Introduction

In an increasingly interconnected world, the ability to send funds abroad has become indispensable. Online forex outward remittances offer a convenient and cost-effective way to transfer money across borders, revolutionizing the financial landscape for individuals and businesses alike. This article delves into the world of online forex outward remittances, exploring their benefits, applications, and the factors to consider when choosing an online forex provider.

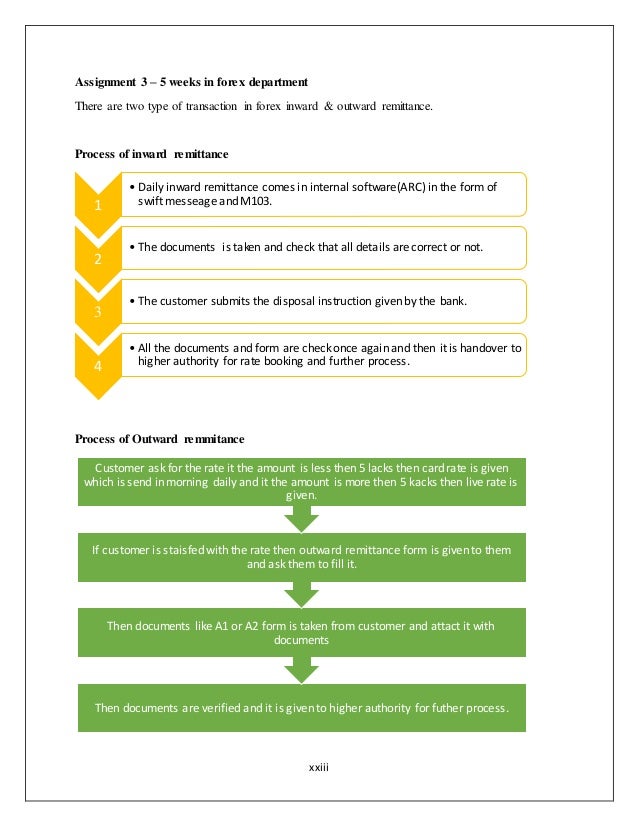

Image: 25penny.com

Understanding Forex Outward Remittances

Forex outward remittance refers to the process of sending money to a recipient in a foreign country. Unlike traditional bank wire transfers, online forex outward remittances leverage foreign exchange (forex) markets to facilitate the exchange of currencies at competitive rates. This process typically involves a currency exchange and a transfer of funds via a bank or a specialised remittance service.

Benefits of Online Forex Outward Remittances

Online forex outward remittances offer a myriad of benefits that have made them a popular choice for cross-border payments:

-

Competitive Exchange Rates: Forex providers often negotiate bulk currency exchanges, which allows them to offer more favourable exchange rates compared to banks or money transfer services.

-

Lower Transaction Fees: Online forex providers typically charge lower transaction fees than traditional banks, reducing the overall cost of remittances.

-

Convenience and Speed: Online forex remittances can be initiated from the comfort of one’s home or office, with funds typically reaching the recipient within 24-72 hours.

-

Security: Reputable online forex providers employ robust security measures to safeguard sensitive data and prevent fraud.

-

Flexibility: Forex outward remittances provide more flexibility in terms of sending and receiving currencies, as well as the amount of funds being transferred.

Applications of Online Forex Outward Remittances

Online forex outward remittances have a wide range of applications, including: -

International Business Transactions: Businesses can use forex outward remittances to pay suppliers, contractors, or employees overseas.

-

Student Expenses: Students studying abroad can use forex outward remittances to cover tuition fees, accommodation, and living expenses.

-

Overseas Investment: Investors can use forex outward remittances to purchase stocks, bonds, or real estate in foreign markets.

-

Remittances to Family and Friends: Individuals can use forex outward remittances to send money to loved ones living abroad.

-

Holiday Travel: Travellers can use forex outward remittances to exchange currency before their trip to secure a more advantageous rate.

Factors to Consider When Choosing an Online Forex Provider

When choosing an online forex provider for outward remittances, there are several key factors to consider: -

Exchange Rates: Compare the exchange rates offered by different providers to ensure you’re getting the most favourable deal.

-

Transaction Fees: Determine the transaction fees charged by the provider, as these can vary significantly.

-

Transfer Speed: Consider the estimated time it takes for the funds to reach the recipient.

-

Security Measures: Ensure the provider employs robust security measures to protect your sensitive information.

-

Customer Support: Choose a provider with responsive and helpful customer support in case you encounter any issues.

Conclusion

Online forex outward remittances have revolutionized the way people and businesses send money abroad. By leveraging competitive exchange rates, lower transaction fees, and the convenience of online platforms, forex remittances offer a cost-effective and secure way to transfer funds globally. As more and more individuals and businesses recognize the benefits of online forex remittances, this payment method will continue to play a vital role in the global financial ecosystem.

Image: howtotradeonforex.github.io

On Line Forex Outward Remittance