If you’re a global business or an individual looking to transfer funds seamlessly across borders, SBI Online Forex Transfer Receipt offers an efficient and reliable solution. This comprehensive guide will lead you through the process of using SBI’s online platform, highlighting the benefits, features, and steps involved in executing a forex transfer. By the end of this article, you’ll be equipped with the knowledge to navigate the platform with confidence and enjoy the convenience of international money transfers at your fingertips.

Image: surveynomoney.blogspot.com

Navigating SBI’s Online Forex Platform

SBI’s user-friendly online forex platform provides a secure and streamlined experience. To begin, you’ll need to register for an account by submitting KYC (Know Your Customer) documents and providing basic details. Once your account is activated, you can access the platform via SBI’s website or mobile app. The platform offers a user-friendly interface that allows you to initiate transfers, view past transactions, and manage your account.

Benefits of Using SBI’s Online Forex Platform:

Using SBI’s online forex platform comes with a range of advantages:

Convenience: Transfer funds online anytime, anywhere, without the need for physical visits to a branch.

Competitive Exchange Rates: SBI offers competitive exchange rates, ensuring you get the most out of your transfers.

Transparency: The platform provides real-time updates on exchange rates and transaction fees, ensuring transparency throughout the process.

Speed: Transactions are processed quickly and efficiently, typically reaching the recipient within 24 hours.

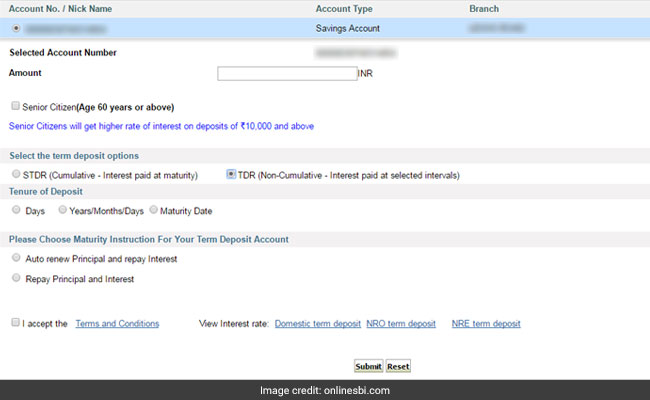

Executing a Forex Transfer with SBI

To initiate a forex transfer through SBI’s online platform, follow these steps:

1. Initiate the Transfer: Log in to your account, select the “Forex” tab, and click on “New Request.”

2. Enter Recipient Details: Provide the recipient’s name, bank account number, SWIFT code, and address.

3. Select Currencies and Amount: Choose the currency you want to send and enter the transfer amount.

4. Review and Confirm: Verify the transfer details, including the exchange rate, fees, and total payable amount. Click “Confirm” to proceed.

5. Payment: Fund the transfer using your registered bank account or online banking.

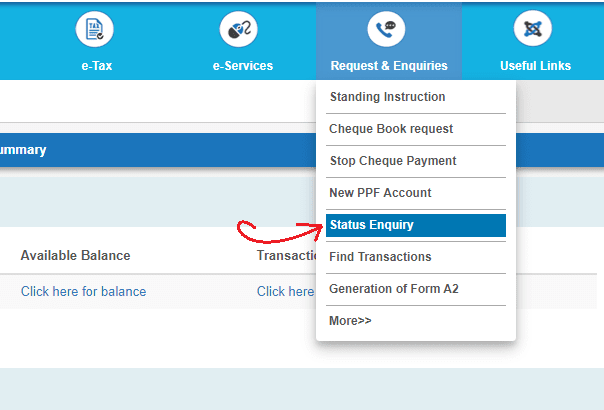

6. Track the Transfer: Monitor the status of your transfer from the “Transaction History” section of the platform.

Image: www.cifnumber.com

Additional Features of SBI’s Online Forex Platform:

In addition to the core transfer functionality, SBI’s online forex platform offers several valuable features, including:

Real-Time Updates: The platform provides real-time exchange rate updates, enabling you to stay informed and make informed decisions.

Automatic Transaction Status Notifications: Receive email or SMS alerts at key stages of your transfer, ensuring you’re always notified.

Transaction Management: Easily manage your pending and past transactions from a centralized location.

Security and Compliance

SBI Online Forex Transfer Receipt follows stringent security measures to protect your personal and financial information. The platform utilizes SSL encryption technology and complies with international regulatory standards. SBI’s compliance with AML (Anti-Money Laundering) and KYC (Know Your Customer) regulations ensures the integrity and transparency of all transactions.

Sbi Online Forex Transfer Receipt

https://youtube.com/watch?v=Sbi_VlZE2VU

Conclusion

SBI Online Forex Transfer Receipt is an ideal solution for individuals and businesses seeking a convenient, secure, and cost-effective way to transfer funds internationally. With its user-friendly platform, competitive exchange rates, and range of valuable features, SBI empowers you to manage your global payments seamlessly. By leveraging SBI’s online forex platform, you can save time, reduce costs, and enjoy peace of mind knowing that your funds are in safe hands.