In today’s interconnected global economy, finance management extends beyond national borders. The foreign exchange market (forex) stands as the world’s largest and most liquid financial market, facilitating international trade, investment, and economic growth.

Image: www.studocu.com

Comprehending the scope of international finance management is crucial for businesses and investors navigating the complexities of the forex market. Let’s delve into the world of international finance and unravel the significance of the forex market.

Understanding the Forex Market

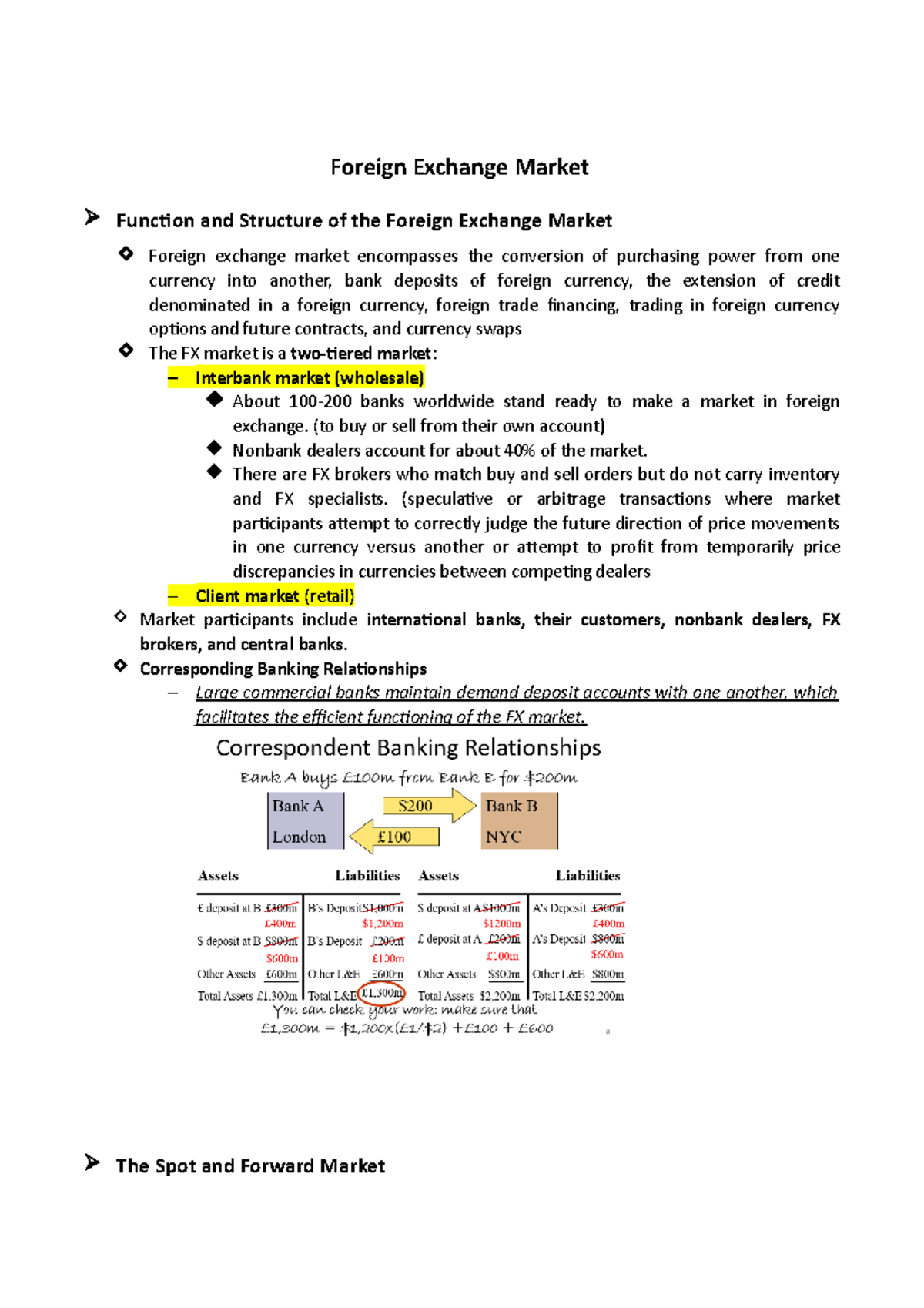

The forex market is a decentralized global marketplace where currencies are traded. It enables businesses, governments, and individuals to buy, sell, and exchange currencies for various purposes, including importing goods, settling international payments, and speculative trading.

The forex market operates 24 hours a day, five days a week, with over-the-counter (OTC) transactions. Currency pairs are traded in standardized lot sizes, with the most traded pair being the Euro (EUR) and the US Dollar (USD), known as the EUR/USD pair.

Scope of International Finance Management

International finance management encompasses the practices and strategies employed by businesses and organizations to manage their financial operations across different countries. It involves decision-making related to foreign exchange risk management, international investment, financing, and cash flow management.

Effective international finance management enables businesses to mitigate exchange rate fluctuations, optimize cash flows, and maximize returns on foreign investments. It requires an understanding of international financial markets, exchange rate dynamics, and regulatory frameworks.

In today’s globalized environment, businesses must adopt comprehensive international finance management strategies to remain competitive. The forex market plays a pivotal role in these strategies, providing the infrastructure and instruments for currency conversion and risk management.

Impact on Global Trade and Economy

The forex market is the lifeblood of global trade and investment. It facilitates the exchange of currencies between countries, enabling businesses to import and export goods and services.

Currency exchange rates play a significant role in international trade. Fluctuations in exchange rates can impact the profitability of exports and imports, influencing economic growth and employment levels.

The forex market also serves as a barometer for global economic health. Currency movements often reflect economic conditions, investor sentiment, and market expectations.

Image: analystprep.com

Managing Exchange Rate Risk

Exchange rate fluctuations can pose significant risks to businesses engaged in international operations. Unfavorable exchange rate movements can erode profit margins, increase costs, and disrupt operations.

To mitigate these risks, businesses can employ a variety of hedging strategies, such as forward contracts, currency options, and swaps. These instruments allow businesses to lock in exchange rates, protect against adverse movements, and manage their foreign exchange exposure.

Trends and Developments in the Forex Market

The forex market is constantly evolving, influenced by economic, political, and technological developments. Some key trends to watch include the rise of automated trading, the adoption of blockchain technology, and the increasing popularity of cryptocurrencies.

Automated trading algorithms have become increasingly sophisticated, leveraging artificial intelligence and machine learning to analyze market data and execute trades.

Blockchain technology has the potential to disrupt the forex market by enhancing transparency, security, and settlement efficiency.

Cryptocurrencies have gained traction in recent years, challenging traditional currencies and offering alternative investment opportunities.

Tips for Effective International Finance Management

Effective international finance management requires a combination of knowledge, experience, and prudent risk-taking. Here are some tips for businesses navigating the forex market:

- Understand the principles of forex trading and hedging strategies.

- Monitor economic and political developments that may impact exchange rates.

- Consult with financial advisors and experts in international finance.

- Diversify currency exposure to mitigate risk.

- Use technology and data analytics to enhance decision-making.

Scope Of International Finance Management-Forex Foreign Exchange Market

Conclusion

The scope of international finance management encompasses the complexities of the forex market, which serves as the global platform for currency trading and facilitates international trade and investment.

Effective international finance management requires a deep understanding of financial markets, exchange rate dynamics, and risk management techniques. By embracing best practices and leveraging expert advice, businesses can navigate the forex market and optimize their financial performance in a globalized economy.

**Call to Action:** Are you interested in delving further into international finance management and mastering the nuances of the forex market? Share your thoughts and questions in the comments section below.