Hello, eager readers! Today, we dive into the fascinating world of foreign exchange rates and bring you up-to-date with the RBI Forex Rates as of 4th November 2016. With a blend of historical context and practical insights, we aim to unravel the mysteries of currency exchange, empowering you to make informed financial decisions.

Image: edegawiwajy.web.fc2.com

Before we delve into the day’s rates, let’s explore the basics of foreign exchange rates. Simply put, forex rates determine the value of one currency against another. These rates fluctuate constantly, influenced by various economic factors such as interest rates, inflation, economic growth, and global demand and supply. Understanding forex rates is crucial for businesses and individuals engaged in international trade or who wish to convert currencies for travel or investments.

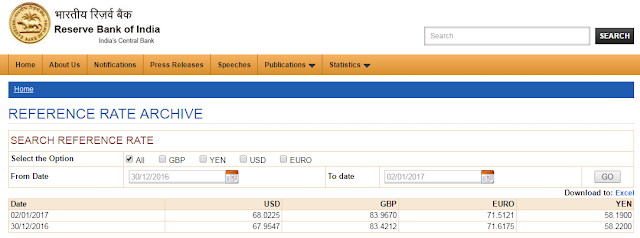

RBI Forex Rates: A Snapshot

The Reserve Bank of India (RBI) is the central bank of India and sets the daily benchmark Foreign Exchange Rates for Indian Rupee (INR). Let’s review the key currency pairs and their rates against INR as of 4th November 2016:

| Currency | RBI Forex Rate |

|---|---|

| US Dollar (USD) | 66.58 |

| Euro (EUR) | 73.47 |

| British Pound (GBP) | 86.45 |

| Japanese Yen (JPY) | 0.59 |

| Canadian Dollar (CAD) | 52.04 |

These rates provide a snapshot of the relative value of foreign currencies against the Indian Rupee on the specified date. Keep in mind that forex rates are constantly fluctuating, so it’s advisable to check the latest rates before making any currency exchange transactions.

Exploring the Factors that Impact RBI Forex Rates

The RBI Forex Rates are determined by a complex interplay of economic factors, including:

- Interest Rates: Higher interest rates in India tend to strengthen the rupee, making it more expensive to exchange foreign currencies.

- Inflation: High inflation in India can erode the value of rupee, making foreign currencies cheaper in comparison.

- Economic Growth: Strong economic growth in India can boost the demand for rupee, leading to appreciation against other currencies.

- Global Demand and Supply: The global demand and supply of foreign currencies also influence the rupee’s value. Increased demand for Indian exports can strengthen the rupee, while a surge in imports can weaken it.

Latest Trends and Insights in RBI Forex Rates

Staying updated with the latest trends and developments in RBI Forex Rates is essential for informed financial decisions. Here are some notable observations:

- Currency Wars: The ongoing tension between major central banks has led to fluctuations in global currency markets, affecting RBI Forex Rates.

- Oil Prices: Fluctuations in oil prices can impact Indian imports and exports, influencing the demand for foreign currencies and ultimately affecting forex rates.

- Political and Economic Stability: Political and economic stability in India can enhance investor confidence, leading to a stronger rupee.

- Foreign Investments: Inflows or outflows of foreign investments can have a significant impact on RBI Forex Rates.

Image: thenfapost.com

Tips and Expert Advice on RBI Forex Rates

Understanding the fundamentals of RBI Forex Rates can help you make smarter financial decisions. Here are some tips from experts:

- Stay Informed: Keep abreast of the latest economic news and updates that may influence forex rates.

- Compare Rates: Compare rates from multiple banks and currency exchange services to secure the best deal.

- Consider Forward Contracts: If you anticipate currency fluctuations, consider entering into a forward contract to lock in a future exchange rate.

- Use Currency Exchanges Wisely: Airports and tourist locations often offer less favorable exchange rates. Use reputable currency exchange services for better rates.

Leverage Online Currency Converters: Utilize online currency converters to stay updated with real-time exchange rates.

Frequently Asked Questions (FAQs) on RBI Forex Rates

Q: Why do RBI Forex Rates fluctuate?

A: RBI Forex Rates fluctuate due to a combination of economic factors, such as interest rates, inflation, economic growth, and global demand and supply.

Q: How can I benefit from exchange rate fluctuations?

A: By understanding the factors that impact forex rates and staying informed about market trends, you can make strategic currency exchange transactions to capitalize on favorable exchange rates.

Q: Is it possible to predict future RBI Forex Rates?

A: Predicting future forex rates with absolute certainty is challenging due to the dynamic nature of currency markets. However, analyzing historical trends, economic indicators, and market sentiment can provide insights into potential rate fluctuations.

Q: What are the risks involved in currency exchange transactions?

A: Currency exchange transactions involve a degree of risk due to fluctuating exchange rates. Adverse rate movements can result in financial losses if not managed prudently.

Q: What is the best time to exchange currency?

A: The best time to exchange currency depends on market conditions and your individual circumstances. Monitoring exchange rates and comparing rates from different sources can help you identify optimal exchange times.

Rbi Forex Rates 4th November 2016

Conclusion

Understanding RBI Forex Rates is essential for navigating the world of foreign exchange and making informed financial decisions. By staying updated on the latest rates, economic trends, and expert advice, you can leverage the dynamic nature of forex markets to your advantage. Remember to consider your individual circumstances and seek professional guidance if necessary. We encourage you to delve deeper into the world of forex rates and explore the opportunities they present. Let us know if you have any specific questions or topics you would like us to explore in the future.