In the realm of currency trading, where the ups and downs of global economies dance before our eyes, understanding the fundamental unit of value – pips – is paramount to success. Grasping the intricacies of pip calculations empowers traders with the precision needed to navigate the ever-fluctuating forex market with confidence.

Image: learn2.trade

So, what are pips, you ask? Picture a chess game, where each move signifies a change in the position of a piece. In forex, pips represent the smallest possible price movement of a currency pair. They are the increments by which exchange rates change, essentially the “ticks” on the currency exchange clock.

Calculating Pips: A Step-by-Step Guide

To calculate pips effectively, let’s take a step-by-step approach:

Step 1: Identify the Currency Pair

Before embarking on the pip-calculation journey, you must select the currency pair you wish to scrutinize. Currency pairs, such as EUR/USD (euro versus U.S. dollar), represent the value of one currency relative to another.

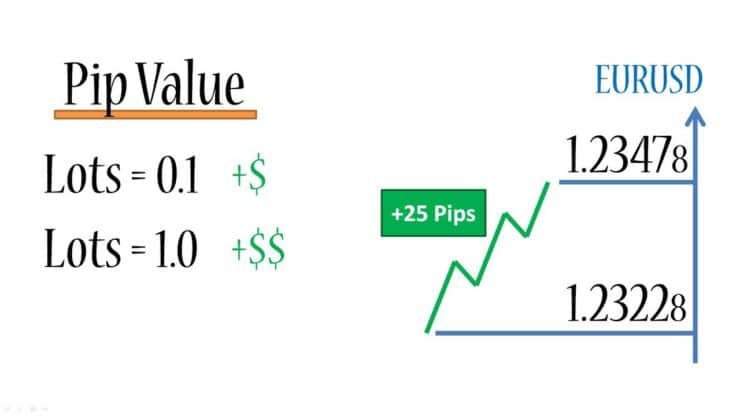

Step 2: Determine the Pip Value

The pip value, which varies depending on the currency pair, dictates the numerical significance of each pip movement. Typically, most major currency pairs have a pip value of 0.0001. Hence, a pip is equal to one-ten-thousandth of the base currency.

Step 3: Understand the Point System

The pip value we just discussed is often referred to as a “point.” In currency pairs that utilize Japanese yen as the base currency, such as USD/JPY, the pip value becomes 0.01, representing one-hundredth of the base currency.

Step 4: Calculate the Pip Change

To determine the pip change between two price quotes, simply subtract the previous quote from the newer one. For instance, if EUR/USD moves from 1.1345 to 1.1350, the pip change is 5 pips, calculated as: 1.1350 – 1.1345 = 0.0005 (5 pips).

Step 5: Convert Pips to Currency Value

Finally, to ascertain the actual monetary value of the pip change, multiply the pip change by the pip value. Continuing our EUR/USD example with a pip value of 0.0001, a change of 5 pips translates to a currency value change of: 5 pips x 0.0001 = $0.0005 (assuming a 1 lot position).

Pips: The Precision Tool of Forex Traders

Equipped with the ability to calculate pips, forex traders gain an invaluable tool that allows them to:

-

Gauge Price Movements: Pips provide a standardized unit for measuring exchange rate fluctuations, enabling traders to assess market trends and volatility.

-

Determine Profit and Loss: Accurate pip calculations are crucial for calculating the profitability or loss incurred on each trade.

-

Manage Risk: Understanding pip values helps traders establish appropriate risk management strategies, setting stop-loss and take-profit levels with precision.

-

Compare Currency Pairs: Traders can compare the pip values of different currency pairs to identify potential trading opportunities and optimize their strategies.

In conclusion, mastering the art of pip calculations is a pivotal step towards becoming a proficient forex trader. By understanding the pip value, point system, and conversion process, traders empower themselves with the ability to accurately measure price changes, gauge market movements, and make informed trading decisions. In the dynamic realm of forex trading, where every tick counts, the ability to calculate pips is the key to seizing opportunities and navigating the market’s complexities with confidence.

Image: brokerforexid.blogspot.com

How Do I Calculate Pips In Forex