In the dynamic world of finance, service trade income and transfers are pivotal forces shaping the global economy. This article delves into these concepts, explaining their impact on forex markets and revealing the advantages they offer international businesses and individuals alike.

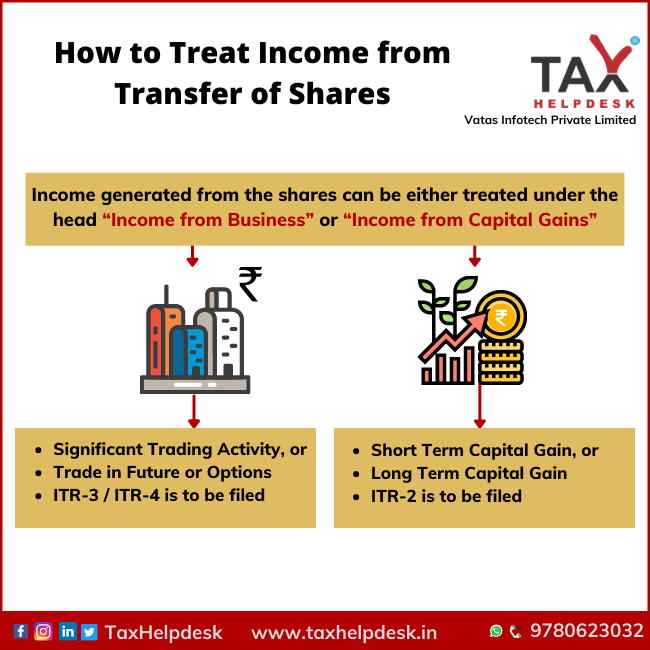

Image: www.taxhelpdesk.in

Service trade encompasses the buying and selling of intangible goods, such as professional services, consulting, and tourism. These services are rendered across borders, forming an essential aspect of international trade. Service trade income refers to the monetary earnings generated by providing these services to foreign clients, while transfers represent financial flows associated with cross-border services.

Understanding Service Trade Income

Service trade income plays a crucial role in stimulating economic growth. By exporting services, countries can capitalize on their expertise, create jobs, and enhance their overall competitiveness. Key drivers of service trade income include:

- Tourism: International tourism generates substantial revenue through accommodation, hospitality, and entertainment services.

- Business services: Outsourcing of services such as accounting, IT support, and legal advice contributes to service trade income.

- Financial services: Banks, insurance companies, and investment firms provide financial services across borders.

- Education: Foreign students studying in universities generate tuition fees and living expenses, contributing to service trade income.

Benefits of Service Trade Income

Service trade income offers numerous advantages for exporting countries:

- Economic Growth: Service exports boost economic activity, create jobs, and stimulate innovation.

- Job Creation: Service industries typically require skilled workers, leading to job creation and higher wages.

- Foreign Exchange Earnings: Service trade income generates foreign currency, strengthening a country’s currency and supporting its trade balance.

- Diversification: Service exports diversify a country’s economy, reducing dependence on a single sector.

Role of Service Trade Transfers

Service trade transfers encompass financial flows related to cross-border services. These include:

- Remittances: Money sent home by foreign workers contributes to service trade transfers and supports developing economies.

- Royalties: Payments made for the use of intellectual property, such as patents and copyrights.

- Fees: Compensation for professional services, such as consulting or training.

Image: www.youtube.com

Impact of Service Trade Transfers on Forex

Service trade transfers have a significant impact on forex markets. When a country exports more services than it imports, there is an inflow of foreign currencies. This can appreciate the exporting country’s currency and depreciate the importing country’s currency. Conversely, a service trade deficit (when imports exceed exports) can lead to currency depreciation for the importing country and appreciation for the exporting country.

Service Trade Income And Transfers In Forex

Conclusion

Service trade income and transfers are vital components of international trade. By leveraging their expertise, countries can generate economic growth, create jobs, and enhance their global competitiveness. Understanding the intricacies of service trade income and transfers is crucial for informed decision-making in forex markets. As economies become increasingly globalized, the interplay between services and financial flows will continue to shape the dynamics of the global economy.