Every trader in the ever-evolving world of Forex aspires to navigate its treacherous waters with confidence and precision. Amidst the plethora of trading strategies, signaling risk strategies stand tall as beacons of hope, guiding traders towards informed and potentially profitable decisions.

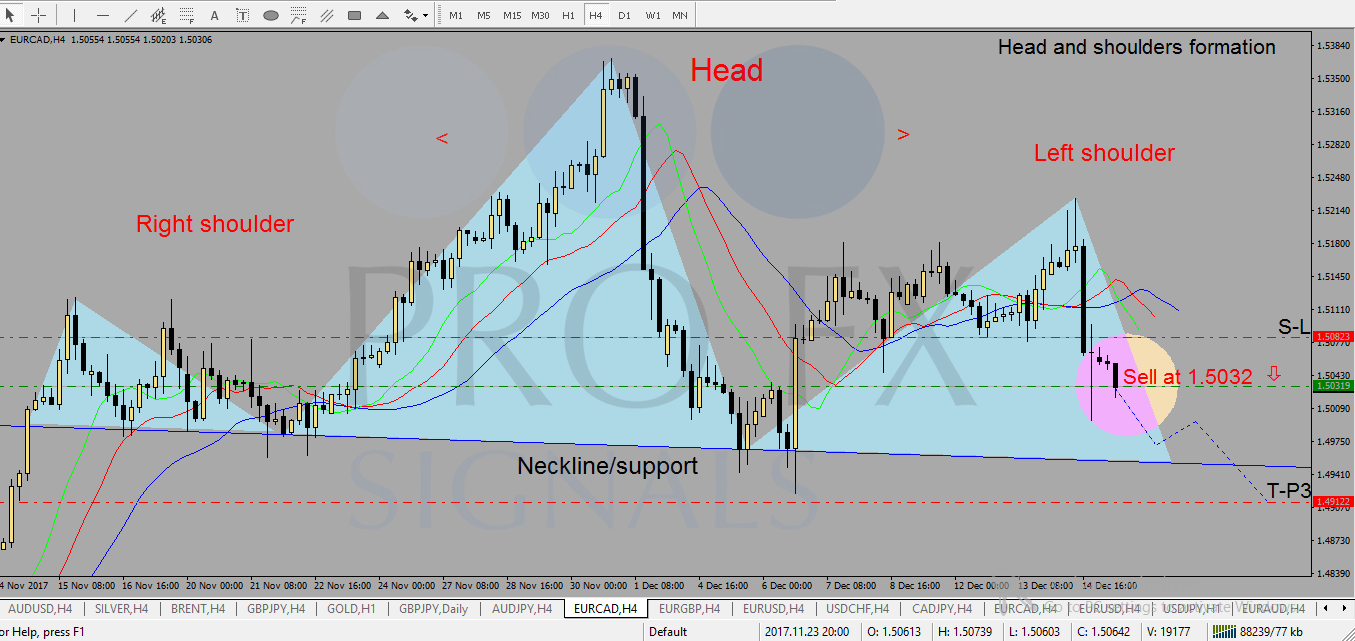

Image: fxprofitsignals.com

Signaling Risk: Your Compass in Forex’s Uncharted Seas

A signaling risk trading strategy is an invaluable tool that provides traders with timely insights into potential market movements. It involves identifying specific price patterns, technical indicators, or market events that can indicate a shift in the market’s direction. By recognizing these signals, traders can adjust their positions accordingly, minimizing losses and maximizing gains.

Demystifying Signaling Risk Strategies

Numerous signaling risk strategies exist, each with its own strengths and weaknesses. Some of the most popular include:

-

Moving Averages: Calculating the average price of an asset over a specific period can reveal trends and potential reversals.

-

Bollinger Bands: These bands plot the standard deviation above and below a moving average, highlighting potential overbought or oversold conditions.

-

Relative Strength Index: This indicator measures the momentum of an asset over a specific period, identifying potential turning points.

-

Ichimoku Cloud: This complex indicator combines multiple indicators to provide a comprehensive view of market trends and support/resistance levels.

Empowering Traders with Expert Insights

Seasoned Forex traders highly recommend signaling risk strategies as an essential element in their trading arsenal. Here are some expert tips:

-

“Signals can be a valuable tool, but they should never replace sound risk management practices,” advises George Soros, legendary investor.

-

“Don’t rely solely on one signal,” cautions Paul Tudor Jones. “Combine multiple signals to increase your confidence.”

-

“Be patient and disciplined,” emphasizes Bill Gross. “False signals are inevitable, so don’t get discouraged.”

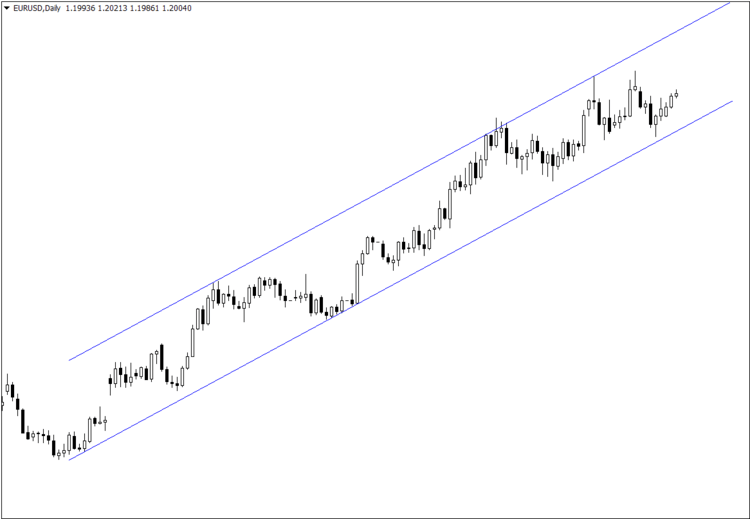

Image: elitetrading.org

Unleashing the Potential of Signaling Risk Strategies

By incorporating signaling risk strategies into your Forex trading, you can:

-

Reduce Uncertainty: Signals provide traders with a sense of direction, mitigating the inherent uncertainty of the Forex market.

-

Improve Decision-Making: By analyzing signals, traders can make more informed decisions about when to enter and exit trades.

-

Maximize Profits: Signals can help traders identify potential high-probability trading opportunities, enhancing their profitability potential.

Signalling Risk Trading Strategy Forex

Embark on Your Forex Mastery Journey

Mastering signaling risk trading strategies empowers you to navigate the Forex market with greater confidence and precision. Embrace these strategies, harness the wisdom of experts, and unlock the path to Forex mastery today. Remember, the market is not merely a battlefield; it’s an arena where knowledge and strategy reign supreme.