Introduction

In the ever-evolving global economy, the foreign exchange market plays a pivotal role in facilitating trade and investment across borders. As a leading player in the Indian banking sector, the State Bank of India (SBI) offers competitive foreign exchange rates for individuals and businesses alike. Understanding these rates is crucial for making informed decisions when dealing with foreign currencies. This comprehensive article delves into the intricacies of SBI forex rates, providing valuable insights to help you navigate the foreign exchange landscape effectively.

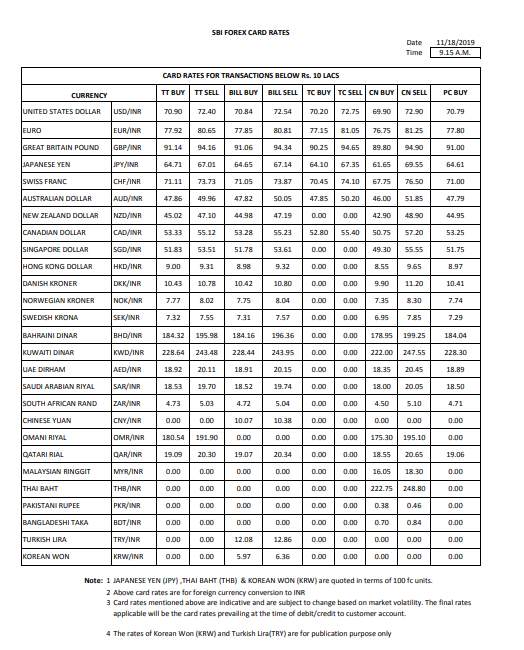

Image: management.ind.in

Decoding Forex Rates: A Basic Understanding

Foreign exchange rates determine the value of one currency in relation to another. These rates fluctuate continuously, influenced by a myriad of economic factors, including interest rates, inflation, trade imbalances, and political stability. Banks and financial institutions, such as SBI, act as intermediaries in the foreign exchange market, facilitating currency conversions and offering competitive rates.

SBI Forex Rates: A Transparent Window to Global Currency Markets

SBI prides itself on offering transparent and competitive forex rates. These rates are updated in real-time, allowing customers to stay abreast of the latest market fluctuations. SBI’s user-friendly online platform and mobile app provide easy access to up-to-date rates for various currency pairs, empowering users to make informed decisions based on current market conditions.

Importance of Monitoring Forex Rates

Currency exchange rates have a direct impact on international trade and travel. Importers and exporters need to understand the prevailing exchange rates to determine the cost of importing goods or selling products abroad. Travelers planning overseas trips can benefit from favorable exchange rates to stretch their travel budgets. Additionally, investors venturing into foreign markets must pay attention to forex rates to gauge potential returns and manage currency risk.

Image: forexgannsystem.blogspot.com

Factors Influencing SBI Forex Rates

SBI forex rates are influenced by both domestic and international economic factors. India’s central bank, the Reserve Bank of India (RBI), plays a crucial role in managing the value of the Indian rupee against other currencies through monetary policy interventions, such as interest rate adjustments. Global economic conditions, such as economic growth, inflation, and geopolitical events, can also impact currency exchange rates.

Leveraging SBI’s Forex Services for Optimal Value

SBI offers a comprehensive suite of foreign exchange services tailored to meet the diverse needs of customers. Individuals can conveniently exchange currencies at any of SBI’s extensive branch network nationwide. The bank also provides online and mobile banking platforms for quick and easy currency conversions. Businesses can benefit from specialized forex services, including forward contracts, to manage their currency risk and optimize their international transactions.

Sbi Forex Rates Today 16 12 2019

Conclusion

Staying informed about SBI forex rates today, 16/12/2019, is essential for individuals, businesses, and investors engaging in cross-border transactions. By understanding the factors influencing these rates and leveraging the competitive services provided by SBI, you can navigate the foreign exchange landscape with confidence and make informed decisions that maximize your global financial potential. Be sure to stay abreast of the latest rates and market trends to make the most of every currency exchange opportunity.