In the pulsating heart of the financial realm, where fortunes are forged and destinies intertwined, aspiring traders face a pivotal choice: should they embark upon the tumultuous waters of forex or navigate the structured shores of futures? This comprehensive treatise aims to illuminate the intricacies of these two formidable markets, empowering investors with the knowledge to make an informed decision that aligns with their trading aspirations.

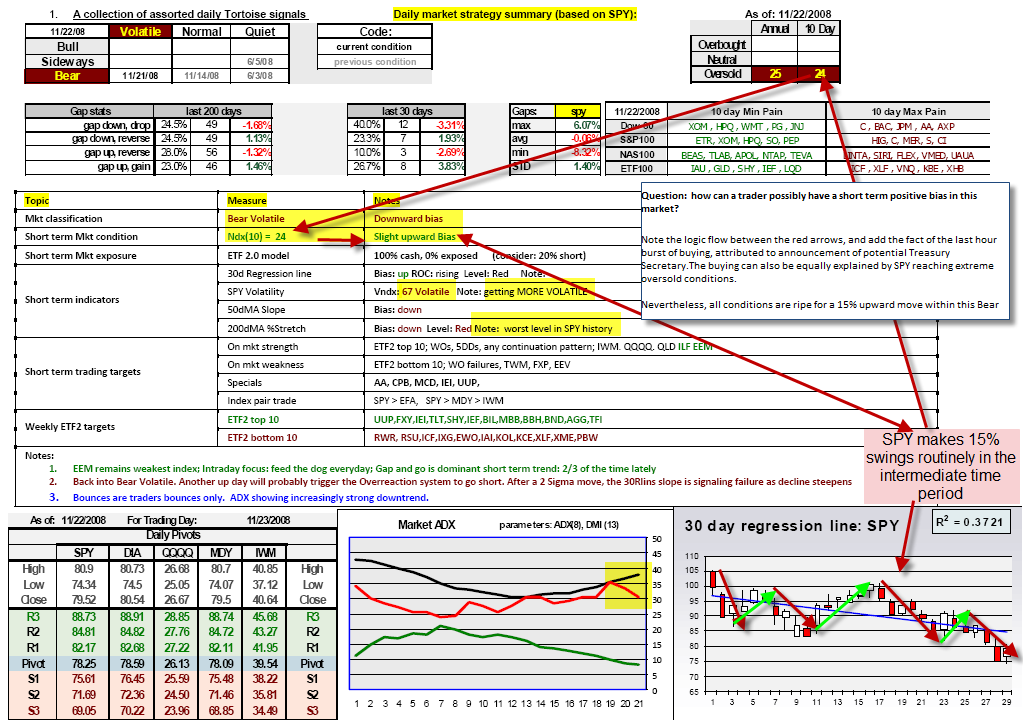

Image: investpost.org

The Essence of Forex: A Fluid Landscape

Forex, an acronym for foreign exchange, stands as the colossal marketplace where currencies from around the globe are traded in a perpetual ebb and flow. Unbound by geographical borders or temporal constraints, the forex market operates 24 hours a day, 5 days a week, orchestrating a symphony of currency exchanges driven by a multitude of factors, from economic fundamentals to geopolitical events.

This boundless liquidity is both a blessing and a curse. It offers traders unparalleled opportunities to capitalize on market movements, but also exposes them to potential volatility that can amplify gains and losses alike. Forex traders must possess strong risk management skills and a deep understanding of the macroeconomic forces that shape currency valuations.

Venturing into Futures: A Structured Gambit

Futures, on the other hand, present a more structured avenue for trading. These contracts obligate the buyer to purchase a specified quantity of an underlying asset, such as commodities, indices, or financial instruments, at a predetermined price on a future date. Futures provide traders with a means of hedging against price fluctuations and speculating on the direction of market trends.

The standardized nature of futures contracts offers several advantages. They ensure transparency and mitigate counterparty risk, as clearinghouses act as intermediaries to guarantee the fulfillment of obligations. Additionally, the use of margin allows traders to control a larger position with a smaller capital outlay, potentially magnifying both gains and losses.

Weighing the Scales: Forex vs. Futures

The choice between forex and futures hinges upon a careful assessment of each trader’s individual circumstances and trading objectives. Forex offers greater flexibility and liquidity, while futures provide more structure and predictability.

For traders seeking continuous market access and the ability to trade a wide range of currencies, forex may prove to be the more suitable option. However, those seeking greater stability, risk mitigation, and the opportunity to leverage positions with margin may find futures more appealing.

Image: www.equiti.com

Should I Trade Forex Or Futures

The Way Forward: A Path to Profits

Regardless of one’s choice, the path to trading success is paved with knowledge, discipline, and emotional resilience. Aspiring traders are well-advised to seek reputable educational resources, develop a comprehensive trading plan, and practice risk management strategies diligently.

Embrace the ever-changing landscape of financial markets with a discerning eye and an unwavering commitment to continuous learning. Whether you navigate the fluctuating currents of forex or the structured terrain of futures, the journey of a trader is one of endless discovery and the pursuit of financial freedom.