In the fast-paced world of foreign exchange (forex) trading, short-term market analysis plays a crucial role in identifying profitable opportunities. As a trader, delving into the intricacies of short-term forex analysis empowers you to make informed decisions, navigate market fluctuations with precision, and maximize your trading returns.

Image: thitruongforex.com

Decoding Short-Term Forex Market Analysis

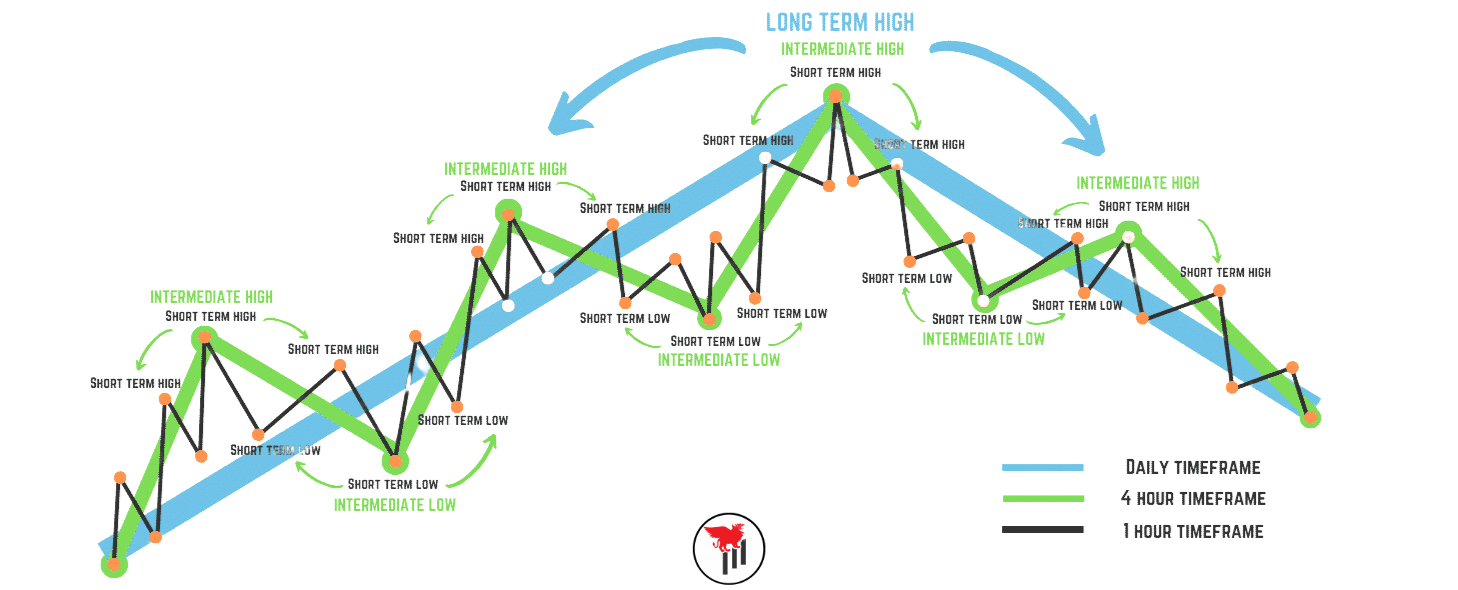

Short-term forex market analysis focuses on evaluating market trends and patterns within a timeframe ranging from minutes to days. This analysis enables traders to pinpoint trading opportunities that align with their risk tolerance and trading strategies. Technical indicators, fundamental news, and market sentiment are essential tools employed in this analytical process.

Technical Analysis: A Cornerstone of Short-Term Forex Trading

Technical analysis forms the backbone of short-term forex market analysis. Traders scrutinize price charts to discern patterns, trends, and support and resistance levels. This approach assumes that market history often repeats itself, and by understanding past price movements, traders can gain insights into potential future market behavior.

Common technical indicators used in short-term forex analysis include moving averages, Bollinger Bands, MACD, and relative strength index (RSI). These indicators provide traders with valuable information about market momentum, volatility, and overbought or oversold conditions. By combining multiple technical indicators, traders can enhance their analysis and increase the probability of successful trades.

Stay Abreast of the Latest News

In the fast-paced forex market, economic data, central bank announcements, and geopolitical events can significantly impact currency prices. Staying abreast of the latest news and events is crucial for short-term traders. Fundamental news can trigger sudden market movements, and being aware of these developments allows traders to adjust their positions accordingly.

News feeds, financial websites, and specialized trading platforms provide real-time updates on market-moving events. By monitoring these sources diligently, traders can quickly respond to changing market conditions and potentially capitalize on profitable opportunities.

Image: opinicusholdings.com

Gauging Market Sentiment

Market sentiment, also known as trader sentiment, refers to the collective opinion of market participants about the future direction of currency prices. Short-term traders closely observe market sentiment to gauge the overall mood and identify potential turning points in the market.

Several indicators can be used to measure market sentiment, including the Commitment of Traders (COT) report, which tracks the positioning of large speculators, and sentiment indicators that analyze social media chatter and news headlines. By understanding market sentiment, traders can align their trading strategies with the prevailing market bias.

Expert Tips for Enhanced Short-Term Forex Market Analysis

1. Practice Diligent Risk Management:

In the dynamic forex market, risk management is paramount. Short-term traders must establish clear risk parameters, including stop-loss and take-profit levels, to limit potential losses and protect their capital. Proper risk management enables traders to stay in control of their trades, even amidst unpredictable market conditions.

2. Seek Education and Stay Updated:

Continuous learning is vital for successful forex trading. Short-term traders should invest in their education, attend webinars, read industry publications, and stay informed about the latest market trends and analytical techniques. Knowledge is power in forex trading, and ongoing education empowers traders to make better-informed decisions.

Frequently Asked Questions

Q: What is the difference between short-term and long-term forex analysis?

A: Short-term forex analysis focuses on timeframes ranging from minutes to days, aiming to identify trading opportunities within a short period. In contrast, long-term forex analysis examines trends and patterns over weeks, months, or even years, providing insights for strategic investment decisions.

Q: How does technical analysis differ from fundamental analysis in forex trading?

A: Technical analysis relies solely on past price data to predict future market behavior. Fundamental analysis, on the other hand, considers economic factors, news events, and geopolitical developments to assess currency value and market direction.

Q: Can I become a successful forex trader with just short-term analysis?

A: While successful forex trading is achievable with a focus on short-term analysis, relying solely on this approach can limit potential returns. A comprehensive approach that combines short-term and long-term analysis, technical and fundamental factors, and risk management strategies optimizes trading success.

Short Term Forex Market Analysis

Conclusion

Mastering short-term forex market analysis equips traders with a powerful tool to uncover hidden opportunities and navigate the ever-fluctuating forex market with confidence. By employing technical indicators, staying informed about market news, gauging market sentiment, and adhering to sound risk management practices, traders can enhance their trading performance and increase their chances of profitability. Are you ready to embark on the exciting journey of short-term forex market analysis?