Harnessing Global Connectivity with SBI Forex

In today’s interconnected world, international financial transactions play a pivotal role in global commerce and personal finance management. Among the forefront providers of forex services in India stands SBI (State Bank of India), catering to the needs of individuals and businesses seeking swift and reliable跨境汇款.To initiate a transaction with SBI Forex, one of the factors to consider is the time required for the funds to reach the designated beneficiary. Understanding this timeframe allows for effective planning and ensures timely delivery.Embarking on this exploration, we will delve into the inner workings of SBI Forex, uncovering the intricacies and shedding light on the typical duration for forex transfers.

Image: forexearningmoney.blogspot.com

Dissecting the Timeline of SBI Forex Transfers

SBI Forex prides itself on providing efficient and time-sensitive wire transfer services, adhering to international banking standards for swift and secure movement of funds across borders. While the exact timeframe for a transaction may vary depending on several factors, SBI strives to facilitate transfers within a reasonable time frame, ensuring that funds reach the intended destination promptly. Typically, an SBI Forex transfer can be completed within 2 to 5 business days, subject to factors such as currency conversion, intermediary bank processing times, and regulatory compliance procedures.

-

Currency Conversion: Upon initiation of a transfer, SBI Forex converts the funds into the desired currency. This conversion process typically takes 1-2 business days as it involves buying and selling currencies in the interbank market.

-

Intermediary Bank Processing: Once the currency conversion is complete, the funds are routed through a network of intermediary banks to reach the beneficiary’s bank. This process can take 1-2 business days, depending on the number of intermediary banks involved and their respective processing times.

-

Regulatory Compliance: As part of its commitment to anti-money laundering and combating the financing of terrorism, SBI Forex adheres to strict regulatory compliance protocols. This may involve additional checks and documentation reviews, potentially adding 1-2 business days to the transfer timeline.

Factors Influencing Transfer Time

While SBI Forex endeavors to complete transfers within the stipulated timeframe, several factors can影响the duration, including:

• Destination Country: The location of the beneficiary’s bank can impact the transfer time. Transfers to neighboring countries tend to be faster than those to distant locations due to fewer intermediary banks involved.

• Transaction Amount: Large-value transactions may require additional scrutiny and compliance checks, potentially extending the transfer duration.

• Time of Initiation: Initiating a transfer during peak business hours or on weekends or holidays can affect the processing time due to reduced staffing levels at banks.

Optimizing Transfer Efficiency

To expedite the transfer process, consider the following tips:

• Provide Accurate Information: Ensure that the beneficiary’s details, including name, account number, and bank address, are correct to avoid delays due to errors.

• Initiate during Business Hours: Avoid transferring funds late in the day or during weekends to minimize the impact of reduced staffing on processing times.

• Consider Smaller Transactions: Breaking down large transfers into smaller, more frequent transactions can help circumvent potential delays associated with金额较大.

• Leverage Online Platforms: Utilize online banking or mobile applications provided by SBI Forex for convenient and real-time transfer initiation and tracking.

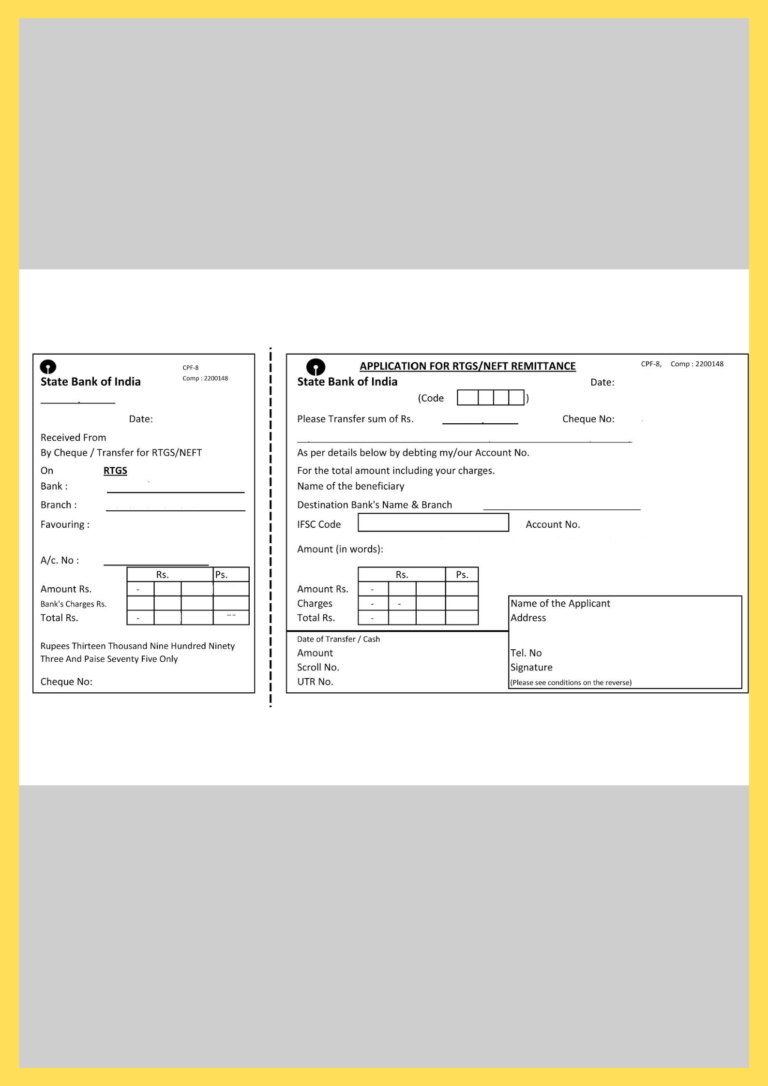

Image: www.getpdfform.com

Sbi Forex How Many Days To Transfer

Conclusion: Empowering Global Transactions

SBI Forex offers a reliable and secure platform for international money transfers, facilitating seamless跨境资金流动. Understanding the transfer timeframe allows for informed planning and ensures timely delivery of funds to intended beneficiaries. By carefully considering the influencing factors and optimizing the transfer process, individuals and businesses can harness SBI Forex’s services for efficient and hassle-free global transactions, fostering economic growth and connecting people across borders.