind during each transaction.

- Swift Currency Exchange: Enjoy competitive exchange rates and eliminate the hassle of carrying large amounts of cash.

- 24/7 Customer Support: Access immediate assistance from the HDFC team, no matter where you are in the world.

- Online Card Management: Conveniently track your expenses, set alerts, and manage your card details anytime, anywhere.

- Exclusive Rewards and Offers: Unlock exclusive discounts, deals, and other perks designed to enhance your travel experience.

Understanding Forex Card Registration

Before embarking on the registration journey, it’s crucial to grasp the concept of a Forex Card and its registration process. A Forex Card is a prepaid or reloadable card designed specifically for hassle-free international transactions. Its registration involves providing essential information to HDFC, enabling them to activate your card and link it to your bank account for seamless currency conversion.

Registering Your HDFC Forex Card: A Step-by-Step Guide

Prepare to register your HDFC Forex Card in a matter of minutes with these straightforward steps:

- Obtain Your Forex Card: Visit your nearest HDFC branch or apply online to procure your HDFC Forex Card.

- Receive Your Card and PIN: Once your application is processed, you will receive your Forex Card and PIN via registered mail.

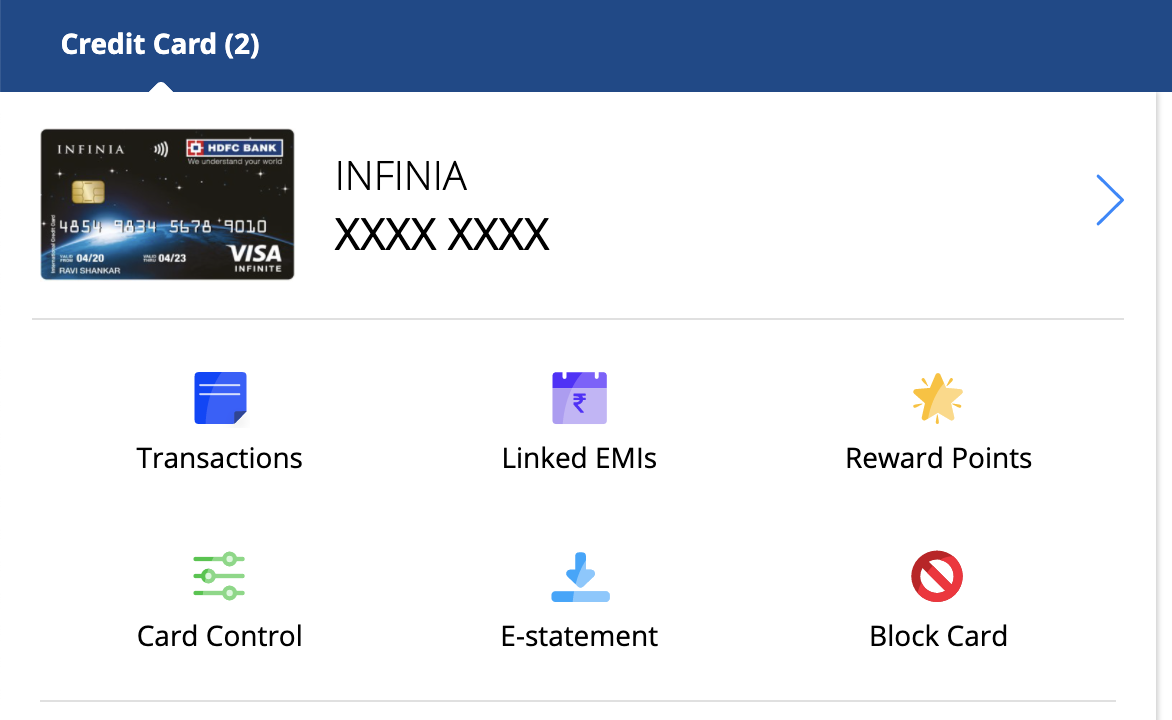

- Go to the HDFC Website or App: Navigate to the HDFC website or mobile app and log in to your account.

- Locate the Forex Card Section: Within the account dashboard, identify the section dedicated to Forex Cards.

- Register Your Card: Enter your Forex Card number, expiry date, and PIN as prompted by the system.

- Select Your Preferred Currency: Choose the primary currency you wish to use on your Forex Card.

- Set Transaction Preferences: Establish daily limits, transaction alerts, and other security measures to suit your needs.

- Complete the Registration: Review your details, accept the terms and conditions, and click submit to complete the registration process.

Image: getprepaidcard.hdfcbank.com

Expert Tips for Forex Card Use

Leverage the insights of seasoned travelers to optimize your Forex Card experience:

- Use ATMs Wisely: Utilize ATMs affiliated with HDFC to avoid additional charges and enjoy favorable exchange rates.

- Track Your Expenses: Monitor your Forex Card transactions regularly to stay informed about your spending and prevent unauthorized usage.

- Disable the Card When Not in Use: Safeguard your card from fraudulent activities by disabling it when not actively using it.

- Store the Card Securely: Treat your Forex Card with the same vigilance as your other financial instruments to prevent theft or loss.

- Inform HDFC of Your Travel Plans: Notify HDFC of your travel itinerary to ensure uninterrupted card usage during your journey.

FAQ on HDFC Forex Card Registration

Here are answers to common queries regarding HDFC Forex Card registration:

- Q: Can I register my Forex Card online?

A: Yes, you can conveniently register your HDFC Forex Card online through the HDFC website or mobile app.

- Q: What documents are required for Forex Card registration?

A: Typically, you will need to provide your HDFC account details, government-issued ID, and a completed Forex Card application form.

- Q: Is there a fee for Forex Card registration?

A: Registration of HDFC Forex Card is generally free of charge, but certain card variants may have associated fees.

- Q: How long does Forex Card registration take?

A: The registration process is usually completed within a few minutes online or during your branch visit.

- Q: What if I lose or damage my Forex Card?

A: Report the incident immediately to HDFC, and they will guide you through the process of blocking your card and issuing a replacement.

My Hdfc Forex Card Is Not Registered

Conclusion

Embark on your international adventure with confidence, knowing that your HDFC Forex Card is registered and ready to seamlessly facilitate your financial transactions. By embracing the tips and expert advice provided in this guide, you’ve equipped yourself with the knowledge to navigate the world with ease and make the most of your overseas experiences.

Are you eager to simplify your international travels with a registered HDFC Forex Card? Share your thoughts and experiences in the comments below and let’s embark on the journey of hassle-free global exploration together.